Onyxcoin (XCN) Price Drop: Oversold Signals Emerge

Onyxcoin (XCN) Price Drop: Oversold Signals Emerge

Onyxcoin (XCN) has faced intense selling pressure, plummeting over 30% in the last month and 11% in the past week. Technical indicators point to a weakening market, with momentum and trend signals firmly bearish.

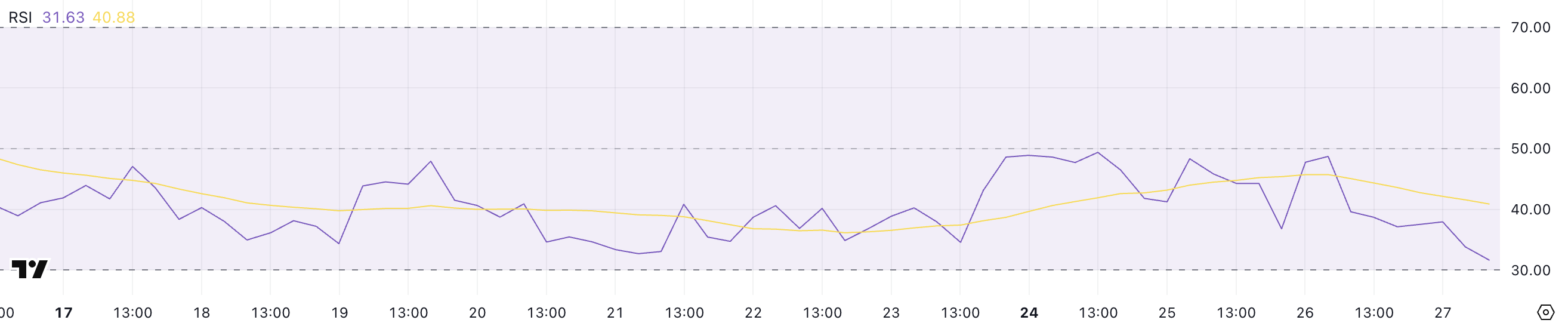

RSI Nears Oversold Territory

The Relative Strength Index (RSI) for XCN has sharply declined to 31.63, approaching oversold levels (below 30). This significant drop, following 12 consecutive days below the neutral 50 mark, suggests strong bearish sentiment. While a bounce is possible, a fall below 30 could signal panic selling. Conversely, a rise above 40 could indicate easing selling pressure.

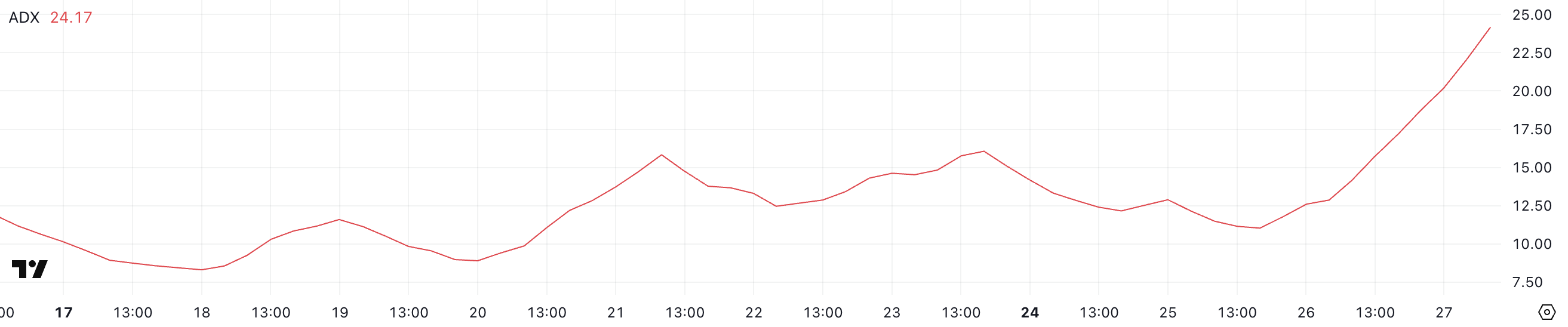

ADX Shows Strengthening Downtrend

The Average Directional Index (ADX) has surged to 24.17, indicating a rapidly strengthening downtrend. This sharp increase, coupled with the falling price, reinforces the bearish control. An ADX above 25 would confirm a powerful downward move, potentially hindering any bullish reversal.

EMA Suggests Potential for Continued Correction

The current bearish alignment of Exponential Moving Averages (EMAs) suggests the downtrend may persist. If the bearish momentum continues, XCN could retest support at $0.0083. A break below this level might lead to further declines, potentially reaching $0.0051 (its lowest since January 17).

However, a return to the strong momentum seen in late January could lead to a recovery. A successful break above the resistance at $0.014 would signal renewed bullish strength, with potential targets at $0.020 and $0.026.

Codeum: Your Partner in Blockchain Security

Codeum offers comprehensive blockchain security and development services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Let us help you navigate the complexities of the blockchain world.

Disclaimer: This analysis is for informational purposes only and not financial advice. Market conditions are volatile. Conduct thorough research and consult a professional before making investment decisions.