Ethereum Dips Below $1500: Buying Opportunity?

Ethereum (ETH) has seen a notable price decline since the start of the year, recently falling below the $1,500 mark. While this might concern some, many investors see it as a strategic entry point.

Ethereum's Dip: A Closer Look

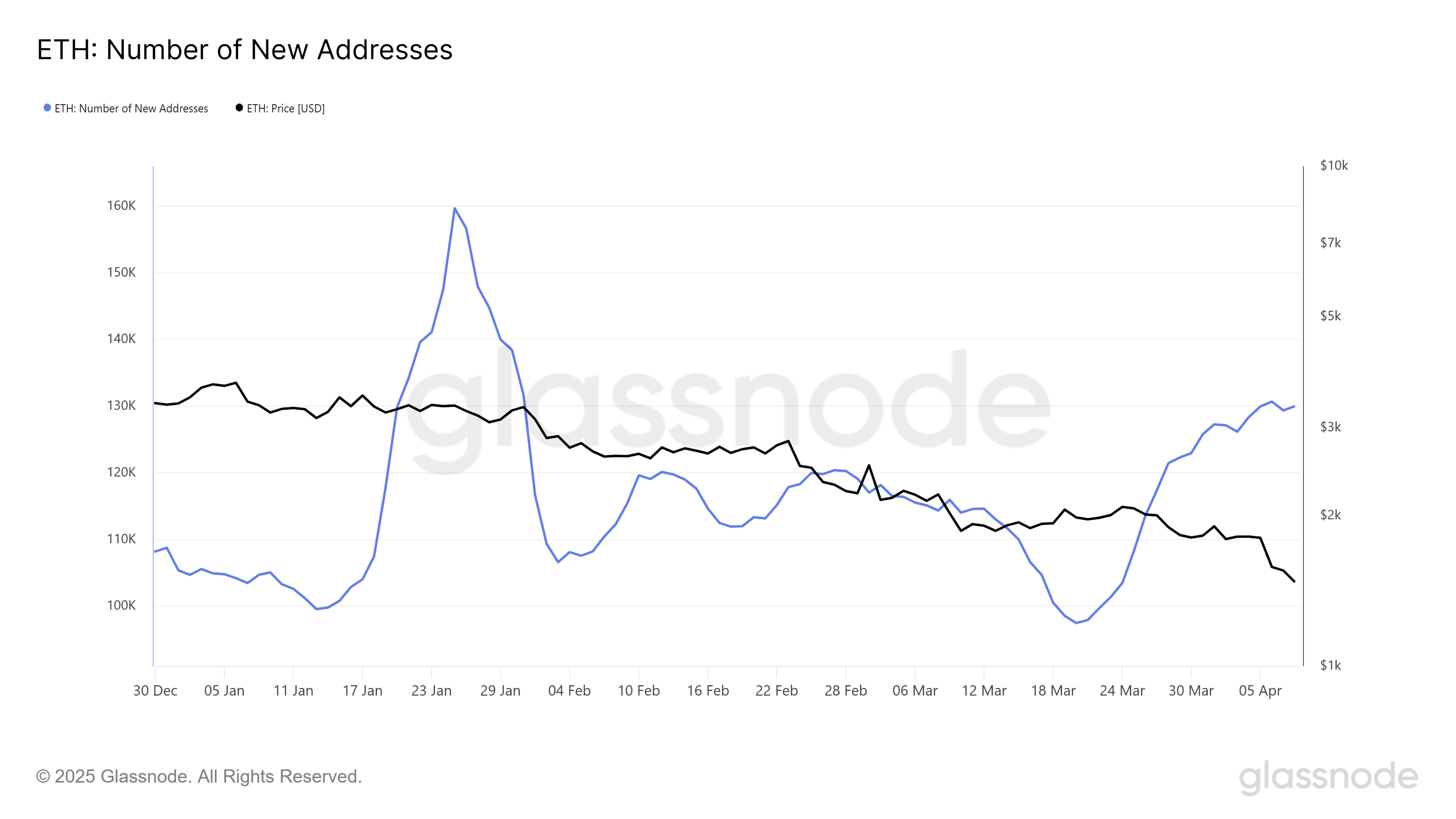

The drop below $1,500 has coincided with a two-month high in new Ethereum addresses, suggesting increased investor interest despite the lower price. This influx of new investors might be driven by the increased accessibility of ETH at this price point.

