Fed Rate Cut? Treasury Sec. Hints at 50 BPS Drop Amid Job Concerns

Treasury Secretary Calls for Aggressive Fed Action

Treasury Secretary Scott Bessent has urged the Federal Reserve to consider a significant 50-basis-point rate cut at the upcoming Federal Open Market Committee (FOMC) meeting in September. This call follows the release of the latest Consumer Price Index (CPI) data and revised job growth figures.

Key Takeaways

- Bessent advocates for a 50 bps rate cut in September, citing weaker job growth.

- Jerome Powell's upcoming speech at the Jackson Hole Economic Symposium will be closely watched for policy clues.

Revised Job Data Fuels Rate Cut Push

Bessent emphasized that the revised, weaker-than-expected job growth data for May and June is the primary driver behind his recommendation. He suggested that had the Fed possessed this data during its previous policy meeting, it might have already initiated rate cuts.

"The real thing now to think about is should we get a 50-basis-point rate cut in September," Bessent told Fox Business on Tuesday.

Inflation Data Presents a Mixed Picture

The latest inflation data reveals a mixed economic landscape:

- Headline CPI rose 2.7% year-over-year, slightly below the estimated 2.8%.

- Core CPI, excluding volatile food and energy prices, increased 3.1% year-over-year, exceeding the 3% estimate.

The higher core CPI suggests that underlying price pressures may be building despite stable headline inflation numbers. Some economists are concerned that the US may be moving towards stagflation, a scenario where slowing job growth coincides with rising inflation.

