Ethereum ETF Inflows Hit Record $1 Billion Amid ETH Surge

Ethereum ETFs Experience Unprecedented Inflows

US-listed spot Ethereum ETFs have recorded a landmark achievement, attracting over $1 billion in net inflows on Monday. This represents the highest daily total since their debut, signaling strong investor confidence in Ethereum.

Key Takeaways:

- Spot Ethereum ETFs recorded over $1 billion in daily net inflows, their highest since last July.

- Investor interest in Ethereum exposure through ETFs is rising as ETH trades around $4,300.

BlackRock and Fidelity Dominate ETF Gains

Leading the charge are BlackRock’s iShares Ethereum Trust (ETHA) and Fidelity Ethereum Fund (FETH), both of which posted their largest single-day inflows. ETHA drew approximately $640 million, while FETH attracted $277 million. The majority of Ether ETFs experienced positive results, with the exception of Invesco's fund.

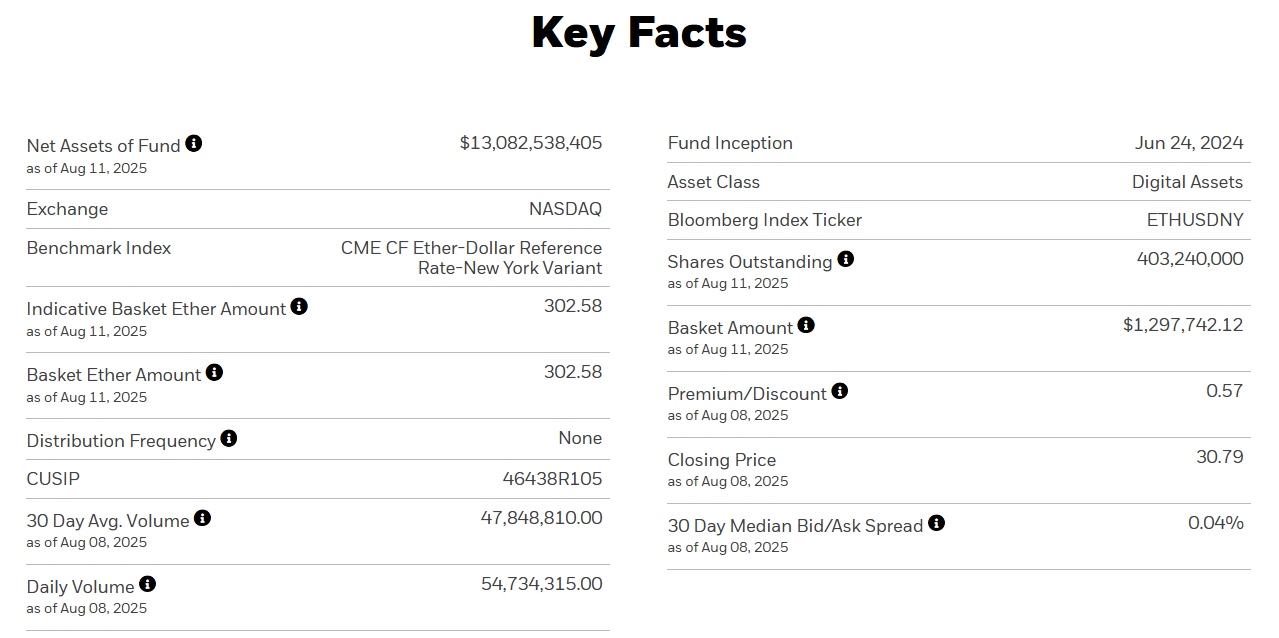

BlackRock remains the dominant player, with assets under management exceeding $13 billion as of August 11.

Ethereum Price Momentum and Corporate Accumulation

These substantial inflows have propelled Ethereum funds into a five-day winning streak. The asset's performance is bolstered by ETH's price hovering around $4,300, a level not seen since December 2021. Currently, ETH is about 12% shy of its all-time high of $4,868, achieved in November 2021.

The price surge is also attributable to aggressive accumulation by publicly traded companies. For example, Fundamental Global, soon to be FG Nexus, recently acquired 47,331 ETH as part of its strategy to gain a significant stake in the Ethereum network.