DEXE Price Surge: Eyes on $9.04 Breakout

DEXE Dominates Daily Gains as Key Breakout Zone Looms

DEXE, the native token of DeXe Protocol, a platform for decentralized autonomous organization (DAO) management, is currently outperforming other crypto assets with a nearly 10% increase in the last 24 hours.

This surge occurs amidst a broader crypto market recovery, boosting overall sentiment. Continued momentum could solidify a bullish outlook for DEXE, potentially leading to further short-term gains.

Traders Increase Bets on DEXE

Analyzing the DEXE/USD one-day chart reveals a consistent upward trend since August 3rd. As of press time, DEXE trades at $8.31, reflecting a 15% climb. Key momentum indicators suggest strengthening buy-side pressure.

Notably, DEXE's rally has pushed its price above the Ichimoku Cloud's Leading Span A (green) and Span B (yellow), signaling bullish momentum.

Leading Spans A and B have now become dynamic support levels at $7.64 and $7.21, respectively, potentially acting as price floors in the short term.

Trading above the Ichimoku Cloud typically signifies a strong bullish trend and positive market sentiment, suggesting further potential for price increases if support levels hold.

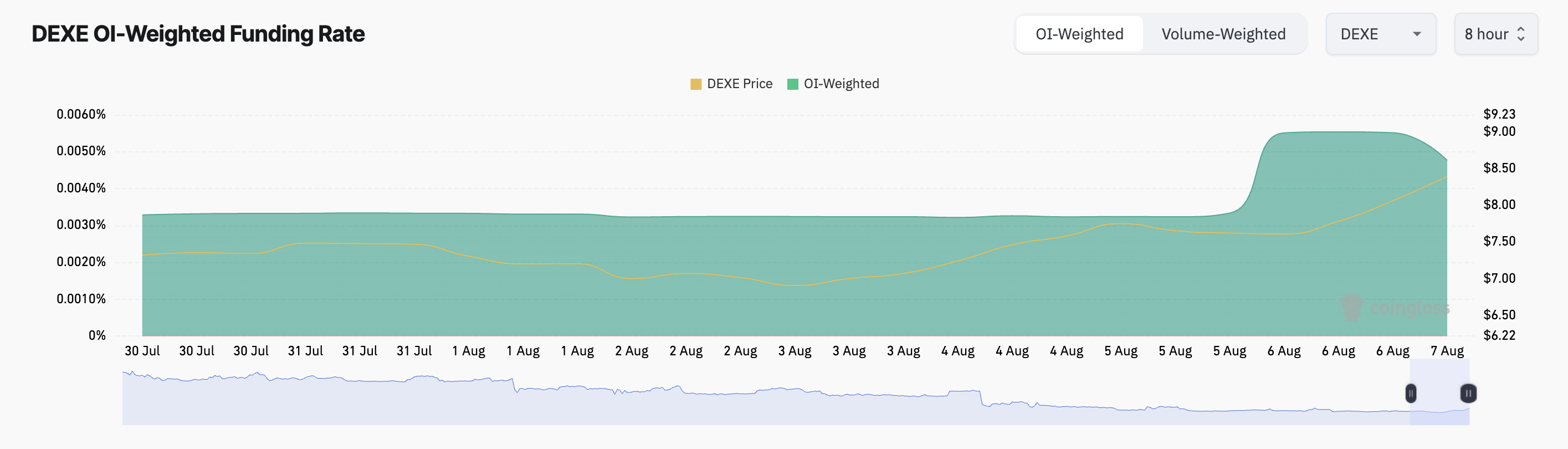

Furthermore, DEXE's funding rate in the derivatives market has been consistently positive since July 20th, currently at 0.0048%, indicating growing confidence among futures traders.

A positive funding rate implies that long traders are dominant and are paying short traders, reflecting a generally bullish market sentiment towards DEXE.

Critical Price Levels: $9.04 Resistance and $6.73 Support

DEXE is currently trading below the $9.04 resistance level. Increased demand and bullish momentum could lead to a breakout, potentially pushing the price towards $9.45.

Conversely, a resurgence of bearish sentiment could trigger a price decline, potentially testing the $6.73 support level.