Dogecoin Treasury Experiment Falters: Stock Plummets

First Dogecoin Treasury Faces Wall Street Skepticism

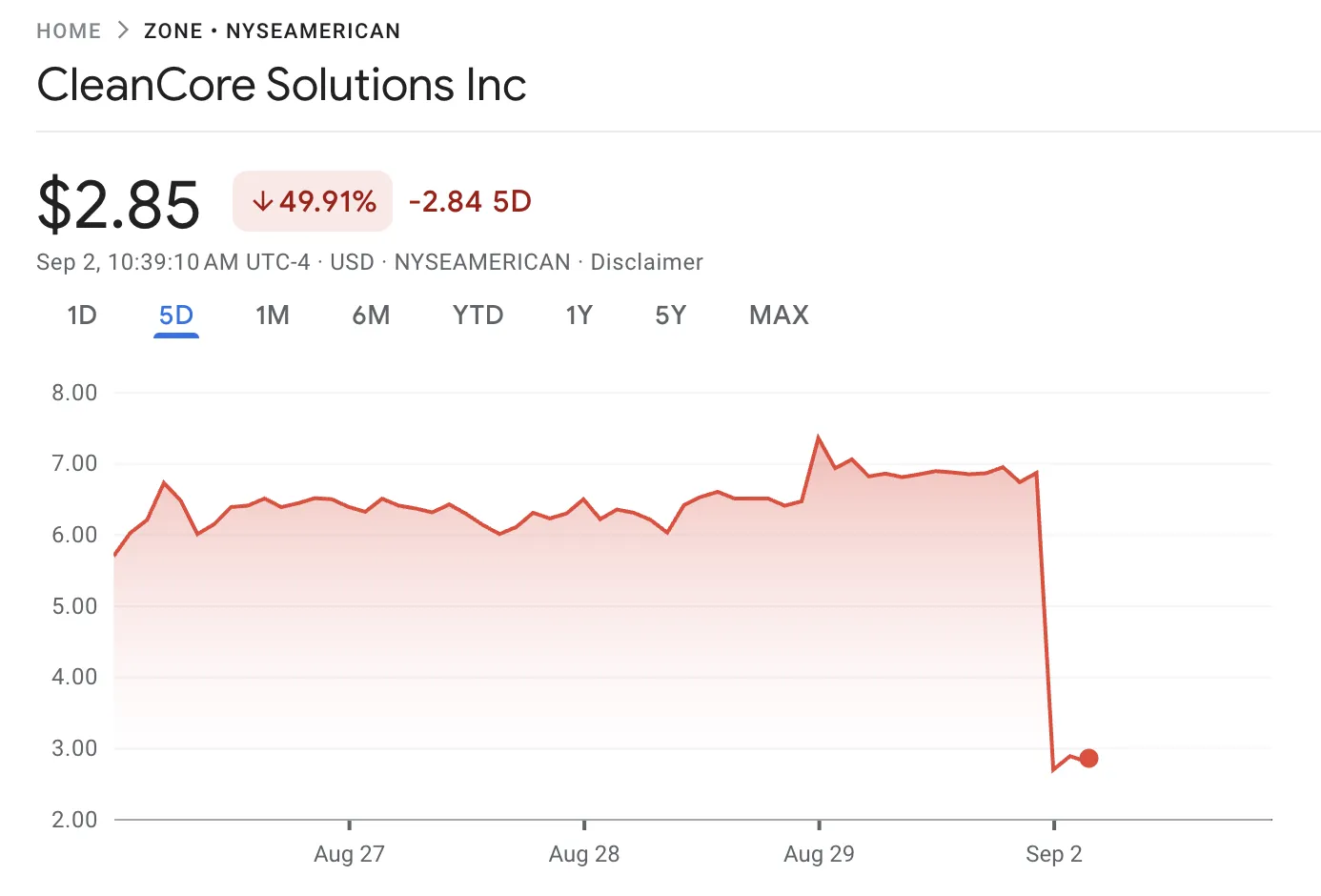

CleanCore Solutions (NYSE:ZONE), previously focused on environmentally-friendly cleaning products, saw its stock price plummet nearly 50% following the announcement of a partnership with House of Doge to establish a Dogecoin (DOGE) treasury. This marks the first attempt by a publicly listed company to adopt DOGE as a primary treasury asset.

The move, involving a $175 million investment, was met with immediate market disapproval, despite the backing of private investors. The company's stock fell over 59% upon the announcement.

The Dogecoin Treasury Concept

Last week, Alex Spiro, Elon Musk’s attorney, sparked interest by revealing plans to chair a Dogecoin treasury. While Bitcoin digital asset treasuries (DATs) have gained traction, CleanCore's embrace of Dogecoin represents a bolder step into the altcoin space.

Why the Negative Reaction?

CleanCore's press release signaled a complete shift in business strategy, with minimal mention of its previous cleaning product operations. CEO Clayton Adams stated, "By anchoring our treasury with Dogecoin…we’re adopting a forward-looking reserve strategy." This drastic pivot appears to have unnerved investors.

DAT Pivots: A Risky Strategy

While some companies have successfully transitioned to Bitcoin DAT strategies, these typically involved businesses already facing profitability challenges. A full pivot, even under favorable circumstances, carries inherent risks.

The current market climate may also play a role. Bloomberg ETF analyst Eric Balchunas highlighted the negative market reaction. The market might be less receptive to a Dogecoin treasury.

CleanCore Solutions $ZONE is converting to become the first ever Dogecoin Treasury company in partnership with the House of Doge. Stock immediately plummets 59%. What a world. pic.twitter.com/xqHYHXixYu

— Eric Balchunas (@EricBalchunas) September 2, 2025

PIPE Offering Complicates the Picture

The $175 million investment is structured as a PIPE (private investment in public equity) offering, where shares are sold at a discount to private investors. PIPE offerings can influence stock prices, making it difficult to assess the true viability of a Dogecoin treasury.

Implications for the Future

CleanCore's performance will be a crucial indicator. A rebound could validate Dogecoin as a treasury asset and demonstrate the continued growth potential of the DAT market. Conversely, continued decline would signal caution against using altcoins, especially meme coins, as treasury assets. It might also discourage other companies from exploring Dogecoin for their treasuries.