Hedera (HBAR) Price Analysis: Bearish Trend Persists?

Hedera (HBAR) Price Analysis: A Mixed Bag

Hedera (HBAR) experienced a 4% increase in the last 24 hours, but remains down nearly 7% over the past week, struggling to break above $0.19. Technical indicators offer a mixed outlook.

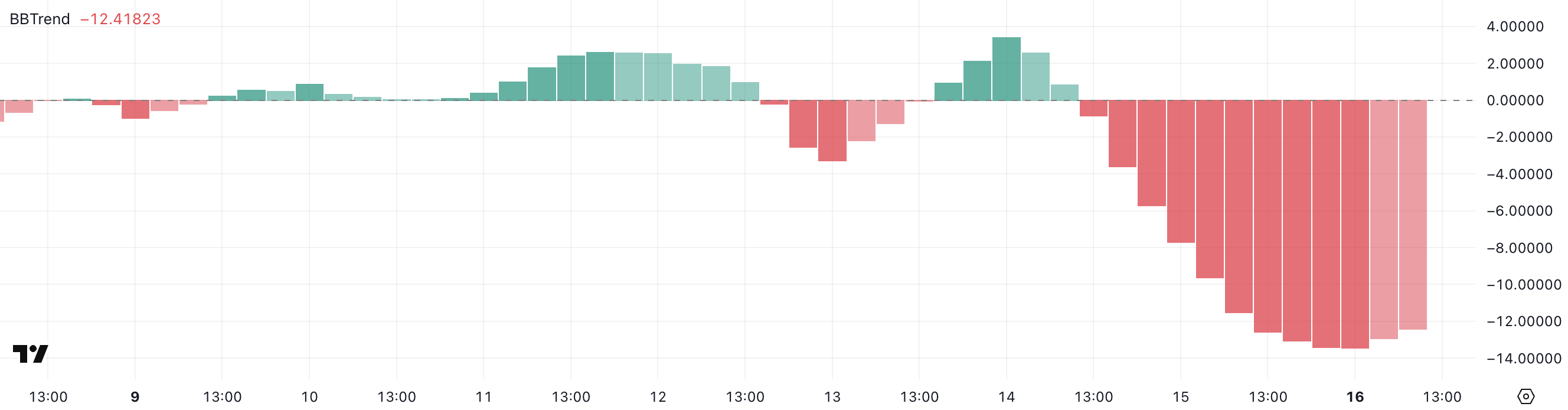

While the Relative Strength Index (RSI) shows a significant recovery, suggesting returning buying pressure, the BBTrend points to growing bearish momentum. This creates a complex scenario for HBAR's immediate future.

Bearish Momentum Intensifies

The BBTrend indicator has plummeted to -12.41, a sharp drop from -0.83 just two days prior, hitting a low of -13.43 earlier today before a slight recovery. This drastic shift suggests increasing bearish pressure and a potential move into a stronger downtrend.

The BBTrend, derived from Bollinger Band analysis, measures price movement strength and direction. Deeply negative values typically indicate a downward trend with rising volatility. For HBAR, this signifies growing bearish momentum.

Source: TradingView

RSI Rebound: A Sign of Hope?

Conversely, the RSI has rebounded significantly, climbing to 50.39 from 26.6 just two days ago. This sharp increase hints at growing buying interest and a potential end to the oversold phase. An RSI around 50 indicates a balance between buyers and sellers, acting as a potential pivot point.

Source: TradingView

Critical Price Levels: $0.160 and $0.155

HBAR's short-term EMAs remain below long-term EMAs, a bearish technical setup. However, the price is approaching key resistance at $0.160. A breakout above this level could signal a move towards $0.175, potentially reaching $0.183 or even $0.193.

Conversely, failure to break above $0.160 could lead to a retest of support at $0.155. A drop below this level may trigger a decline to $0.150, reinforcing the bearish trend.

Source: TradingView

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult a professional before making investment decisions. Market conditions are dynamic.