Saros (SAROS) Soars 1000%

Saros (SAROS) Soars 1000% Since March

The Solana-based altcoin, Saros (SAROS), experienced a phenomenal surge, gaining 1024% since the start of March. This impressive rally propelled Saros to new all-time highs (ATHs) almost daily throughout the month, reaching a peak of $0.163. However, with the momentum potentially slowing, investors are now questioning the sustainability of this remarkable growth.

Inverse Correlation with Bitcoin

Interestingly, Saros has shown a negative correlation with Bitcoin (BTC) of -0.43. This inverse relationship proved beneficial during Bitcoin's March struggles. While BTC faced significant declines, Saros rallied, largely due to this decoupling. However, should Bitcoin regain upward momentum, Saros could face increased selling pressure as the correlation shifts.

SAROS Correlation to Bitcoin. Source: TradingView

Technical Indicators Suggest Potential Correction

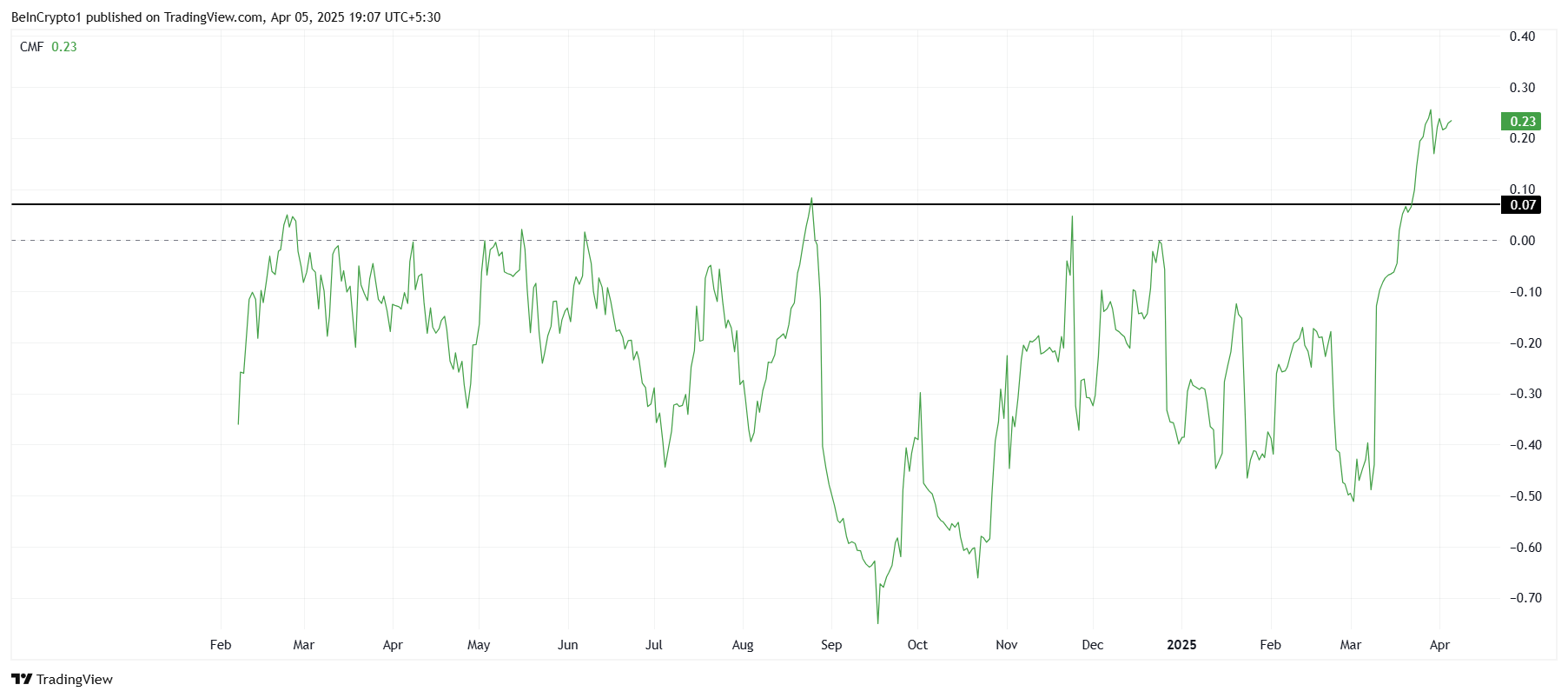

While investor interest remains strong, as evidenced by the rising Chaikin Money Flow (CMF) indicator, a recent crossing of the 0.7 saturation threshold signals a potential overbought condition. This historically precedes price corrections, suggesting a pullback for Saros is likely. Profit-taking could drive the price down towards the $0.100 support level. A break below this level could trigger a further decline to $0.055.

SAROS CMF. Source: TradingView

SAROS Price Analysis. Source: TradingView

Current Market Outlook

Saros is currently trading at $0.153. While the uptrend could potentially push the price towards $0.200, investors need to carefully monitor key support levels. A sustained break below $0.100 would invalidate the bullish outlook, suggesting a potential correction is in play.

Codeum's Note: Codeum provides comprehensive blockchain security and development services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us to discuss your project's security and development needs.

Disclaimer: This analysis is for informational purposes only and should not be considered investment advice. Market conditions are subject to rapid change.