Kalshi's Solana Integration: A Boost for SOL Liquidity?

Kalshi Adds Solana Deposits: Implications for SOL Liquidity

Kalshi, a prediction market platform, has integrated Solana (SOL), allowing users to directly fund their accounts using SOL from their wallets. This addition joins existing options like Bitcoin, USDC, and Worldcoin. This integration could significantly impact SOL liquidity.

The direct deposit option eliminates the need for SOL holders to convert to stablecoins before participating in Kalshi's prediction markets. This should increase SOL circulation between wallets and the Kalshi platform, thereby boosting on-chain demand.

Can Kalshi Revitalize Solana?

Solana's on-chain activity over the past year has largely centered around high-speed decentralized exchange (DEX) trading and meme coins. For instance, meme coins accounted for nearly 65% of Solana's May trading volume, with daily DEX turnover exceeding $45 billion at its peak. However, Kalshi's integration introduces a new utility for SOL.

Users can now stake SOL on predictions ranging from weather forecasts and election outcomes to pop culture events like the GTA 6 release date. This diversification drives broader token movement across various markets.

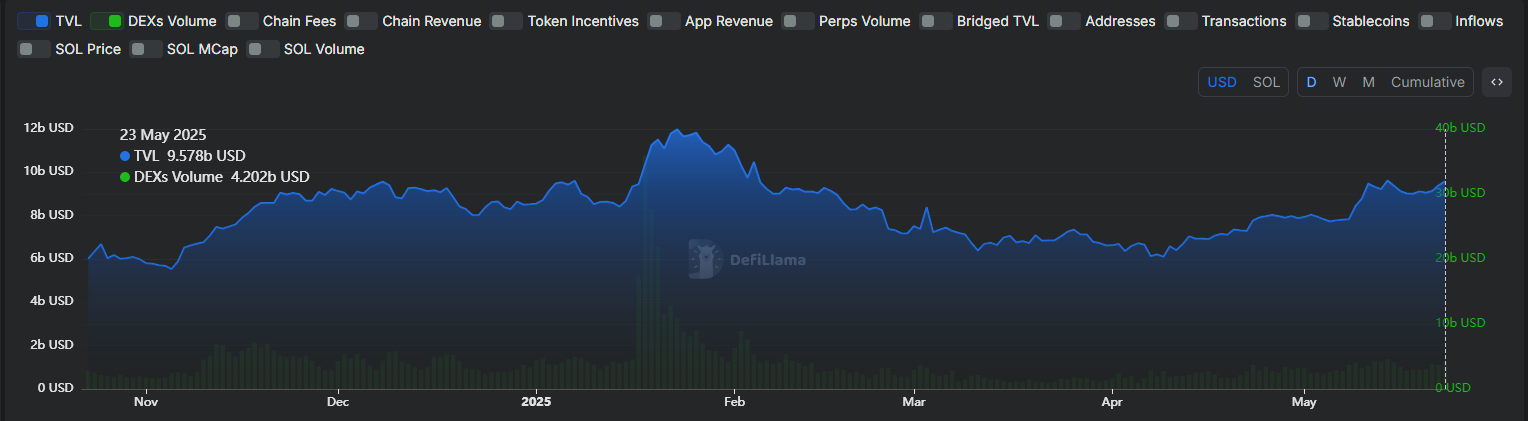

Solana TVL and DEX Volume in 2025. Source: DeFilLama

This increased activity could enhance Solana's market depth, as funds tied up in prediction market contracts eventually flow back into the broader ecosystem. The seamless conversion of SOL to USD via Zero Hash integration further reduces friction compared to traditional on-ramps, potentially attracting more crypto-native traders.

Kalshi's Market Share and the Future of Solana

Kalshi's expanding user base ($1.97 billion trading volume in 2024, up from $183 million the previous year) could boost Solana's liquidity. The platform operates in over 40 US states and recently launched a mini-app for Worldcoin users.

Kalshi vs Polymarket Stats 2025. Source: Polymarket Analytics

Given Polymarket, Kalshi's decentralized counterpart, already utilizes Solana, this integration could create a bridge between DeFi and regulated prediction markets. Users often utilize multiple platforms for varied odds and niche predictions, so this dual support could be beneficial.

Disclaimer: This information is for educational purposes only. Always conduct thorough research and consult a financial professional before making any investment decisions.