HBAR Price: $35M Liquidation Looms if Hedera Hits $0.23

HBAR Price Eyes Key Resistance Level

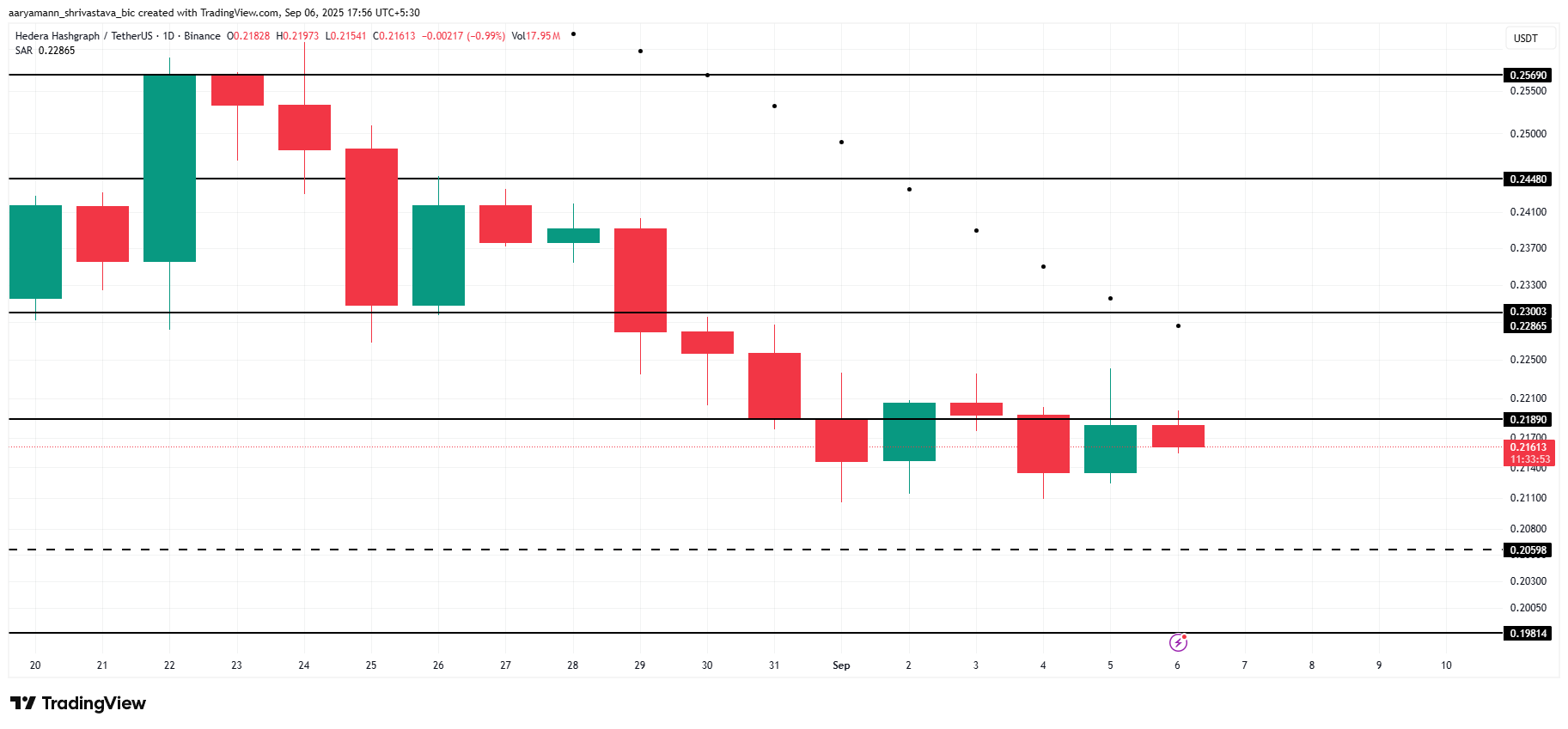

Hedera (HBAR) is showing signs of potential recovery after a period of price decline. Currently trading around $0.216, HBAR is attempting to stabilize, and a potential move upwards could trigger significant market liquidations.

