POPCAT Price: Robinhood Listing Impact

POPCAT Price Analysis: A Recent Rally and Uncertain Future

The meme coin POPCAT has experienced a challenging period since early February, with a significant 48% price drop. Despite attempts at recovery, the lack of strong market support and investor confidence has hindered any substantial rebound.

Weak Investor Sentiment

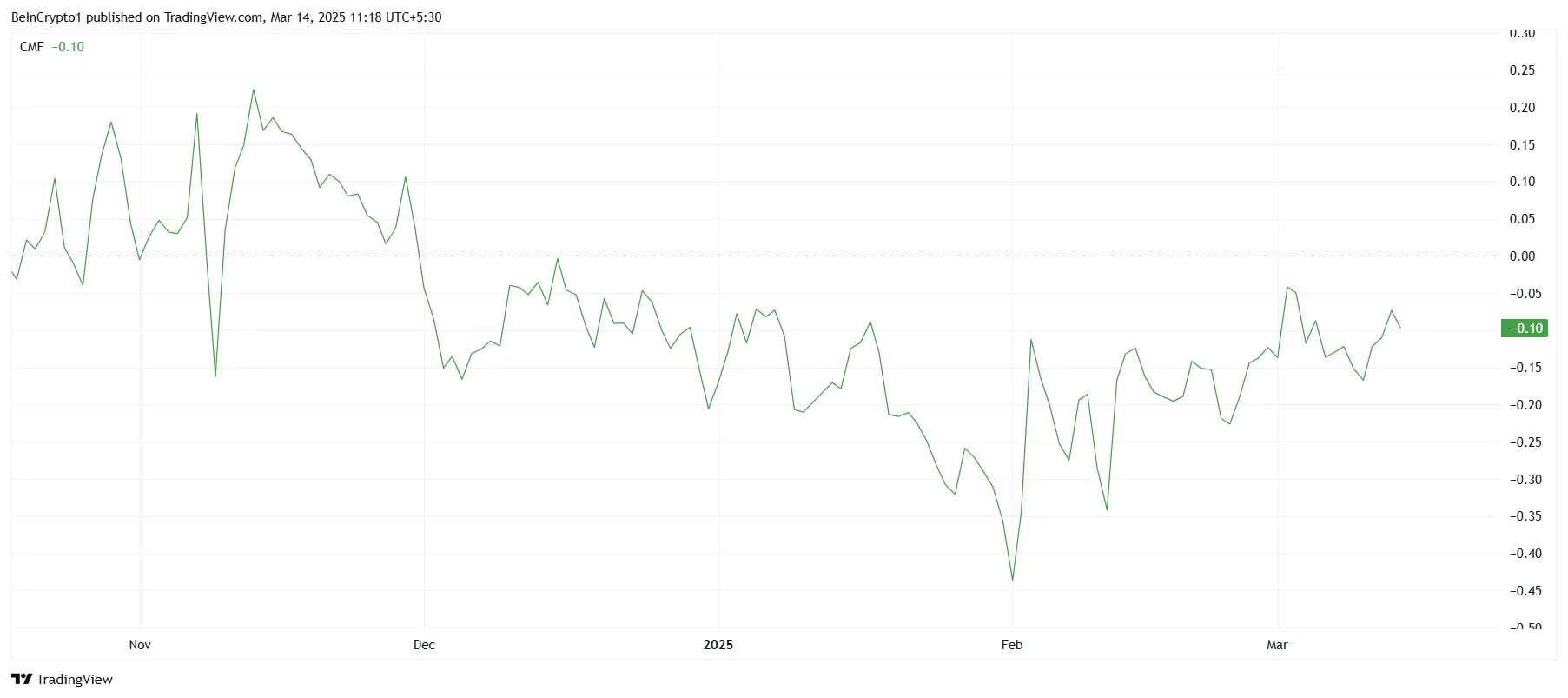

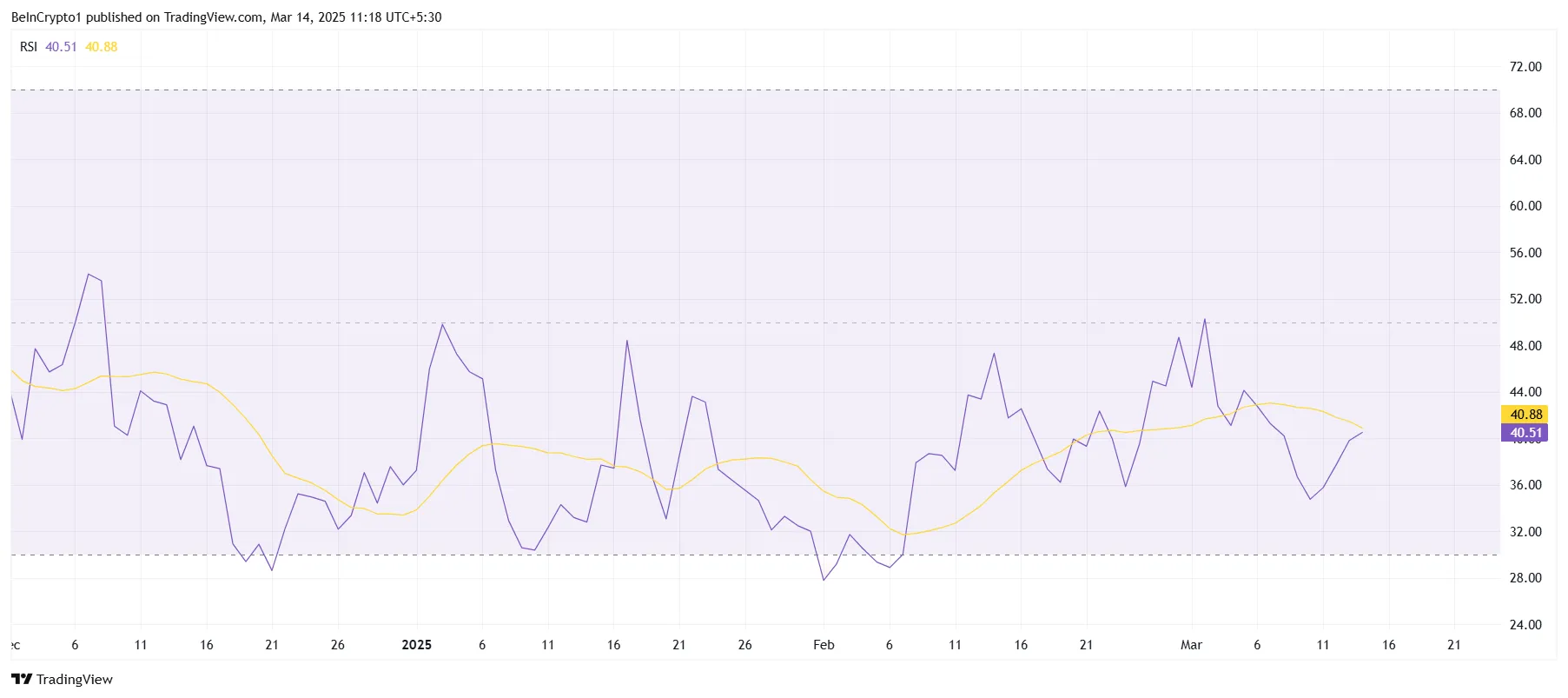

Technical indicators paint a picture of weak investor confidence. The Chaikin Money Flow (CMF) has remained below zero for over three months, indicating consistently weak buying pressure. Similarly, the Relative Strength Index (RSI) has stayed below 50 for the same period, signaling weak bullish momentum.

This lack of investor enthusiasm is preventing a meaningful price increase and keeping POPCAT in a bearish cycle. Until market sentiment improves, a sustained recovery remains unlikely.

Robinhood Listing: A Potential Catalyst?

A recent positive development is POPCAT's listing on Robinhood. This event has triggered a nearly 20% rally in the last four days, pushing the price to $0.180. This increased exposure could attract new investors.

However, the price is currently consolidating between the support level of $0.140 and resistance at $0.203. Breaking through the resistance level of $0.203 will be crucial for a sustained recovery, potentially leading to a test of $0.238.

Conclusion

POPCAT's price trajectory remains uncertain. While the Robinhood listing offers a glimmer of hope, overcoming the current bearish sentiment and breaking through key resistance levels will require sustained market improvement and increased investor confidence. Codeum offers services to help blockchain projects navigate the complexities of the crypto market. Our expertise in smart contract audits, tokenomics, and security consultation can provide the foundation for a more secure and successful future.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.