Nano Labs' $50M BNB Buy: Stock Dips Despite Reserves Boost

Nano Labs Acquires $50 Million in BNB

Chinese Web 3.0 infrastructure provider, Nano Labs, announced a $50 million purchase of BNB, Binance Chain's native cryptocurrency. This acquisition, executed via an over-the-counter (OTC) deal, brought their total digital asset holdings (including Bitcoin) to approximately $160 million. Nano Labs acquired 74,315 BNB at an average price of $672.45 per coin.

Strategic Reserve Building

This substantial BNB purchase represents the first step in Nano Labs’ plan to build a $1 billion BNB reserve. This ambitious goal follows a previously announced $500 million convertible notes offering, convertible into Class A shares at $20 per share. The company aims to hold 5% to 10% of BNB's total circulating supply in the long term.

Nano Labs isn't alone in its strategy. Earlier this year, Bhutan's Gelephu Mindfulness City (GMC) added BNB to its reserves alongside Bitcoin and Ethereum, highlighting a growing trend of diversification beyond the top two cryptocurrencies. Other altcoins like Solana (SOL), XRP, and Hyperliquid (HYPE) are also attracting institutional interest in 2025.

Stock Price Decline Despite BNB Purchase

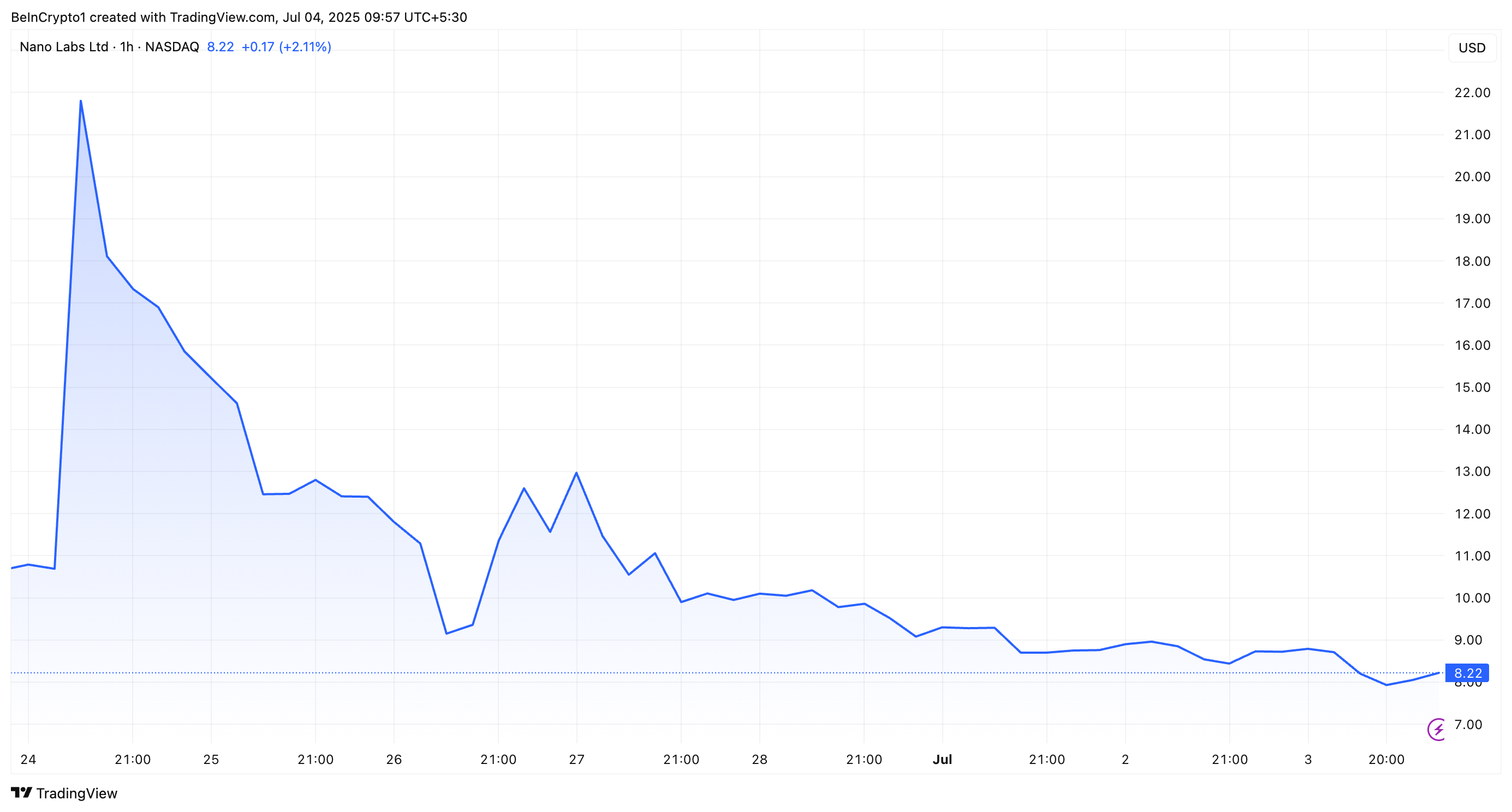

Despite the significant BNB acquisition, Nano Labs' stock price (NA) experienced a 4.7% drop at market close, continuing a downward trend from the previous week. While a previous announcement briefly caused a surge, these gains were completely erased. The stock fell an additional 2.1% in after-hours trading. Interestingly, the price of BNB itself remained largely unaffected, appreciating by 0.19% in the past day and 2.6% over the past week, trading at $661.2.

Note: Codeum offers comprehensive blockchain security services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies.