Hyperliquid's Efficiency: Revenue Per Employee Eclipses Giants

Hyperliquid's Revenue Model Disrupts Traditional Finance

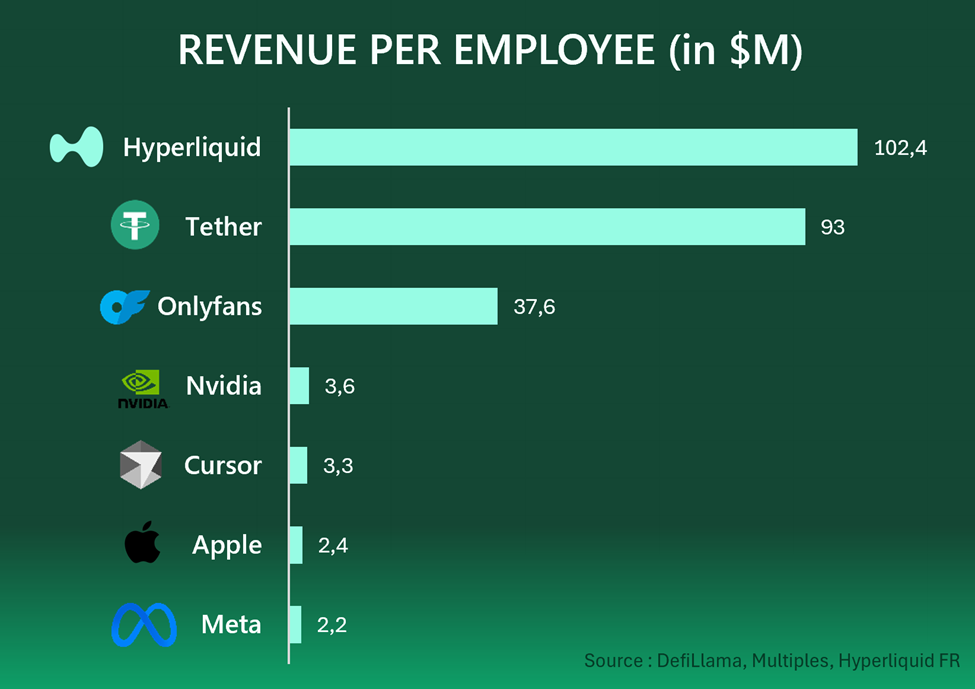

A decentralized derivatives exchange (DEX) is making waves by outperforming established corporations in terms of revenue per employee. Hyperliquid, with its lean operational model, is generating revenue figures that rival those of Wall Street giants.

Hyperliquid vs. Industry Leaders

Data from DeFiLlama indicates that Hyperliquid generates an estimated $1.127 billion annually with just 11 core contributors. This translates to a remarkable $102.4 million in revenue per employee.

- In comparison, Tether's per-employee revenue is approximately $93 million.

- Apple, despite its massive $400 billion annual sales, generates only $2.4 million per employee.

The Power of Lean Crypto Operations

Hyperliquid's efficiency highlights the potential of lean operational models in the crypto space. Unlike traditional firms burdened by large headcounts, Hyperliquid's structure allows a small team to generate significant revenue.

Self-Funding and VC Rejection

Jeff Yan, CEO and co-founder of Hyperliquid, confirmed the team's size and their commitment to self-funding. The company has notably turned down venture capital, with Yan criticizing traditional VC financing for creating an "illusion of progress" through inflated valuations.

Hyperliquid's Dominance in Blockchain Revenue

Hyperliquid's impact extends to the broader blockchain ecosystem. The exchange captured 37% of total blockchain revenue in July, underscoring its significant role in the DeFi economy. According to DeFiLlama, Hyperliquid, Solana meme coin launchpad Pump.fun, and Aerodrome account for 75% of all revenue distributed to token holders.

Future Developments

Hyperliquid is preparing for its HIP-3 upgrade, which aims to evolve the platform into a full Web3 infrastructure layer, supporting decentralized applications and “smart derivatives.” This move could position Hyperliquid as both a trading venue and a foundational layer for decentralized finance (DeFi).

Challenging Traditional Metrics

By surpassing established companies like Apple and Tether in per-capita efficiency, Hyperliquid challenges traditional corporate benchmarks and prompts a reassessment of operational effectiveness.

Chart of the Day

Source: DefiLlama

Byte-Sized Alpha

- Experts warn Bitcoin could face a 51% attack as mining centralizes.

- China mulls yuan-backed stablecoin as Beijing makes a play against US dominance.

- VanEck puts Bitcoin’s biggest detractors on blast with ‘Hall of Shame’ list.

- Harvard economist calls out the US for failing on sensible crypto regulation.

- Is Bitcoin becoming too expensive for retail investors?

- Is MicroStrategy’s Bitcoin flywheel facing its first real stress test?

- Ethereum price dip triggers million-dollar losses for traders.

- HBAR price may repeat history as bearish squeeze strengthens.

- XRP price drops 11% as holders appear stuck between hope and reality.

Crypto Equities Pre-Market Overview

| Company | At the Close of August 19 | Pre-Market Overview |

|---|---|---|

| Strategy (MSTR) | $336.57 | $339.75 (+0.94%) |

| Coinbase Global (COIN) | $302.07 | $304.34 (+0.75%) |

| Galaxy Digital Holdings (GLXY) | $24.10 | $23.99 (-0.44%) |

| MARA Holdings (MARA) | $15.17 | $15.15 (-0.13%) |

| Riot Platforms (RIOT) | $11.96 | $11.98 (+017%) |

| Core Scientific (CORZ) | $14.35 | $14.32 (-0.21%) |

Crypto equities market open race: Google Finance