Dogecoin ETF Hopes Fuel Market Amid Whale Activity

Dogecoin Market Eyes Potential ETF Launch

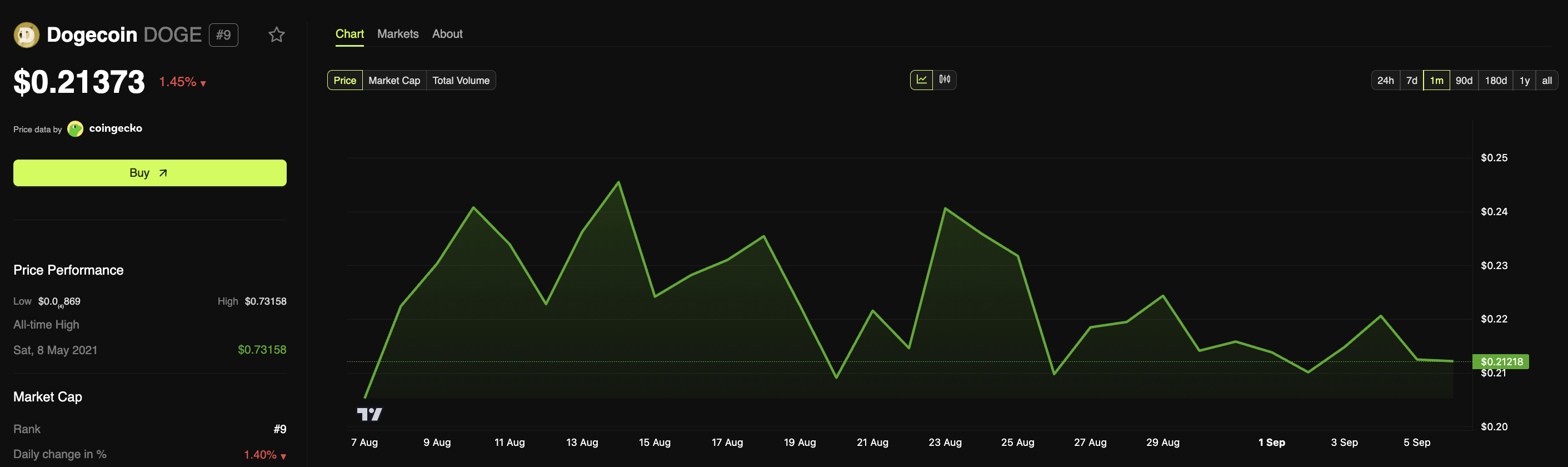

Dogecoin (DOGE) is at a critical juncture as discussions around a potential REX-Osprey DOGE ETF intensify. The market is reacting to the possibility of a new source of institutional investment, but on-chain data paints a complex picture.

REX Shares filed its DOGE ETF registration earlier this year, and recent commentary suggests it could debut soon. A Bloomberg ETF analyst speculated that REX may be looking to launch a Doge ETF.

If approved, the REX-Osprey DOGE ETF would be the first ETF product directly tied to Dogecoin, potentially attracting significant capital inflows.

Conflicting Signals: Whale Activity and Technical Indicators

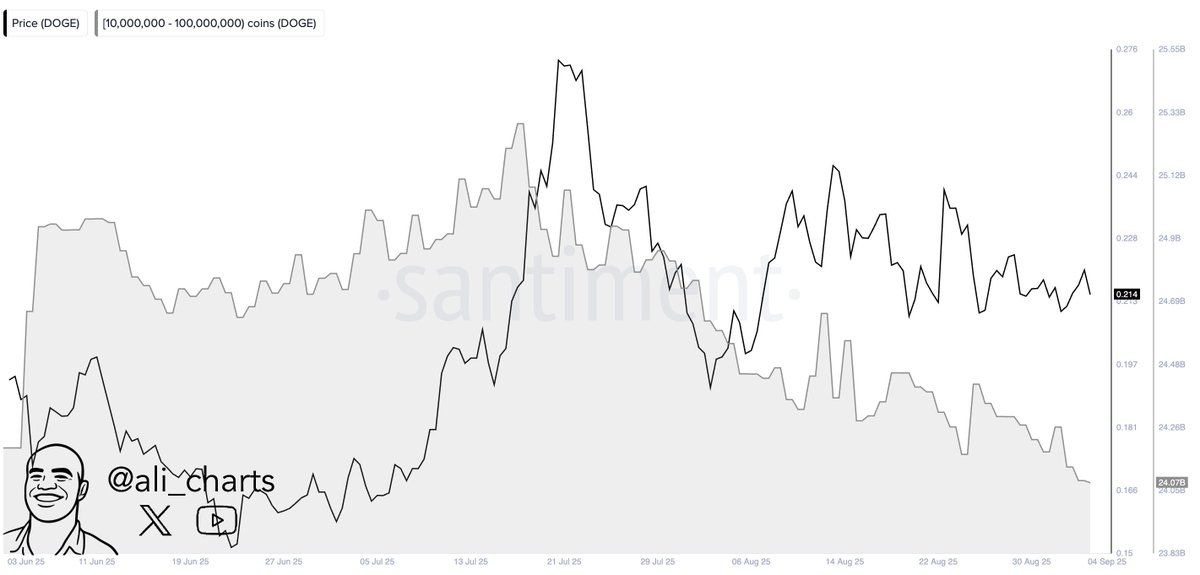

Recent on-chain data reveals contrasting trends in DOGE activity.

TD Sequential Indicator Flashes Buy Signal

According to analyst Ali, the TD Sequential indicator is signaling a potential buying opportunity for DOGE. This technical indicator suggests a possible shift in momentum.

Whale Activity Shows Distribution

However, Ali also observed significant whale sell-offs, with approximately 200 million DOGE sold within 48 hours. This divergence suggests uncertainty among large holders.

Technical Analysis Points to Potential Upside

Other analysts see bullish potential based on technical patterns. One X account noted DOGE's consolidation pattern and potential for a breakout above downtrend resistance. Another suggested a target range of $1–$1.4 if a breakout occurs.

ETF Approval Not Guaranteed

Despite the optimism, the SEC's review process for crypto-related ETFs is often lengthy and uncertain. The current market reaction is largely based on anticipation. The whale sell-offs might also reflect profit-taking behavior.

In conclusion, Dogecoin faces a period of potential change as the market considers its first ETF. The ultimate outcome will depend on regulatory decisions and the behavior of large holders.