Solana Futures Turn Bearish: SOL Price Dip Imminent?

Solana Futures Market Turns Bearish

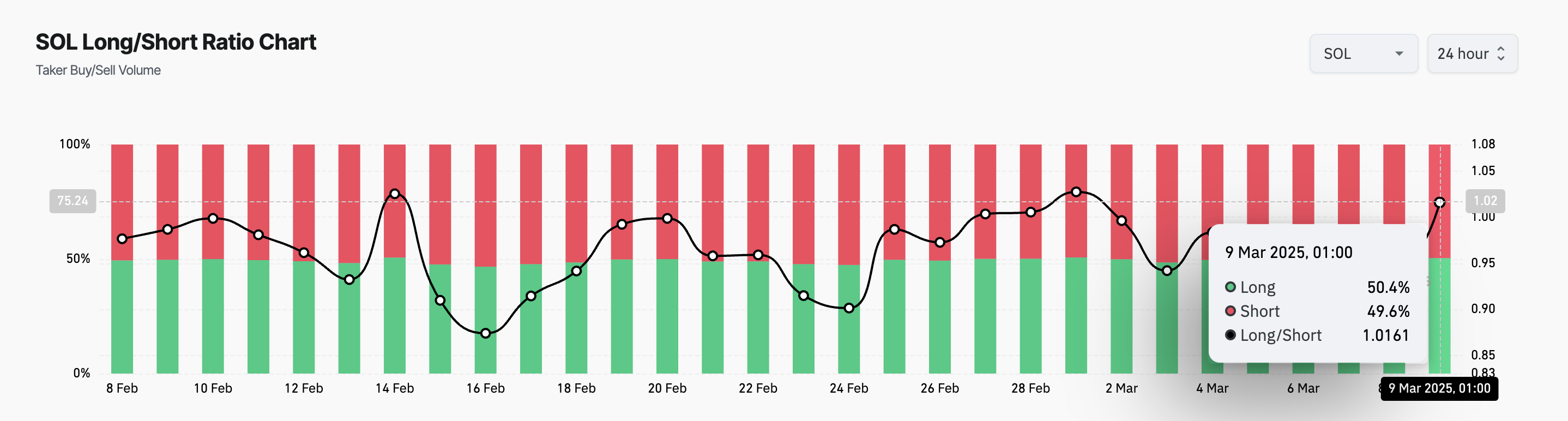

Recent market volatility has significantly impacted Solana (SOL), leading to a bearish shift in its futures market. Leveraged traders are hesitant to take bullish positions, raising concerns about a potential price drop below $130.

Bearish Indicators: Funding Rates and Open Interest

A negative funding rate for SOL perpetual futures over the past three days (currently at -0.0060%, according to Coinglass) indicates that short sellers are paying to maintain their positions, a clear bearish signal. This means more traders are betting against SOL's price rising.

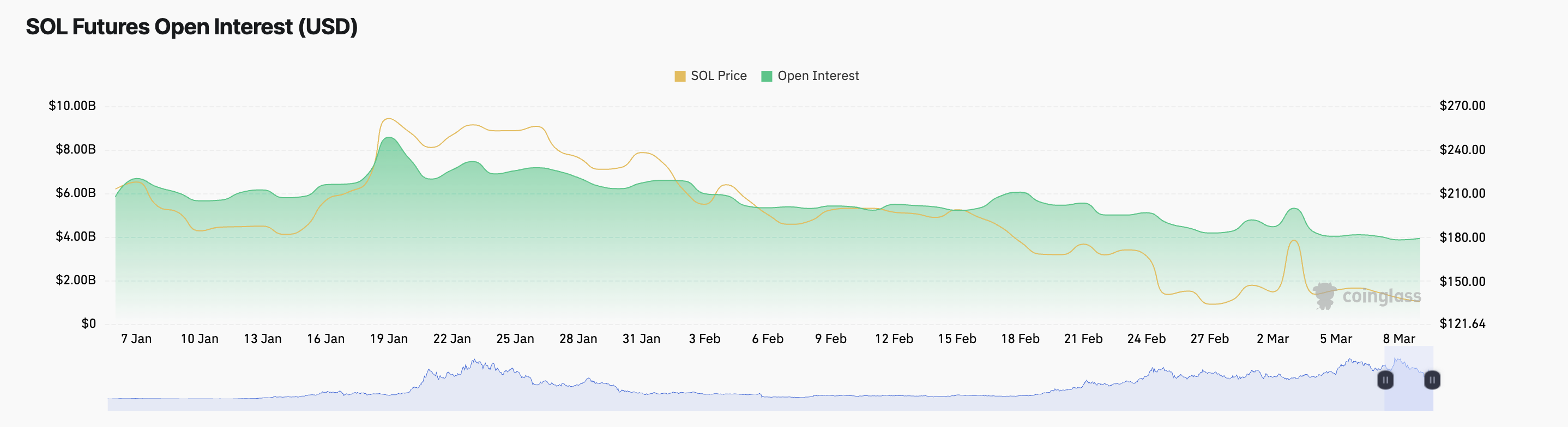

Further strengthening this bearish outlook is the declining open interest. Open interest, representing the total number of active futures contracts, has fallen by 19% since the beginning of March, currently at $3.94 billion. This suggests traders are closing positions, lacking conviction in a short-term SOL price recovery.

Will SOL Fall Below $130?

At the time of writing, SOL trades at $137.70, slightly above the support level of $136.62. If bearish sentiment persists, this support could transform into resistance, potentially pushing the price down to $120.72. However, a resurgence of bullish momentum could reverse this trend, potentially driving SOL to $182.31.

Note: This analysis is for informational purposes only and should not be considered financial or investment advice. Market conditions are volatile. Always conduct your own research.

Codeum provides comprehensive blockchain security solutions including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us today to secure your blockchain project.