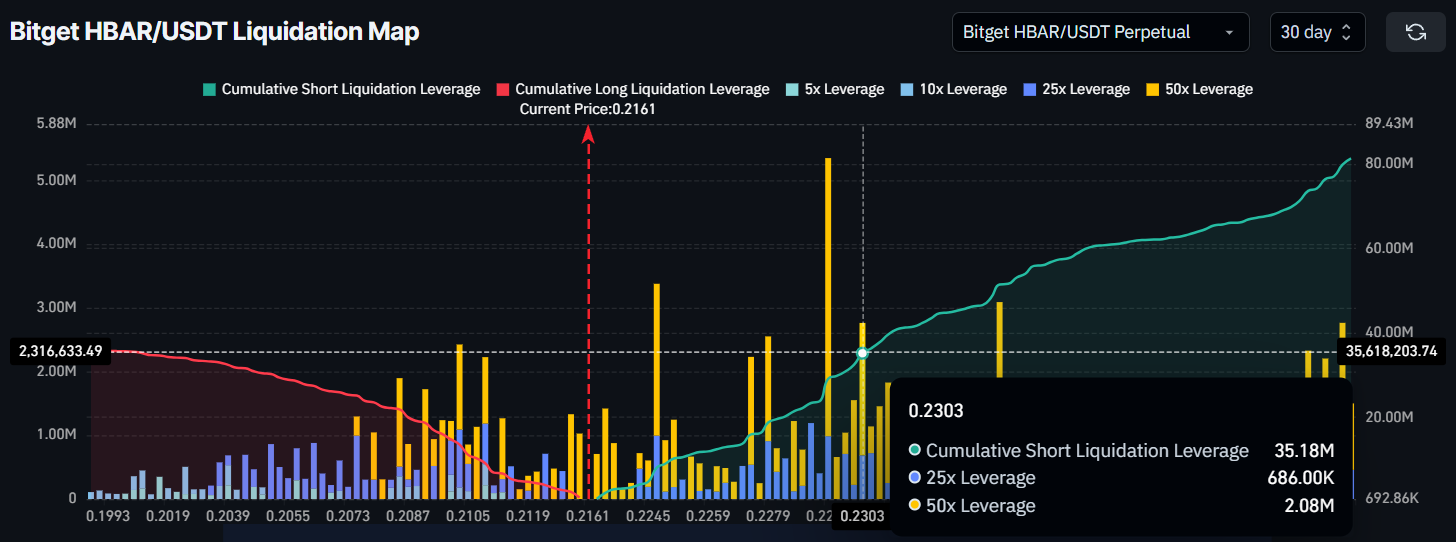

Potential Short Squeeze Above $0.23

Liquidation data indicates that over $35 million in short positions could be liquidated if HBAR reaches $0.230. This scenario could create a short squeeze, potentially boosting bullish momentum and allowing HBAR to extend its rebound.

Traders should be aware that a move beyond $0.230 could result in increased volatility. While liquidations may drive prices upward, this level represents a crucial price zone. Successful penetration of this resistance could attract further capital inflows from bullish investors.

