Rate Cut Could Fuel Next Crypto Bull Run

Wall Street anticipates US interest rate cuts before 2026, driven by cooling inflation and market adjustments. A looser monetary policy could significantly benefit the crypto market.

Market Predictions and Rate Cut Expectations

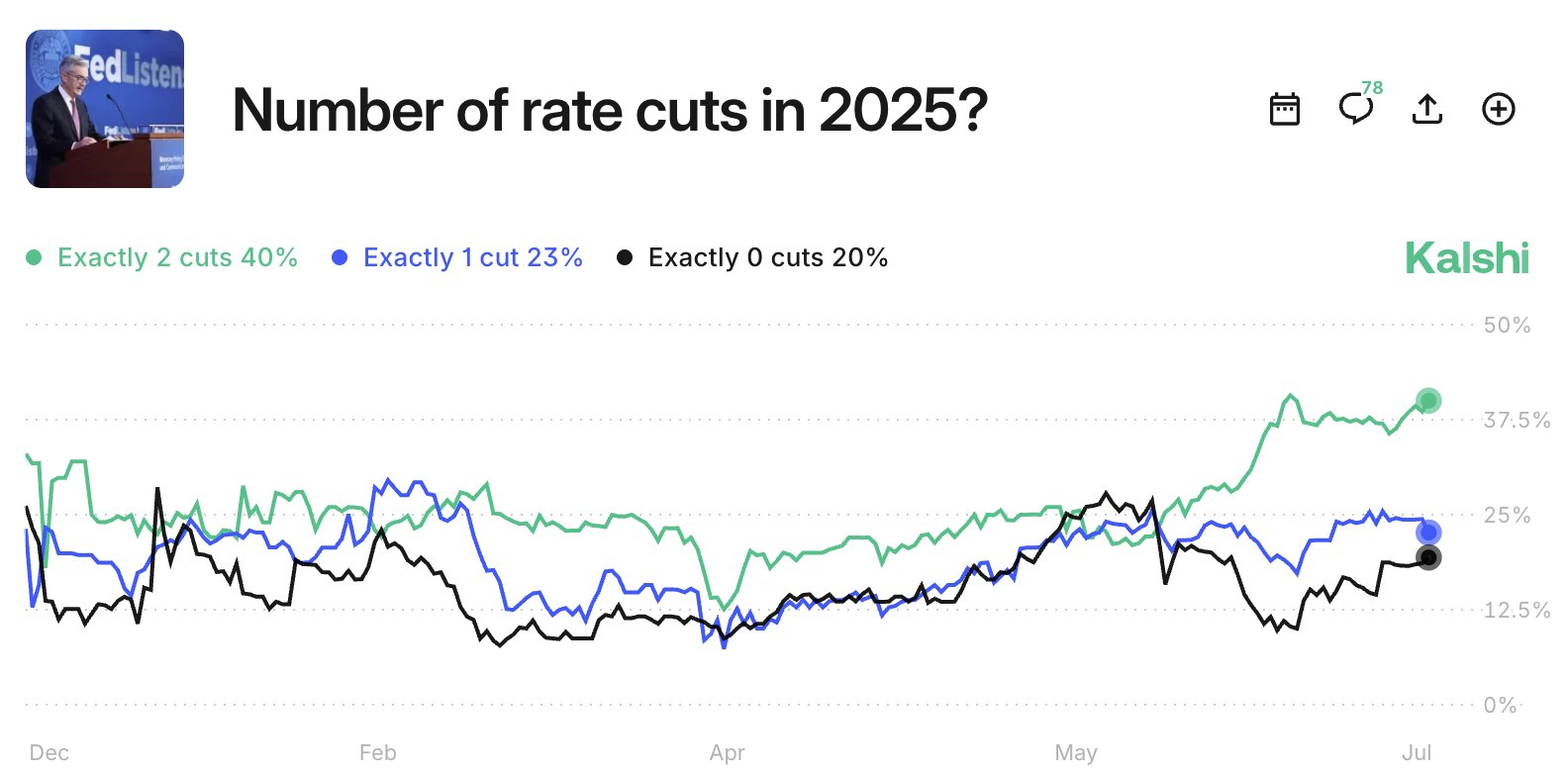

The Federal Reserve has maintained rates at 4.25%–4.50% since June, but speculation is increasing. Goldman Sachs projects the first rate cut in September. Prediction markets like Kalshi estimate a 40% chance of two rate cuts by year-end.

US inflation expectations have sharply declined. One-year consumer expectations fell to 4.4% in July, the lowest since February, marking a 2.2 percentage point drop in two months. Longer-term, five-year outlooks dropped 0.8 percentage points to 3.6%.

With these trends, the Fed has leeway to ease monetary policy without sparking inflation concerns. Bitcoin is holding above $118,000, and Ethereum is near $3,700, levels that have historically rallied following Fed rate cuts due to increased liquidity and investor risk appetite.

Potential for a Major Crypto Bull Run

Historically, rate cuts have initiated robust crypto bull markets. In March 2020, when the Fed cut rates during the COVID-19 crisis, Bitcoin surged from under $10,000 to over $60,000 within a year. Ethereum also benefited, supported by DeFi and NFT growth.

If a new rate cut cycle begins in September, similar conditions could emerge. Lower yields often drive investors to risk-on assets like crypto. Capital may shift from bonds and cash into Bitcoin, Ethereum, and select altcoins.

Falling inflation expectations and regulatory clarity could further boost investor confidence, potentially extending the current crypto cycle beyond previous highs.

However, the timing and depth of the cuts are critical. A delayed or shallow response from the Fed could limit the upside for crypto markets.

Key Dates to Watch

- July 29–30: Next Federal Reserve policy meeting. Market participants will closely analyze Fed commentary for signals about September.

- September 16–17: FOMC reconvenes; widely considered the first realistic window for a rate cut, especially if inflation continues to decline.

Other Key Indicators to Monitor:

- July CPI print: Due early August, shaping expectations for the September decision.

- Jackson Hole Symposium (Aug 22–24): Powell’s speech could significantly shift sentiment.

- US Jobs Reports (August & September): Labor market softness may strengthen the case for rate cuts.

These dates provide crypto traders with potential market inflection points. A confirmed Fed pivot could trigger renewed buying pressure, particularly in Bitcoin, Ethereum, and high-liquidity altcoins.

Disclaimer: This is not financial advice. Please conduct thorough research before making investment decisions.

At Codeum, we understand the importance of security in the blockchain space. We offer smart contract audits, KYC verification, and custom DApp development to ensure the safety and reliability of your projects. Contact us today to learn more about how we can help you navigate the crypto landscape securely.