PEPE Price: Can History Repeat Itself?

The cryptocurrency market capitalization experienced a 12.3% drop in six weeks, falling from $3.73 trillion to $3.42 trillion. The bullish sentiment from November and December, when Bitcoin surged past $100,000, has significantly diminished. Bitcoin consolidated around the $100,000 level, but altcoins suffered steeper losses over the past six weeks.

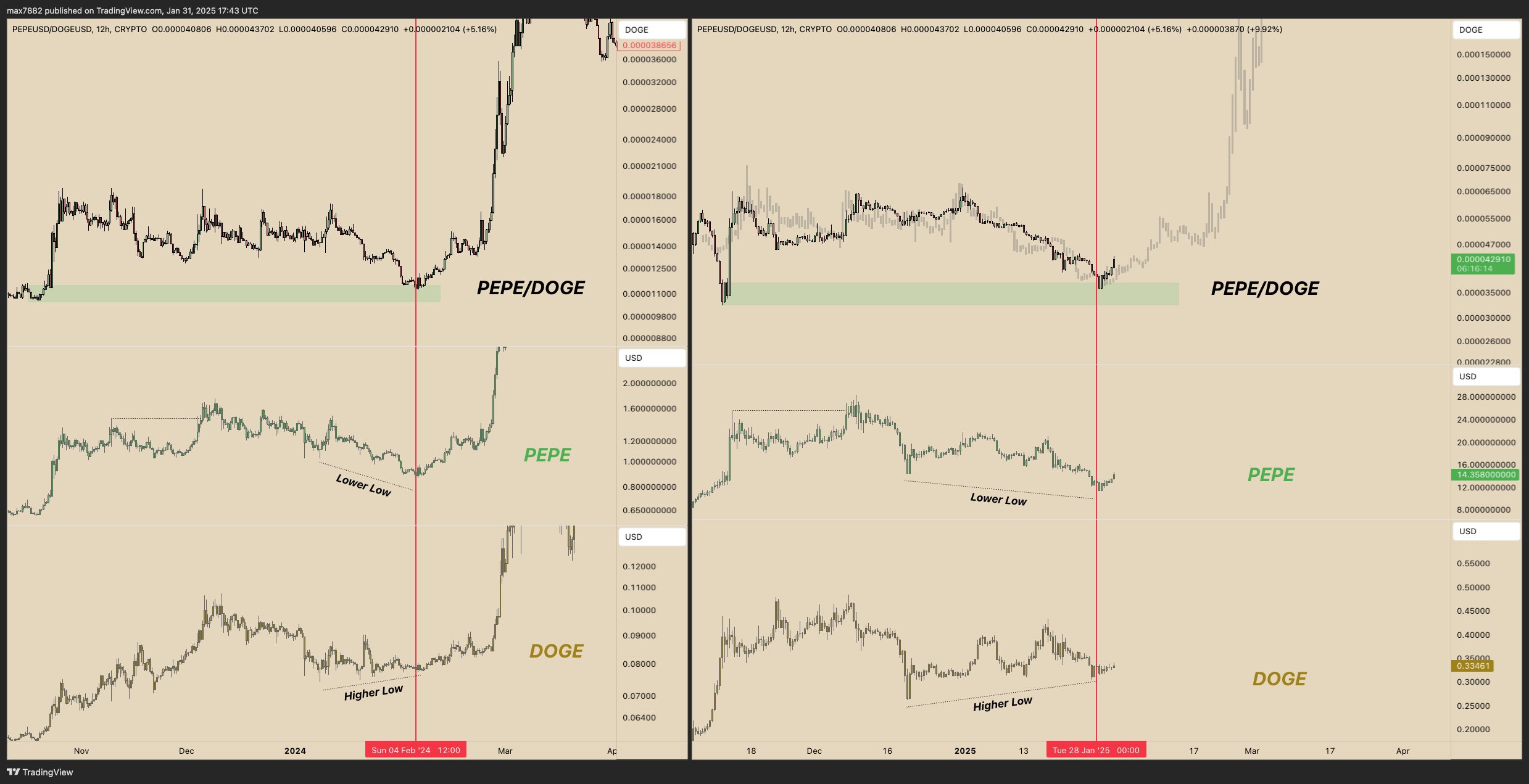

Pepe (PEPE) is down 57.8% from its all-time high in mid-December. However, there are indications that a bottom may have formed. Comparing PEPE's performance to Dogecoin (DOGE) offers valuable insight.

