Pi Coin Price: Bearish Squeeze Threatens New Lows

Pi Coin Price: Stuck Near All-Time Low

Pi Coin is exhibiting continued weakness, struggling to initiate any substantial recovery. Failed breakout attempts suggest the cryptocurrency remains vulnerable to further declines.

Recent trading has highlighted Pi Coin's inability to distance itself from its historic low price point.

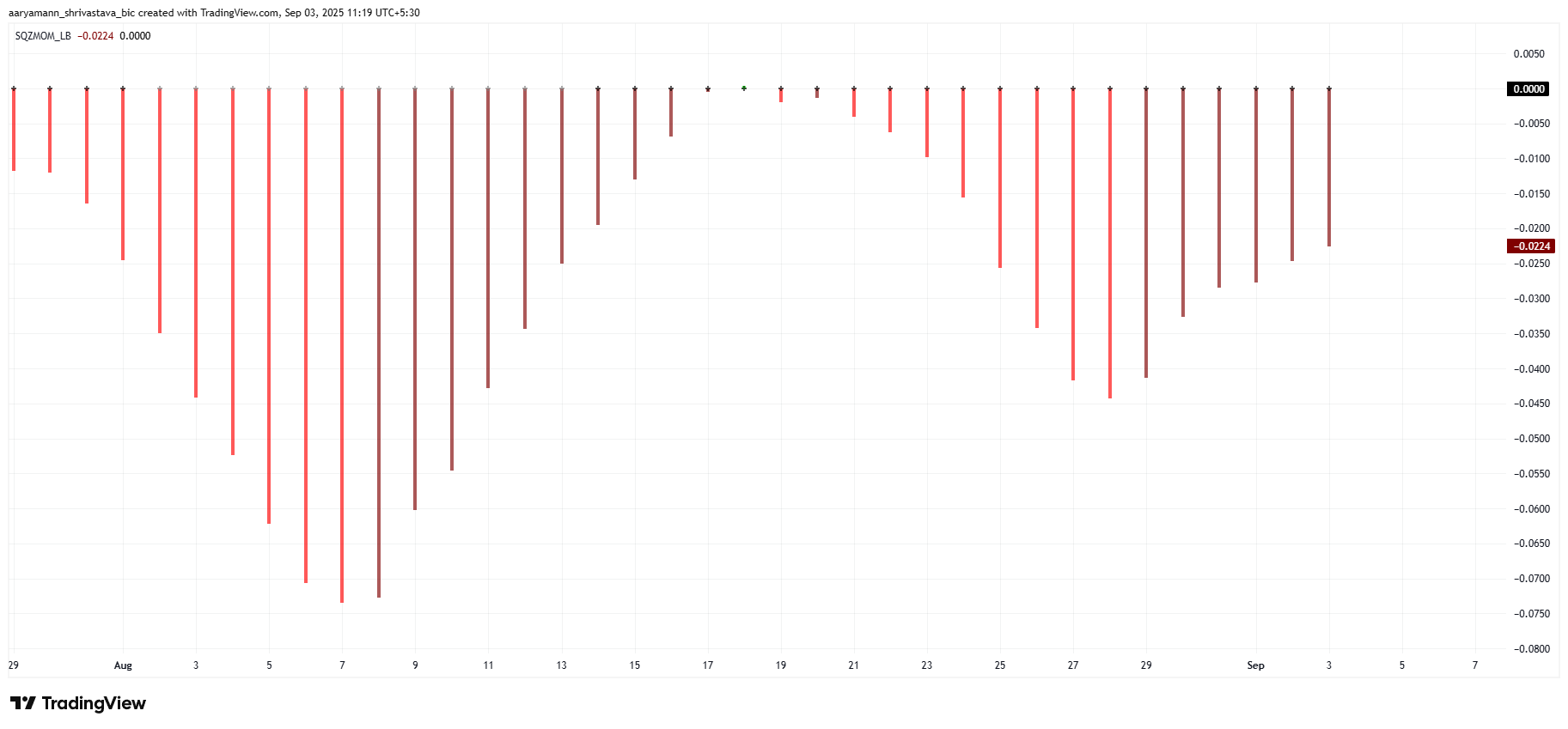

Squeeze Momentum Indicator Signals Potential Drop

The Squeeze Momentum Indicator on Pi Coin's chart indicates a squeeze formation. This often precedes increased volatility. Currently, the indicator leans bearish, suggesting a higher probability of downward pressure. A resolution of this squeeze could trigger a sharp price decrease if sellers dominate.

This poses a risk for Pi Coin holders. If the squeeze releases downwards, prices could approach critical support levels. Without strong buying activity, the cryptocurrency faces further declines, potentially exposing investors to losses.

