Fed Rate Cuts & Crypto: Bessent's Push Amidst Market Turmoil

Fed Rate Cuts & Crypto Market Uncertainty

US Treasury Secretary Scott Bessent recently urged the Trump administration to lower interest rates, citing the negative impact of high rates on the bottom 50% of Americans. However, this initiative faces significant opposition from Fed Chair Jerome Powell, who may ultimately decide against a rate cut.

Lower interest rates are generally considered bullish for risk-on assets like cryptocurrencies. A previous 50bps rate cut last September led to a positive impact on the crypto market. However, the current situation is more complex.

Can the Fed Cut Rates?

While Bessent advocates for rate cuts, Powell's stance remains a key obstacle. He previously expressed support for slower rate cuts and has shown a willingness to resist political pressure. His opposition to rate cuts adds significant uncertainty to the market's outlook.

Furthermore, the Trump administration's Crypto Reserve policy faces Congressional pushback, adding another layer of uncertainty. The administration's willingness to fight for this policy amidst market volatility is questionable.

US-China Tariffs Exacerbate Crypto Market Volatility

The recent imposition of tariffs by the US against China, Canada, and Mexico, and subsequent retaliatory measures, adds further complexity. Geopolitical tensions can significantly impact market sentiment, potentially negating any positive impact from potential rate cuts.

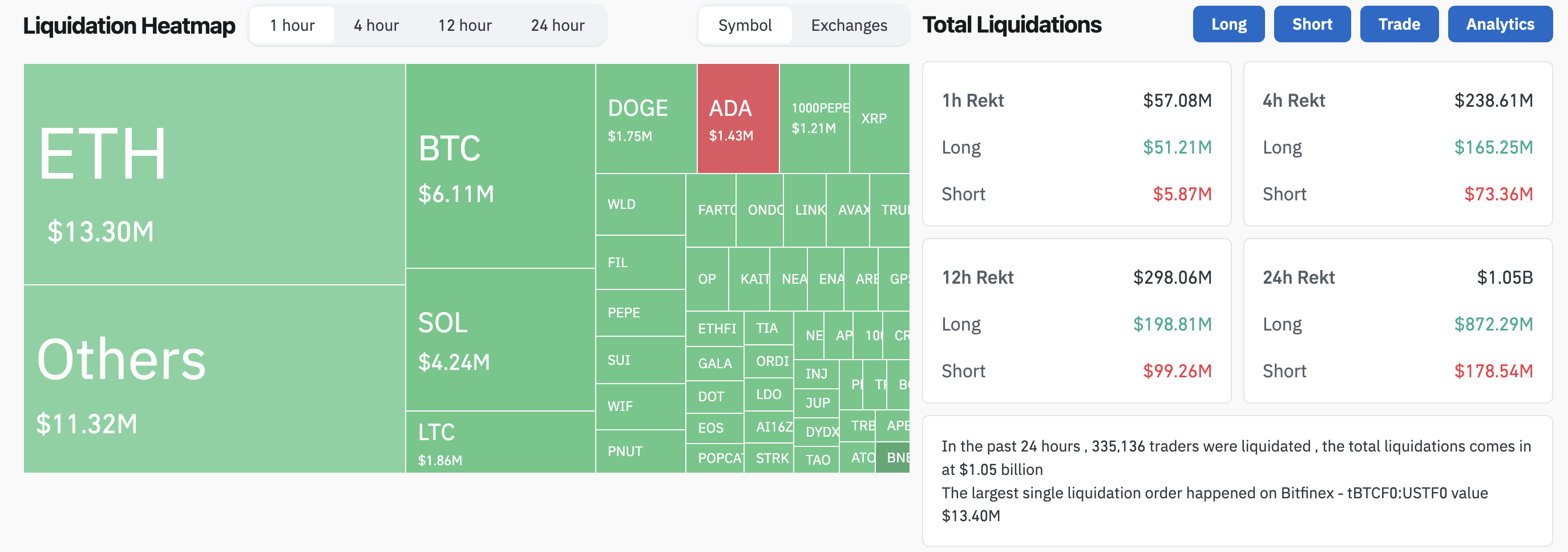

Crypto liquidations are already high, and a full-blown trade war could severely impact market liquidity. The current market climate might make pursuing rate cuts unwise.

Note: Codeum offers services to help navigate the complexities of the crypto market, including smart contract audits, KYC verification, and custom smart contract and DApp development. Our expertise can help you mitigate risk and build secure, robust blockchain solutions.

Market Outlook and Conclusion

The current confluence of factors – Bessent's push for rate cuts, Powell's opposition, and escalating trade tensions – creates a highly uncertain environment for crypto markets. While lower interest rates could potentially be bullish, the negative impact of increased geopolitical risk cannot be ignored. The situation demands careful consideration and monitoring of market developments.

Source: CoinGlass