Retail Investors Fuel Solana Surge

Solana (SOL) is experiencing a resurgence after a month-long decline of 16.81%. Over the past 24 hours, the asset has seen a bullish 2.87% gain, reaching a price of $2,718.88 (at press time).

Historic Pattern Taking Shape

Analysis of Solana's Market Value to Realized Value (MVRV-z) score on Glassnode reveals a pattern similar to previous movements that preceded significant rallies. The MVRV-z score helps gauge potential overvaluation or undervaluation. A crypto analyst noted that Solana is showing signs consistent with prior bull runs.

Quote from Analyst: "Solana is yet to enter a bull market this cycle."

Source: Glassnode

This suggests that, based on past performance in the green zone, the current upward trend could signal a sustained rally.

Decreasing Supply and Retail Investor Demand

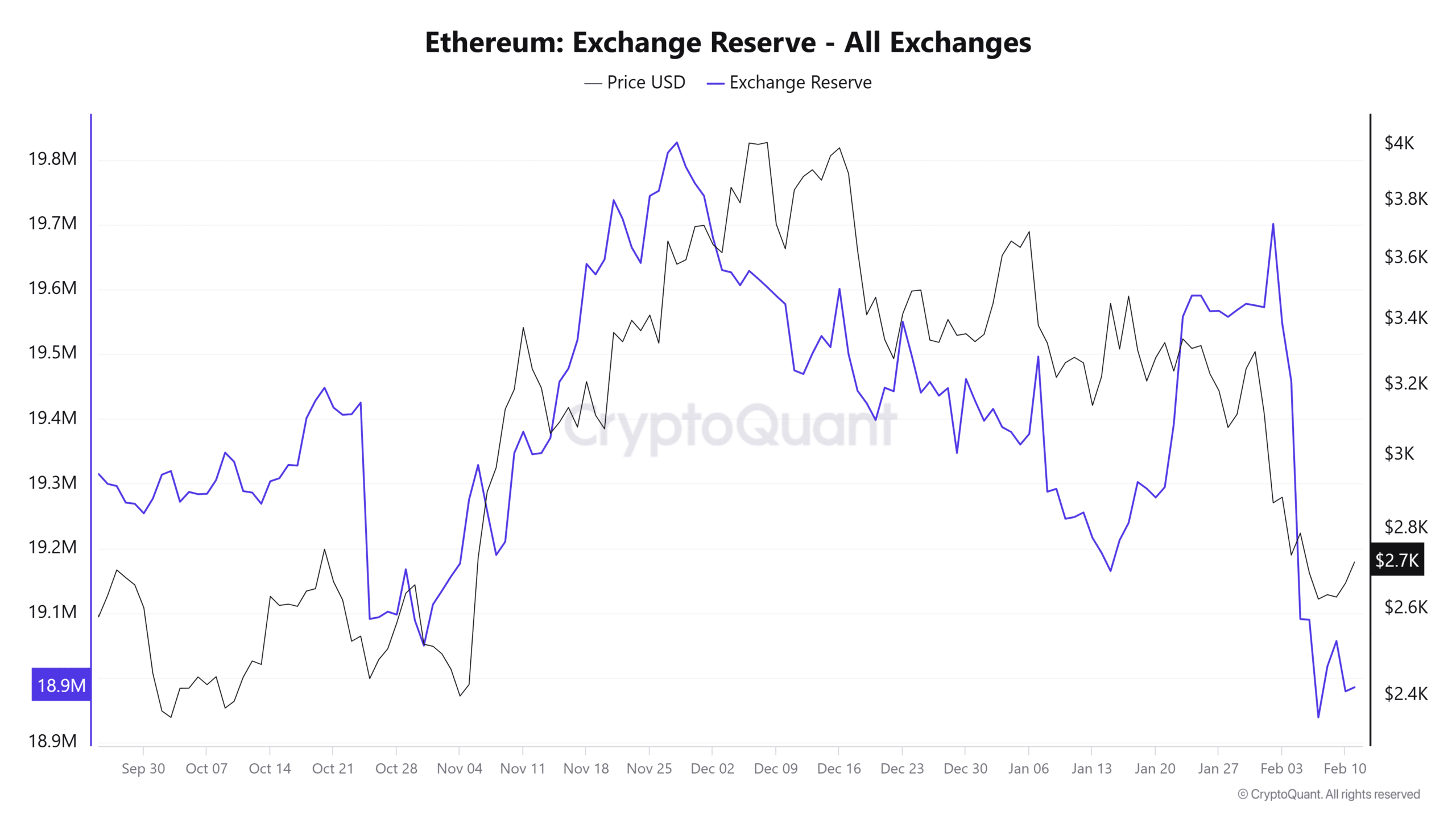

Data from CryptoQuant indicates a significant decrease in Solana exchange reserves. From February 2nd to press time, approximately 714,129 SOL has been removed from exchanges. This suggests strong buying pressure, with investors moving SOL into private wallets.

