Positive Altcoin Trends Amid Market Turmoil: Key Insights

Resilience in Altcoins as Market Volatility Peaks

Amidst a fourth consecutive week of market cap decline, nearing a $1 trillion loss in November, mid- and low-cap altcoins reveal encouraging trends.

What are these trends, and how do they impact the current market environment? This report delves deeper.

Emerging Altcoin Signals in a Pessimistic Market

Despite the market sentiment index remaining in "extreme fear" throughout November, several positive indicators for altcoins are emerging. A report from CryptoQuant highlights the resilience of mid- and low-cap altcoins compared to Bitcoin and large caps.

Bitcoin and large caps saw notable declines, while mid- and small-cap altcoins experienced minimal impact. Analyst Darkfost notes the relative resilience of these smaller caps compared to Bitcoin.

Furthermore, a divergence between Bitcoin Dominance (BTC.D) and OTHERS Dominance (OTHERS.D) is evident. In November, OTHERS.D rose from 6.6% to 7.4%, while BTC.D decreased from 61% to 58.8%.

This shift indicates that altcoin investors are holding their positions, anticipating recovery rather than panic-selling.

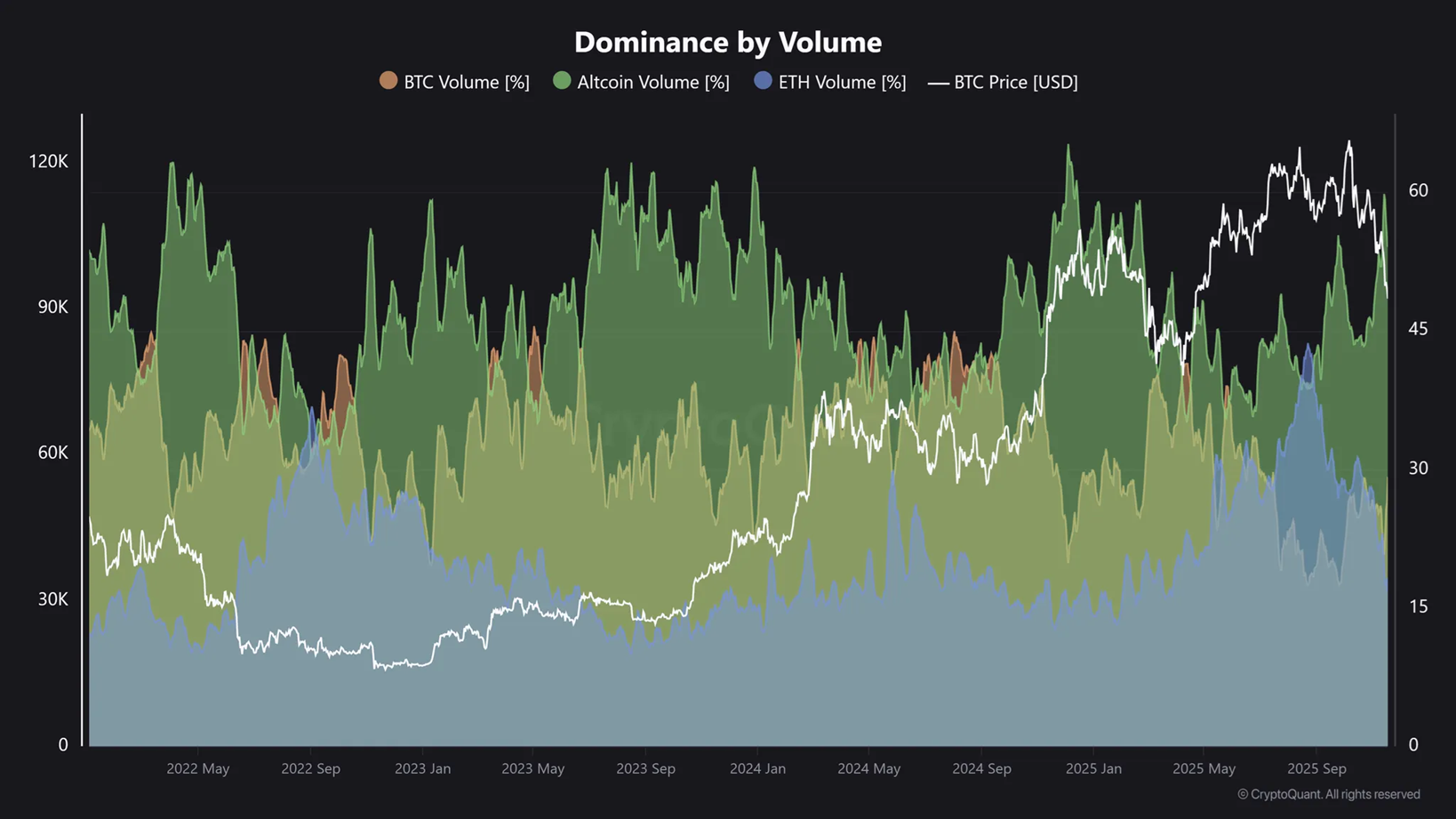

Additionally, Binance data shows that 60% of trading volume is now from altcoins, the highest since early 2025.

Analyst Maartunn notes that this increase in altcoin trading volume often correlates with heightened market speculation.

In conclusion, mid- and low-cap altcoins are attracting liquidity and demonstrating stronger performance, indicating investor optimism for a potential market recovery.