Pepe vs. Dogecoin: A February 2024 Replay?

In February 2024, the PEPE/DOGE pair retested a key support level before a substantial price increase. A similar pattern is emerging now. This suggests that PEPE might outperform DOGE in the coming weeks.

The chart below illustrates the PEPE/DOGE price action in 2024, highlighting the potential for a repeat performance.

Source: Max on X

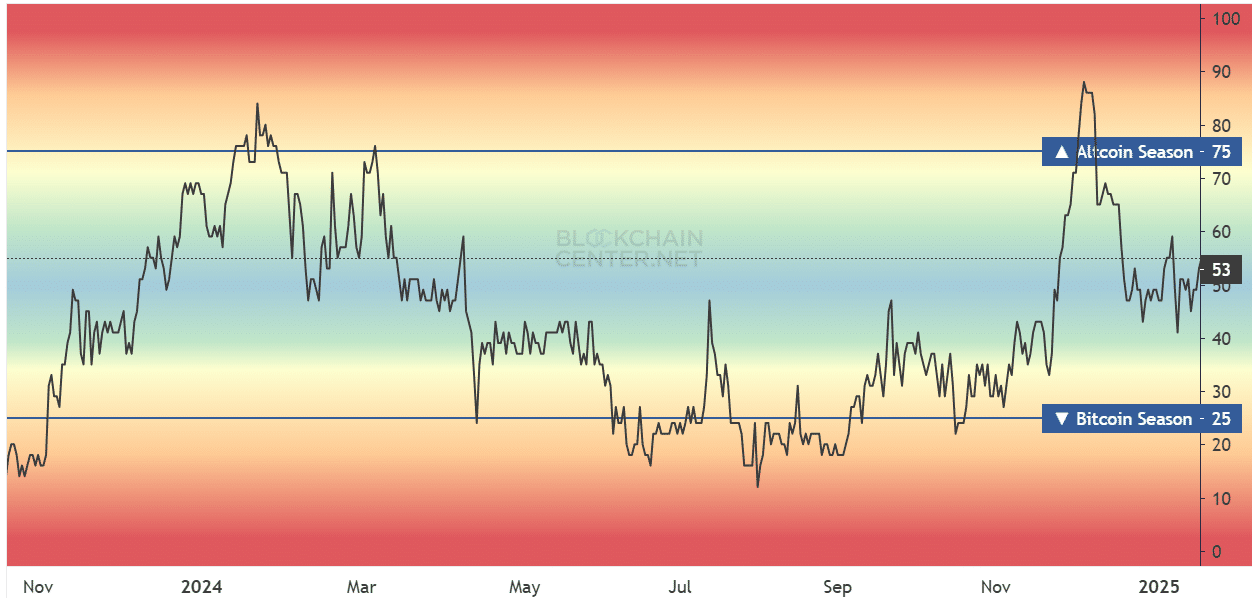

Altseason Potential

While PEPE/DOGE may have found a bottom, the broader altcoin market may still have further to fall. The altcoin season index currently sits at 53, suggesting an altseason isn't fully underway. This mirrors the situation in February and March 2024.

The following chart shows the Altseason Index.