The increased number of new addresses also indicates that investors may be positioning for a potential price rebound. The current price is significantly lower than earlier this year, making it an attractive buying opportunity for some.

Analyzing Market Indicators

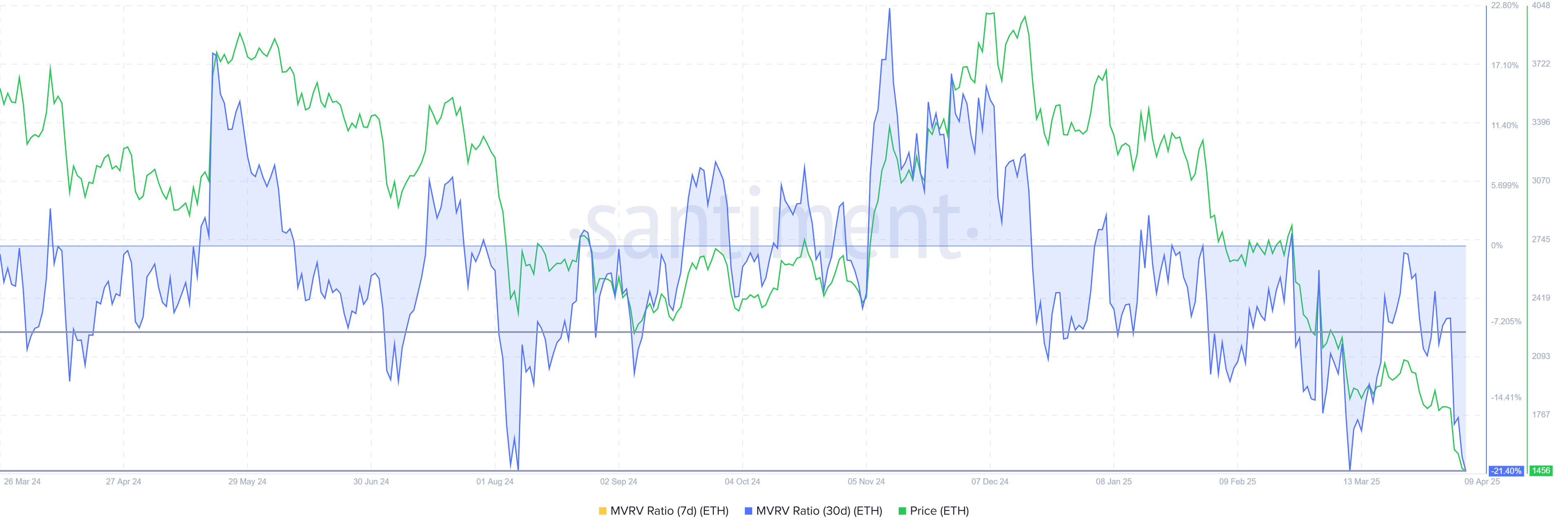

The Market Value to Realized Value (MVRV) ratio currently sits in the "opportunity zone" (-8% to -21%). This suggests that Ethereum is undervalued, historically triggering price reversals. This low MVRV ratio supports the theory that Ethereum is in an accumulation phase, potentially offering significant returns for investors entering the market now.

ETH Price: Potential Rebound or Further Decline?

Ethereum's price has dropped by approximately 19% in the last 48 hours, reaching a yearly low of $1,375 before recovering slightly. The loss of the $1,533 support level is significant. A successful reclaim of this level could signal a recovery towards $1,745. Breaking above $1,745 would confirm a reversal of the 4-month downtrend.

However, a continuation of the bearish trend could see Ethereum test support levels below $1,429. A break below $1,375 would strengthen the bearish outlook, potentially leading to a more prolonged decline.

Disclaimer: This analysis is for informational purposes only and shouldn't be considered financial advice. Market conditions are highly volatile.

At Codeum, we provide comprehensive blockchain security services, including smart contract audits, KYC verification, and custom smart contract and DApp development. We also offer tokenomics and security consultation and partnerships with launchpads and crypto agencies.