Hedera (HBAR) Price Rebound: Analysis & Outlook

Hedera (HBAR) Price Rebound: Analysis & Outlook

Hedera (HBAR) has shown a slight price increase, climbing above $0.21 in the last 24 hours. However, this follows a 40% correction over the past 30 days, leaving the token's future trajectory uncertain. While a short-term rebound is underway, technical analysis suggests bearish momentum still holds sway.

Technical Indicators Suggest a Cautious Outlook

Several key technical indicators point to continued uncertainty:

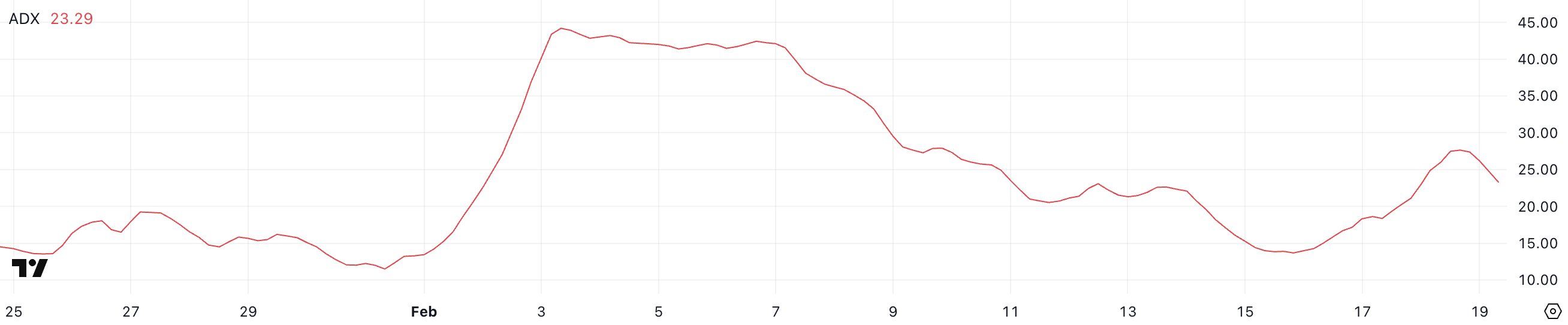

- ADX (Average Directional Index): Currently at 23.2, below the 25 threshold indicating a strong trend. This suggests the current upward movement lacks significant strength. A sustained rise above 25 would signal strengthening bullish momentum.

- Ichimoku Cloud: Remains bearish, with the price trading below the red cloud. This indicates ongoing downward pressure. A break above the Kijun-sen (baseline) and into the cloud would be a significant bullish signal.

- EMAs (Exponential Moving Averages): Short-term EMAs remain below long-term EMAs, reinforcing the bearish trend. A bullish crossover, where short-term EMAs move above long-term EMAs, would signal a potential trend reversal.

The charts below illustrate these indicators.

Potential Price Scenarios

Bearish Scenario: If the downtrend intensifies, and the $0.17 support level breaks, HBAR could see a further decline towards $0.12, representing a 42% drop from current levels.

Bullish Scenario: A sustained price increase above the Kijun-sen and into the Ichimoku cloud, accompanied by a rise in ADX above 25 and a bullish crossover of EMAs, could signal a strong recovery. Breaking the $0.25 resistance level could lead to further gains, potentially reaching $0.35 or even $0.40 (a 90% increase from current levels).

Conclusion

Hedera's HBAR price remains volatile. While a short-term price increase is evident, the overall technical outlook is cautiously bearish. Investors should closely monitor the key technical indicators discussed above before making any investment decisions. Remember to always conduct thorough research and consult a financial advisor before investing in cryptocurrencies.

Codeum Note: At Codeum, we offer a suite of blockchain security and development services including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies to secure your blockchain projects.