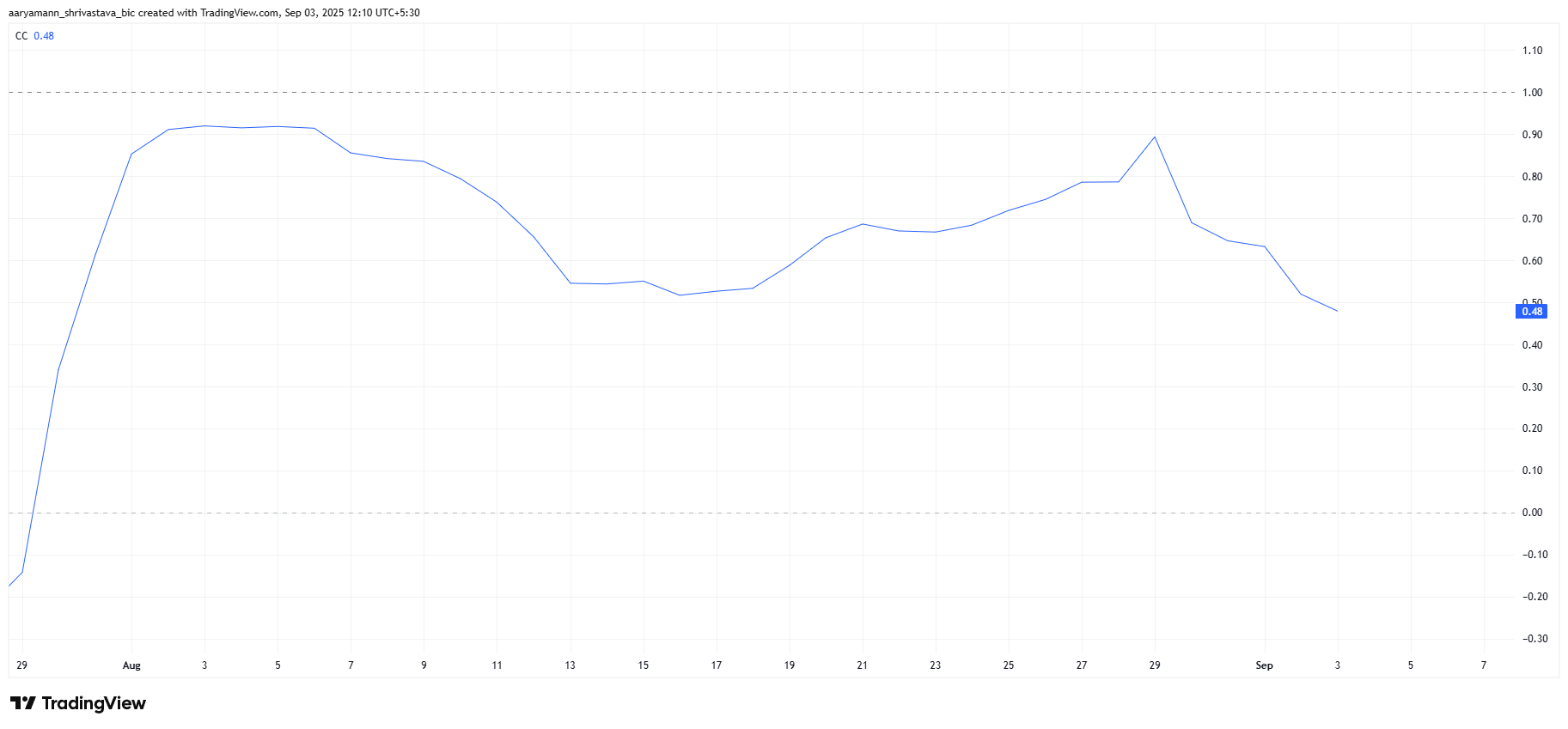

Weakening Correlation with Bitcoin

Adding to Pi Coin’s challenges is its declining correlation with Bitcoin. Currently at 0.48, the correlation indicates a divergence from BTC's movements. Historically, Pi Coin tends to follow Bitcoin's trends more closely, but this break suggests an inability to benefit from BTC's recent uptrend.

Typically, Pi Coin's correlation with Bitcoin strengthens during bearish cycles but weakens during BTC rallies. This pattern is proving detrimental, as Bitcoin's gains aren't reflected in Pi Coin's performance.

Price Analysis and Key Levels

Currently, Pi Coin is trading at $0.343, a 12.4% decrease in the last three days. It's holding slightly above the $0.344 support level, which has previously prevented further declines. However, this support appears fragile under mounting selling pressure.

If bearish conditions prevail, Pi Coin risks losing the $0.344 support and retesting its all-time low of $0.322. A break below this level could send the token to new all-time lows, escalating downside risk for investors.

Conversely, if Pi Coin rebounds from $0.344, it could rally to $0.360 in the near term. A stronger surge could see it test $0.401, potentially invalidating the current bearish outlook and providing temporary relief for investors, signaling renewed recovery efforts.