Source: CryptoQuant

AMBCrypto's analysis, using the Coinbase Premium Index, attributes much of this demand to U.S. retail investors. A positive index value, currently at 0.0255, reflects increased buying activity on Coinbase relative to Binance.

Surge in Buying Volume

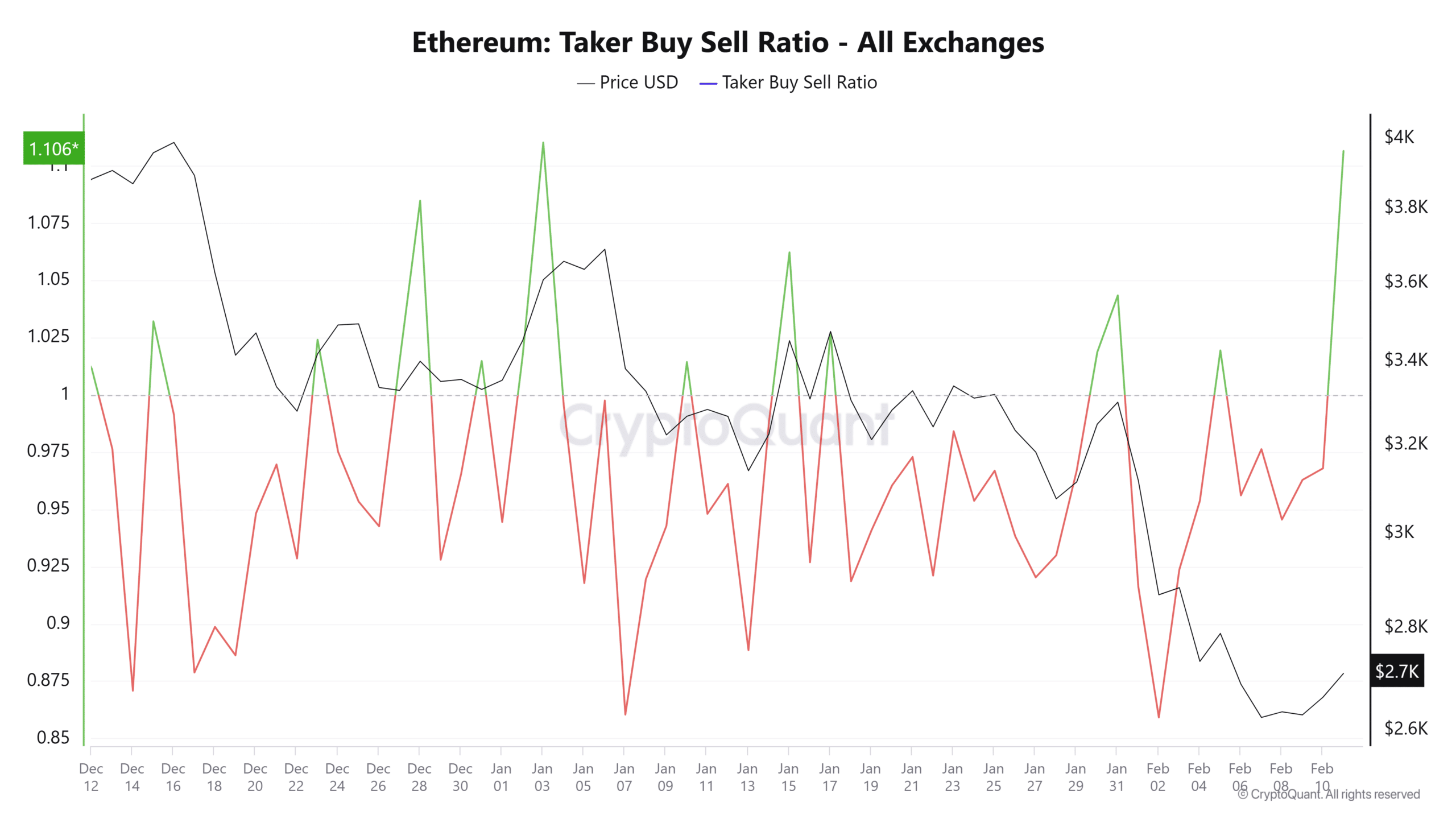

The Taker Buy Sell Ratio has increased from 0.967 to 1.084—a level last seen on January 3rd. A ratio above 1 indicates higher buying than selling activity in the derivatives market, further reinforcing bullish sentiment.

Source: CryptoQuant

With robust buying in the spot market and bullish signals in the derivatives market, Solana's rally appears to be gaining momentum. At Codeum, we provide comprehensive blockchain security and development services, including smart contract audits, KYC verification, and custom smart contract and DApp development. Let us help secure your Solana project.