Market Anticipates Rate Cut

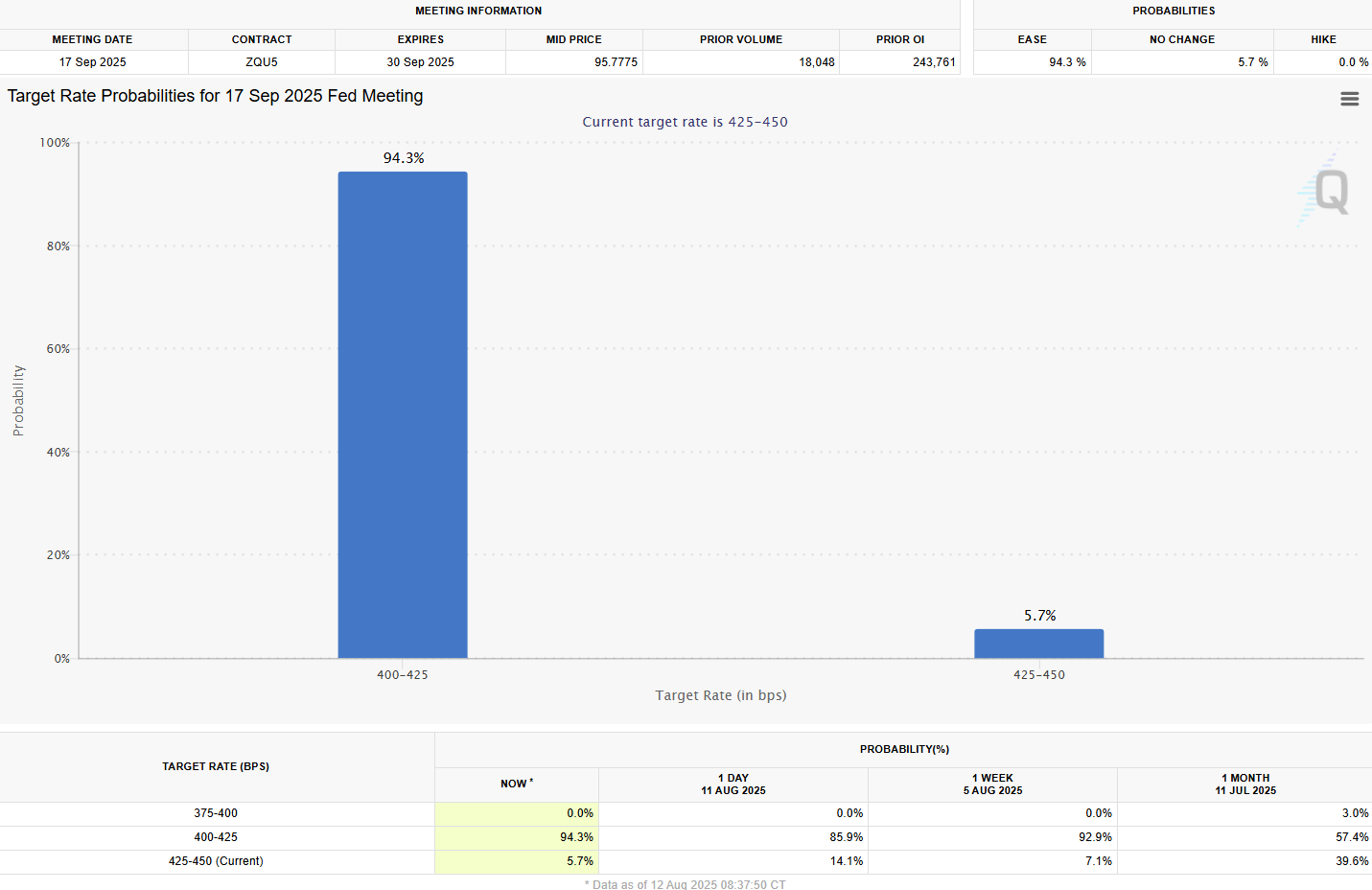

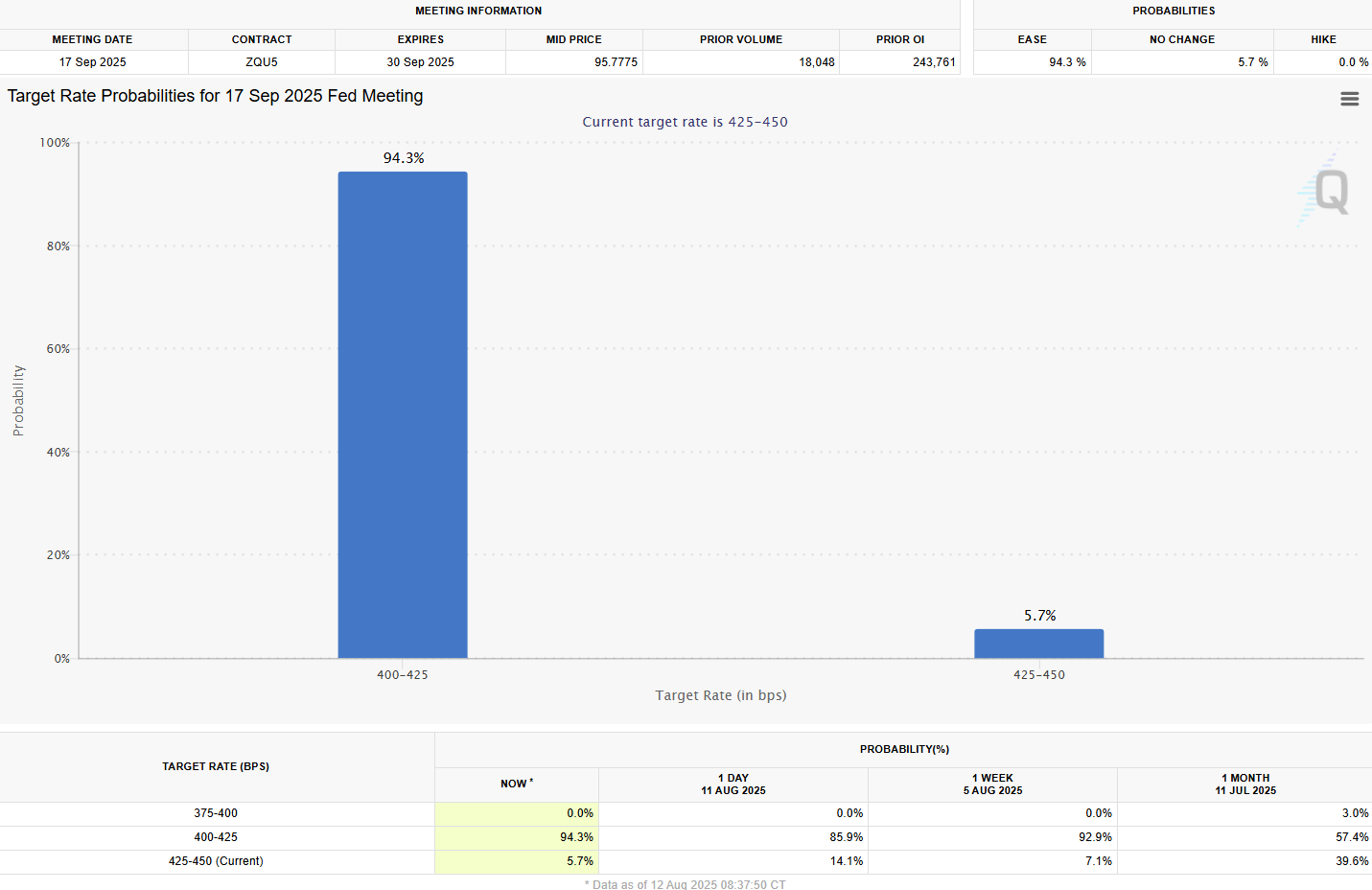

Despite concerns, market participants increasingly expect a rate cut. CME's FedWatch tool indicates a 94% probability of a September rate cut, up from approximately 86% the previous day. The majority of traders anticipate a quarter-point cut.

Potential Changes at the Fed

Bessent also expressed optimism about the confirmation of Stephen Miran, President Trump’s nominee to the Fed Board, expecting him to be in place for the September meeting. Miran, as former chair of the Trump Administration’s Council of Economic Advisers, is expected to support the president's economic policies.

Powell's Jackson Hole Speech in Focus

All eyes are now on Fed Chair Jerome Powell's upcoming keynote address at the Jackson Hole Economic Symposium in Wyoming. He is expected to outline the central bank's policy outlook. According to BitMEX co-founder Arthur Hayes, Powell might use this platform to signal the end of quantitative tightening or announce regulatory changes, potentially boosting Bitcoin and other crypto assets. Blockchain developers and investors will be closely watching for any hints on future monetary policy.