Source: Blockchain Center

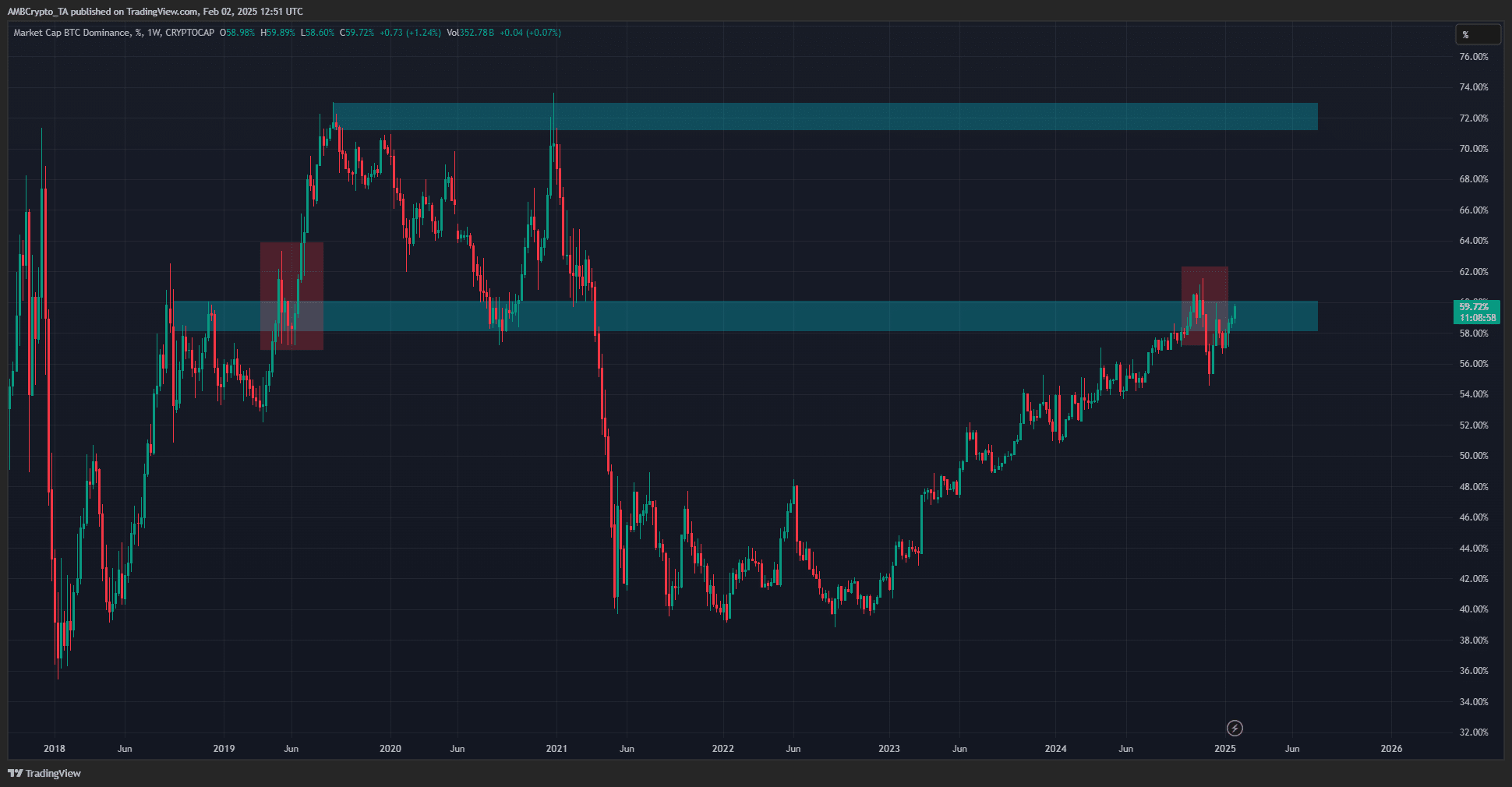

Interestingly, during a similar period in 2024, Bitcoin rallied significantly following spot ETF approvals, rising from $42,000 to $72,000 in six weeks. The Bitcoin dominance chart indicates a crucial long-term resistance level; a rejection at this level in November resulted in a mini alt-season. This potential scenario could benefit Pepe.

Source: BTC.D on TradingView

Overall, market sentiment is cautious, with significant fear and hesitation around "buying the dip." While historically such periods offer opportunities for substantial returns, investors must remain mindful of the inherent risks involved. Past performance is not indicative of future results.

Disclaimer: This analysis is solely the writer's opinion and does not constitute financial advice. Conduct thorough research before making any investment decisions.