HYPE Price Analysis: Weakening Momentum?

Hyperliquid (HYPE) Price Analysis: A Shifting Landscape

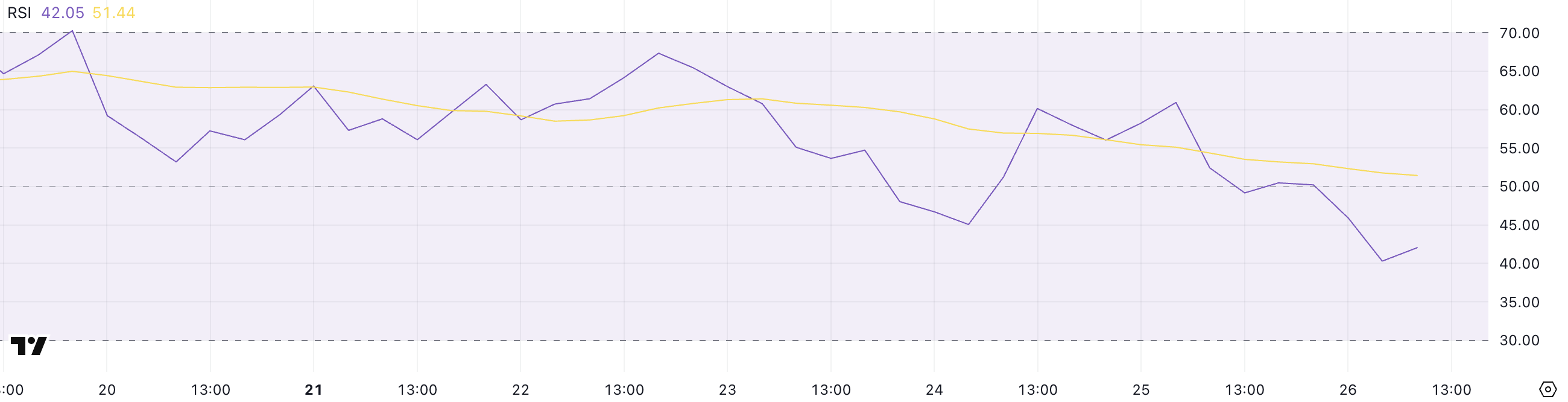

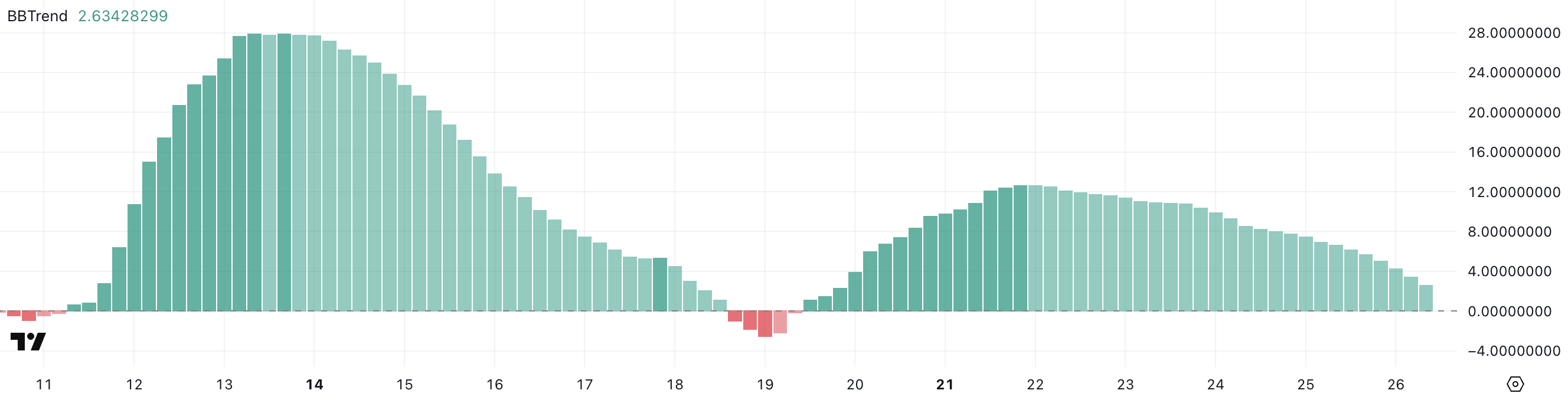

Hyperliquid (HYPE) recently reported $42.53 million in fees over the past 30 days, demonstrating strong revenue generation. However, a closer look at momentum indicators reveals a concerning trend. Both the Relative Strength Index (RSI) and BBTrend are signaling a potential slowdown.

Weakening Momentum: RSI and BBTrend Signals

The RSI has dropped significantly, falling to 42 from 60.93 in just one day. This sharp decline suggests weakening bullish momentum and increased trader caution. Previously in overbought territory, HYPE is now approaching neutral to slightly oversold conditions.

The BBTrend indicator also shows a dramatic fall, dropping to 2.63 from 12.68 in just five days. This significant decrease indicates a major slowdown in trend strength, hinting at a potential consolidation phase or deeper correction.

Critical Price Point: Support or Rally?

HYPE has unsuccessfully attempted to break through the key resistance at $19.26 twice. This failure puts pressure on the short-term trend, creating a critical juncture. The price is now poised to either collapse below support or ignite a new rally towards $25.

A continuation of bearish momentum could see HYPE test support at $16.82. Further intensified selling pressure could push the price down to $14.66, potentially opening the way towards deeper support levels at $12.42 and even $9.32.

Conversely, a resurgence of bullish momentum could lead to another challenge of the $19.26 resistance. A successful breakout could propel HYPE towards $21, and potentially even $25.87 if momentum remains strong. This would be the first time surpassing $25 since February 21.

Disclaimer

This analysis is for informational purposes only and should not be considered investment advice. Market conditions are volatile. Always conduct your own research and seek professional advice before making financial decisions.