RWA Market Explodes: $62.7B Market Cap

RWA Market Cap Soars 144% in Three Months

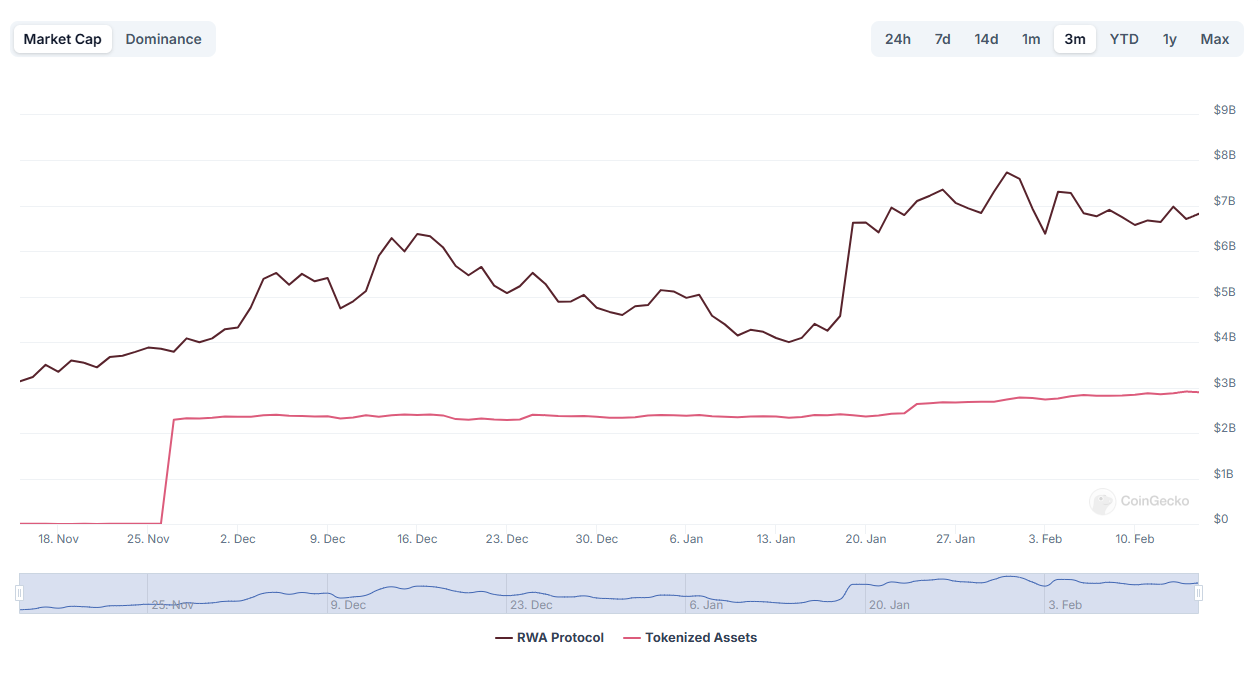

The Real-World Assets (RWA) sector is experiencing explosive growth. In the last three months alone, the RWA coin market cap jumped 144% to $62.7 billion. The total value of tokenized real-world assets also saw significant gains, reaching $17.3 billion—a 13% increase during the same period. This growth builds on an already impressive year-over-year increase of 54%, reaching $62.7 billion from $25.7 Billion on November 4, 2024.

This surge is attributed to several key factors, including increased institutional adoption and a more favorable regulatory environment in the US following the election of Donald Trump. His administration's crypto-friendly stance is boosting investor confidence in RWA projects and blockchain tokenization.

Regulatory Changes Fuel RWA Growth

Reduced regulatory hurdles and clearer guidelines are attracting significant capital inflows into the RWA sector. This influx of investment is benefiting both established and emerging RWA projects.