Bitcoin's Influence on HBAR

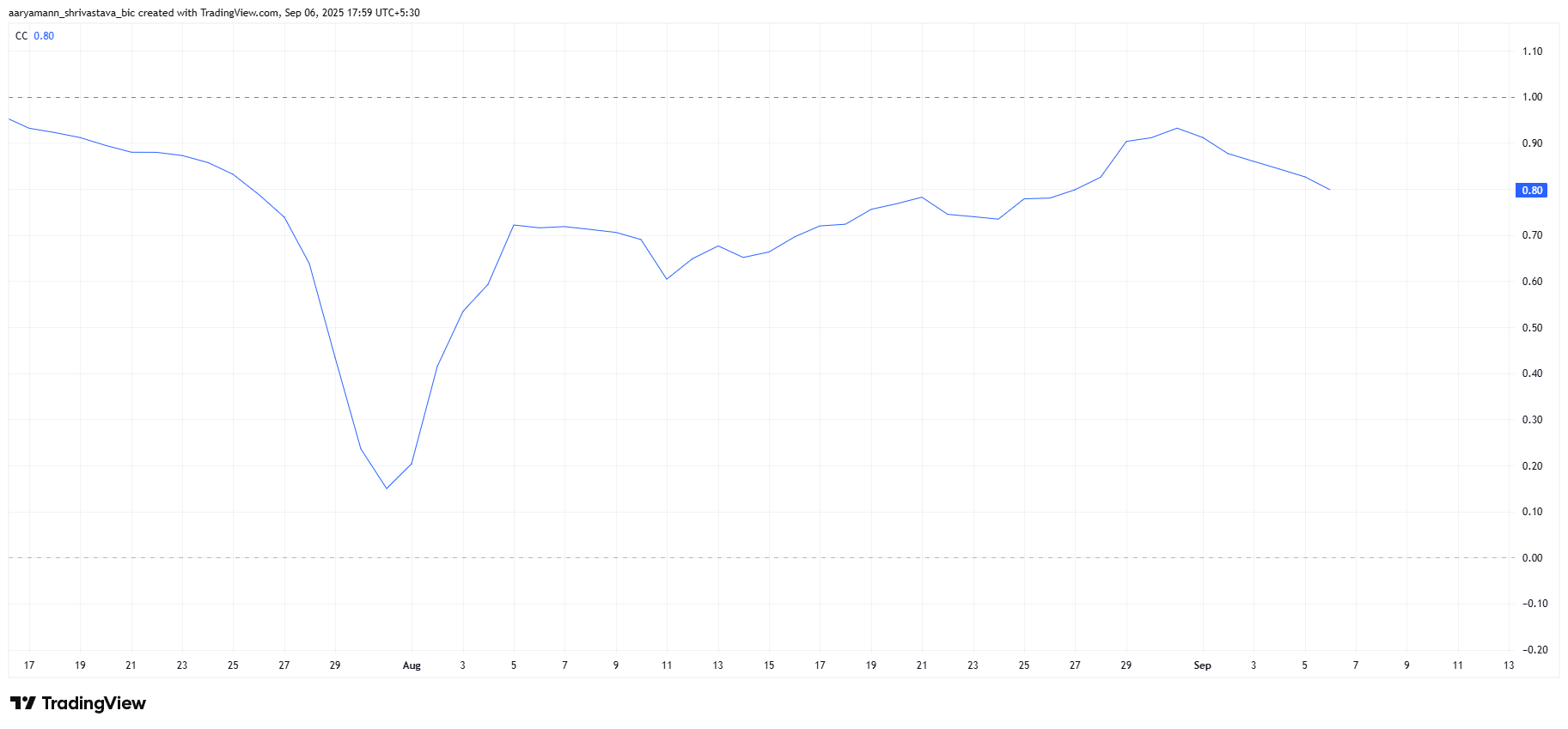

Hedera's price movement is significantly correlated with Bitcoin, exhibiting a 0.80 correlation coefficient. This indicates a strong relationship between the two cryptocurrencies.

As long as Bitcoin maintains support above $110,000, HBAR is likely to benefit. This correlation could provide a buffer against potential downside risks, allowing Hedera to test higher resistance levels if Bitcoin remains stable.

Key Price Levels to Watch

HBAR is currently facing resistance at $0.218. Overcoming this barrier could pave the way for a move towards the next key resistance level at $0.230. A successful breach of this level could trigger the liquidation of short positions and potentially propel HBAR towards $0.244.

Conversely, if bullish momentum stalls, HBAR may consolidate between $0.218 and $0.205, invalidating the immediate bullish outlook.