PUMP Token Defies Bear Market with Buybacks

PUMP Bucks Bearish Market Trend

Pump.fun’s native token, PUMP, has demonstrated resilience this week, climbing 17% against a backdrop of widespread market declines. This surge is attributed to the protocol’s strategy of using platform fees to execute token buybacks.

These buybacks aim to provide support for token holders by reducing the circulating supply and mitigating sell pressure—a strategy gaining traction within the crypto space. For projects seeking to optimize their tokenomics, Codeum offers expert blockchain consulting services to ensure long-term stability and growth.

Currently, PUMP is trading at $0.0035, representing a 40% increase compared to a month ago. However, it remains 50% below its initial launch price in July, when it rapidly declined from $0.007 to $0.0024 within ten days.

This initial drop reflected a waning of initial hype; however, recent performance indicates that buybacks are contributing to market stabilization.

Revenue Engine Driving Buybacks

Pump.fun's revenue model is key. The platform generates fees from every token created through its service. This model has yielded $734 million over the past year, with peak volumes coinciding with the meme coin boom in January, fueled by tokens like TRUMP and MELANIA.

Since its inception, Pump.fun has facilitated the launch of over 12.5 million tokens and attracted 23 million wallets, establishing a sizable user base.

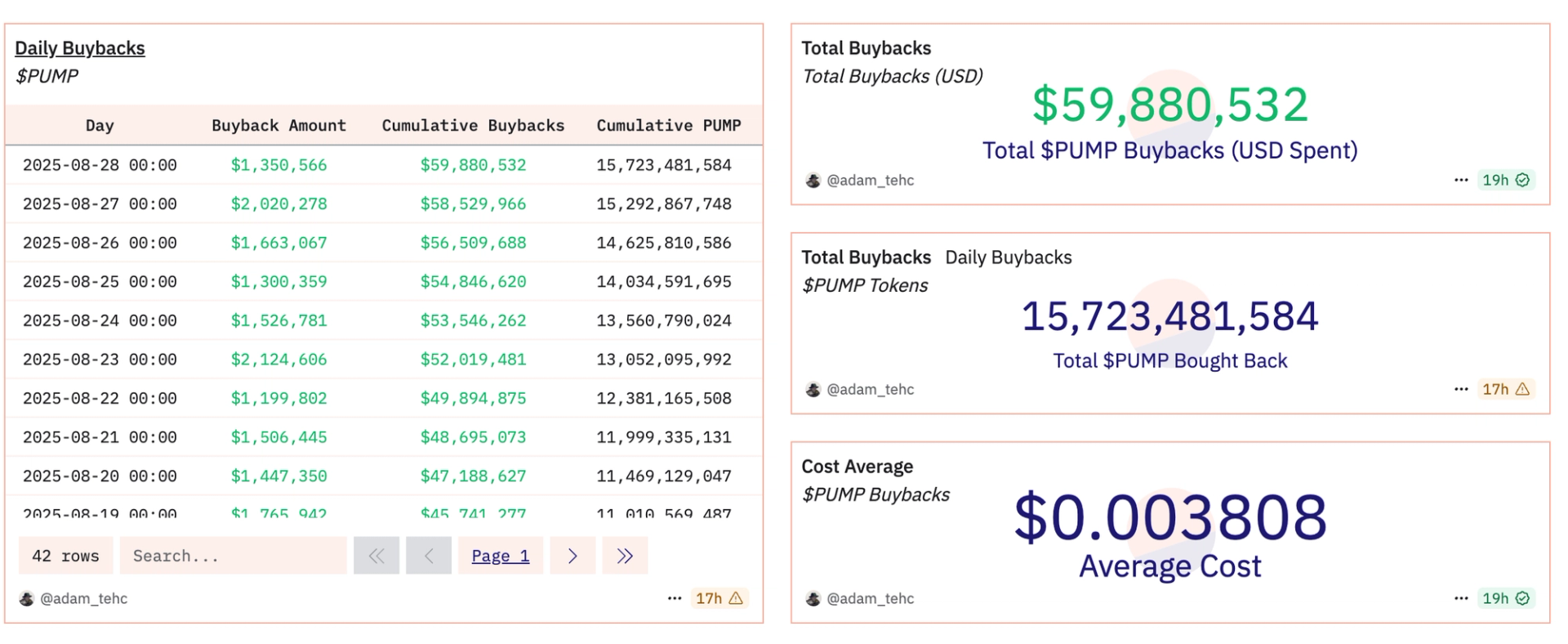

This activity has enabled Pump.fun to allocate $59 million towards buybacks, according to Dune dashboards, which has bolstered PUMP's recent recovery.

The timing of these buybacks could prove beneficial, as historical data suggests that autumn tends to be a more favorable period for digital assets following the summer slowdown. This alignment of factors may create opportunities for further upside.

Nevertheless, PUMP is still significantly below its initial highs, and its future performance will depend on the consistency of fee revenue in a potentially softening market.

In contrast, major cryptocurrencies are facing downward pressure. Bitcoin is trading at $108,500 and Ether at $4,337, both experiencing declines between 6% and 7% this week.