SOL Price Up 2% Before FOMC

Solana (SOL) Price Surge Before FOMC Meeting

Solana (SOL) experienced a 2% price increase in the last 24 hours, reaching $147.83. This upward trend reflects broader market optimism ahead of the Federal Open Market Committee (FOMC) meeting.

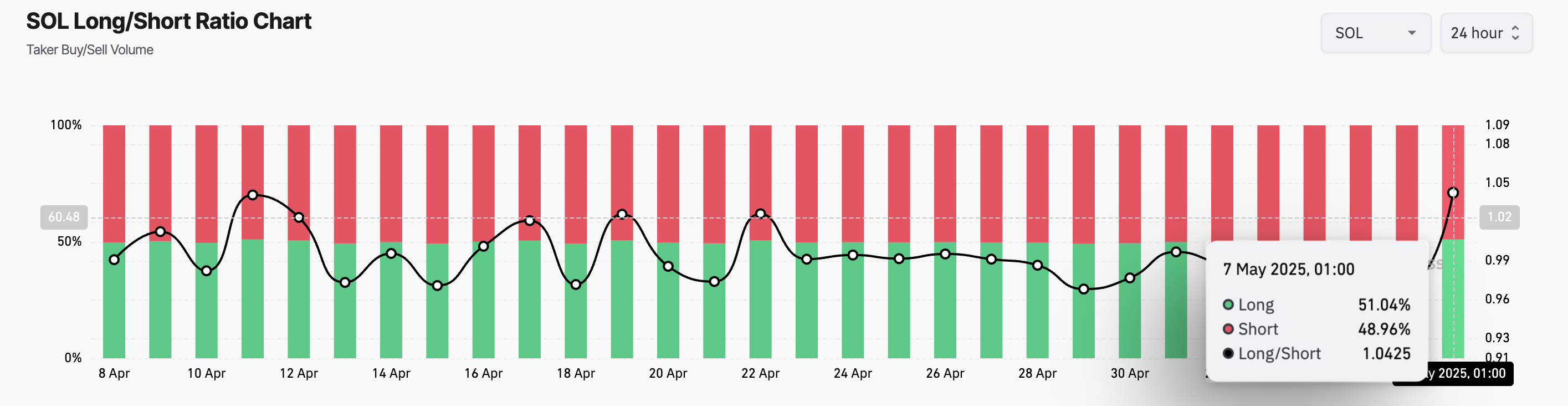

Increased demand for long positions in SOL futures markets suggests traders anticipate further price growth. According to Coinglass, the SOL long/short ratio hit a monthly high of 1.04, clearly indicating bullish sentiment.

Solana Futures Traders Show Strength

The chart below from Coinglass illustrates the significant increase in the long/short ratio for SOL, signifying a strong preference for long positions among futures traders.

Source: Coinglass

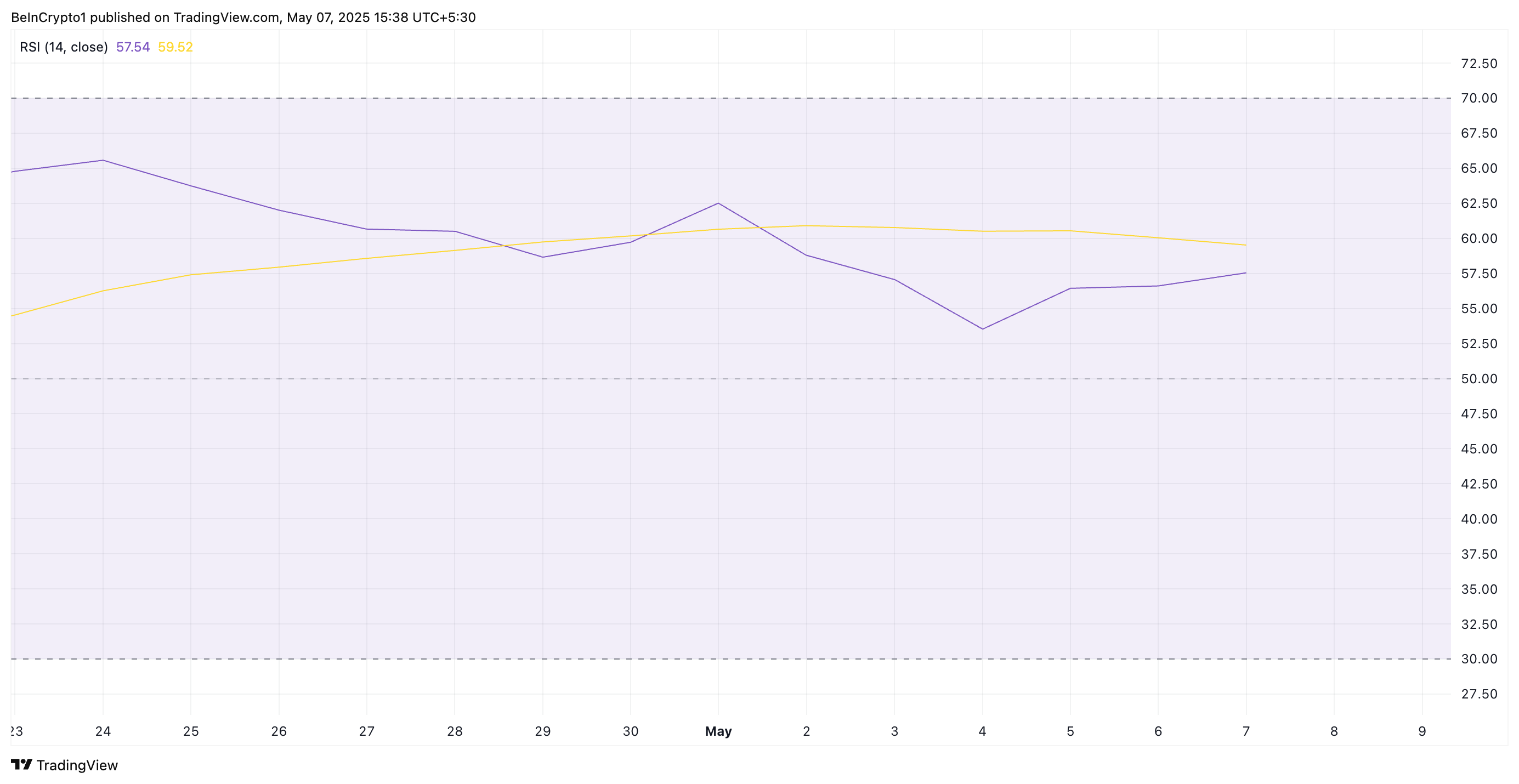

Further supporting this bullish outlook, SOL's Relative Strength Index (RSI) on the daily chart is at 57.54, indicating growing momentum but still leaving room for further gains before reaching overbought territory (typically above 70).

Source: TradingView

SOL Price Analysis: Support and Potential

At the time of writing, SOL is trading at approximately $147.69, bouncing off support near $142.59. A continued positive market environment after the FOMC could push SOL towards $171.88, its March 3 high. However, a negative FOMC outcome could reverse this trend, potentially dropping SOL below the support level and towards $120.81.

Source: TradingView

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Market conditions are volatile. Conduct thorough research and consult a professional before making any investment decisions.

Codeum provides comprehensive blockchain security and development services, including smart contract audits, KYC verification, and custom smart contract & DApp development. We also offer tokenomics and security consultations and have partnerships with several launchpads and crypto agencies.