Onyxcoin (XCN) Price Plunges: Market Analysis

Onyxcoin (XCN) Price Plunges: Market Analysis

Onyxcoin (XCN) experienced a sharp decline in February, losing over 35% of its value. The downward trend continued into March, with a further 19% drop in the last seven days. This significant price correction has reduced its market capitalization from a high of $1.4 billion on January 26th to $572 million.

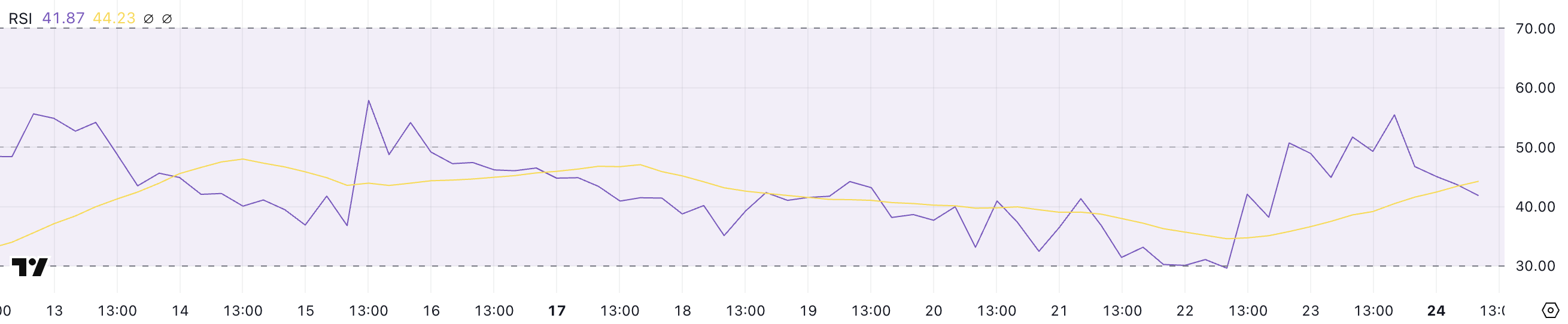

Technical Indicators: RSI and ADX

Technical indicators paint a picture of weakened buying pressure. The Relative Strength Index (RSI) currently sits at 41.8, having fallen from a recent high of 55.4. This suggests a shift from bullish to bearish sentiment. The Average Directional Index (ADX) stands at 25.2, indicating a strong downtrend. A value above 25 typically signifies a robust trend, in this case, a bearish one.

Key Support and Resistance Levels:

- Support: $0.014 – A break below this level could trigger further selling.

- Resistance: $0.0229 – Breaking above this level might signal a potential reversal.

Future Price Predictions

The current downtrend poses challenges for XCN. A continued decline could push the price towards the critical support level of $0.014. Conversely, a successful break above the resistance at $0.0229 could signal a potential reversal, potentially leading to further price increases.

Codeum's Role in Blockchain Security: Codeum provides comprehensive blockchain security solutions, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consulting, and partnerships with launchpads and crypto agencies. Our services are designed to help projects navigate the complex landscape of blockchain development and security.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.