Source: CoinGecko

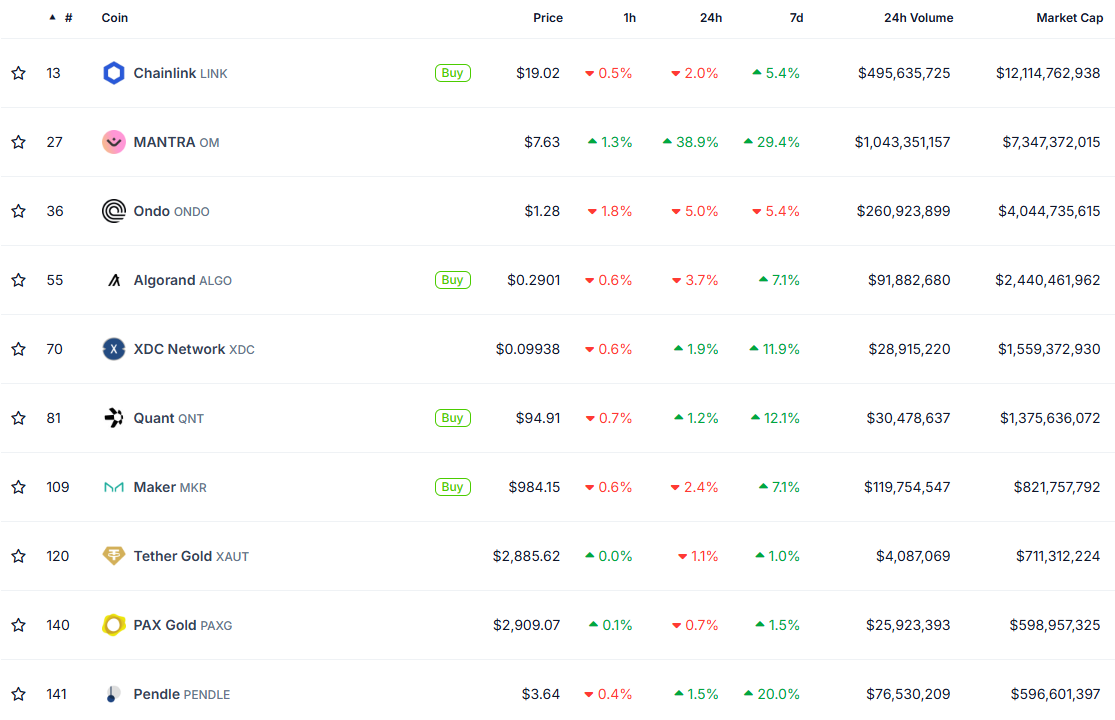

Top Performing RWA Tokens

Most major RWA tokens have performed exceptionally well, with notable gains observed in the last week. While ONDO experienced a slight dip, it's still up an impressive 382% year-over-year.

- Mantra: Nearly 30% increase in the past week.

- Injective (INJ): Over 16% increase in the past week.

- PinLink: Surged 86%.

- XVS: Rose 77%.

Source: CoinGecko

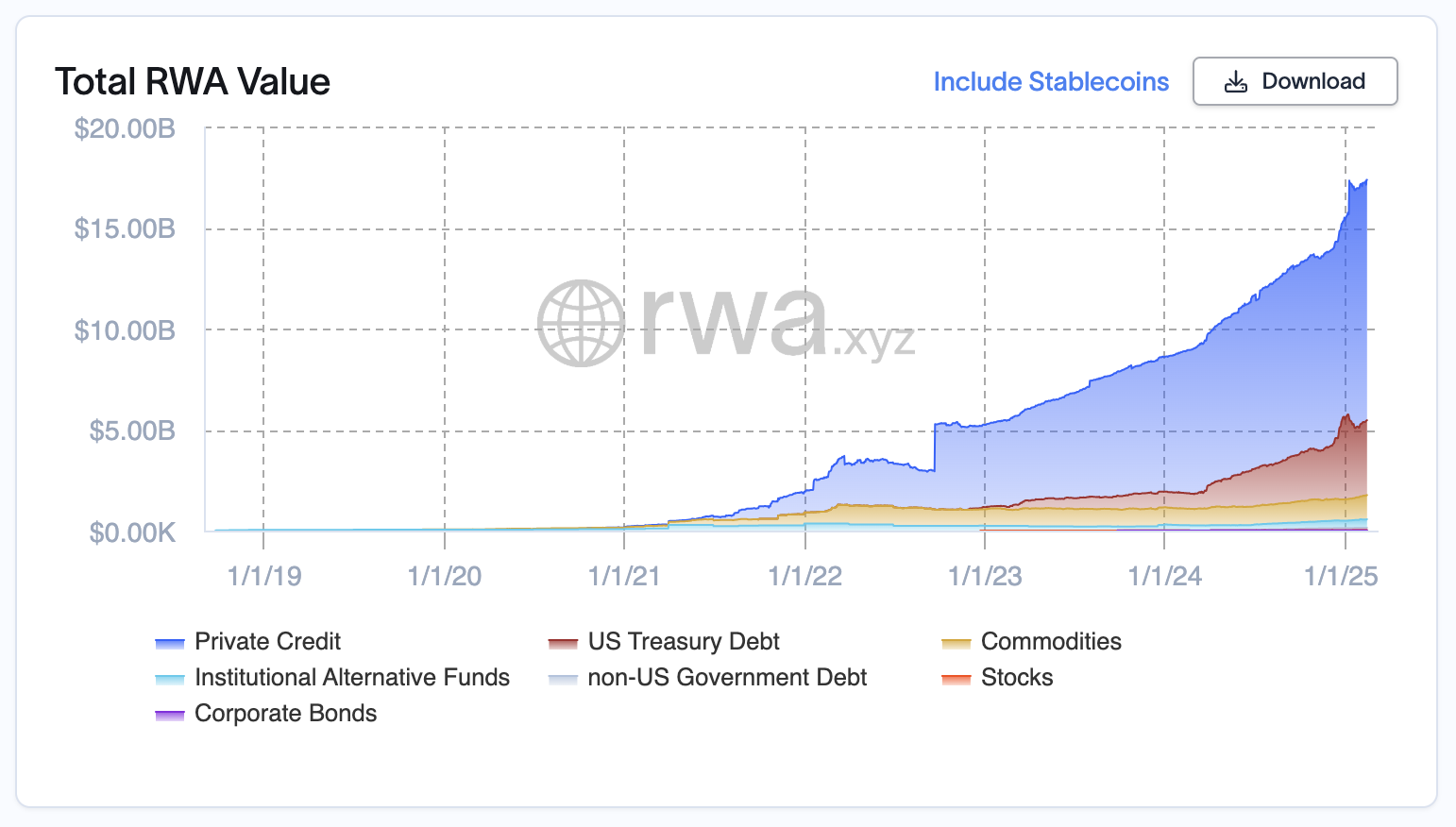

Total RWA Value Reaches $17.3 Billion

The total value of all real-world assets (RWA) has reached $17.3 billion, reflecting growing confidence in the sector. This represents a 96% increase year-over-year and 13% in the last three months.

Private Credit currently dominates the market, holding $11.9 billion of the total value, highlighting the potential for efficiency gains through tokenization.

Source: rwa.xyz

Disclaimer: This information is for educational purposes only and not financial advice. Market conditions are volatile.

Codeum provides comprehensive blockchain security and development services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us to learn more.