Crypto Market Dip: BTC, ETH, SOL & XRP Price Drop Explained

The cryptocurrency market experienced a recent downturn, with Bitcoin (BTC) falling below the key $95,000 support level and pulling altcoins like Ethereum (ETH), Solana (SOL), and XRP down with it. This correction is attributed to several converging factors.

Crypto Market Correction: Analyzing the Decline of BTC, ETH, SOL, & XRP

Data from CoinMarketCap shows Bitcoin dropped below the psychologically significant $95,000 mark, triggering a broader market sell-off. Ethereum, Solana, XRP, and other altcoins also experienced substantial price declines.

Macroeconomic Uncertainty

Global economic uncertainty played a significant role. Concerns about potential trade wars and the US Federal Reserve's quantitative tightening policy fueled bearish sentiment. The anticipation of only one Fed rate cut this year, likely in the second half, contributed to investor apprehension.

Reduced Capital Inflows

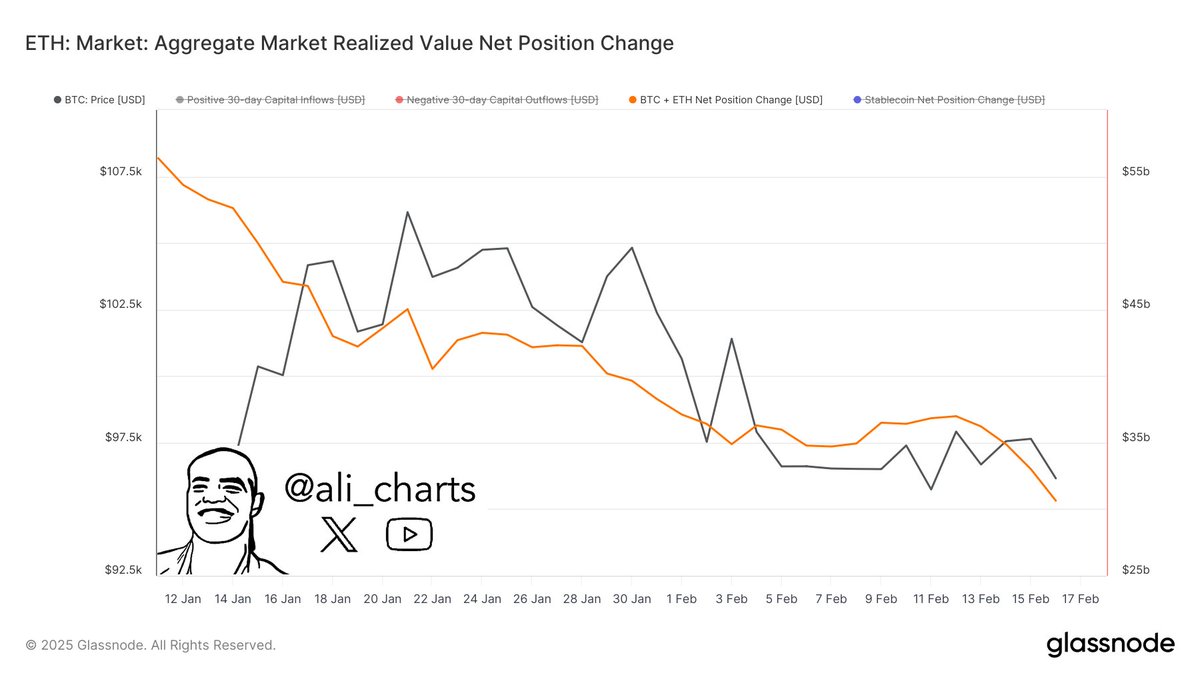

Crypto analyst Ali Martinez noted a >30% decline in capital inflows into Bitcoin and Ethereum over the past month, dropping from $45 billion to $30 billion. This reduced liquidity hampered the market's ability to sustain higher prices, leading investors to become more cautious.

Impact of Rug Pulls

The crypto market downturn was exacerbated by the LIBRA meme coin rug pull, which resulted in estimated losses of over $286 million. This event negatively impacted investor confidence and further reduced market liquidity. The association of this event with prominent figures added to the negative sentiment.

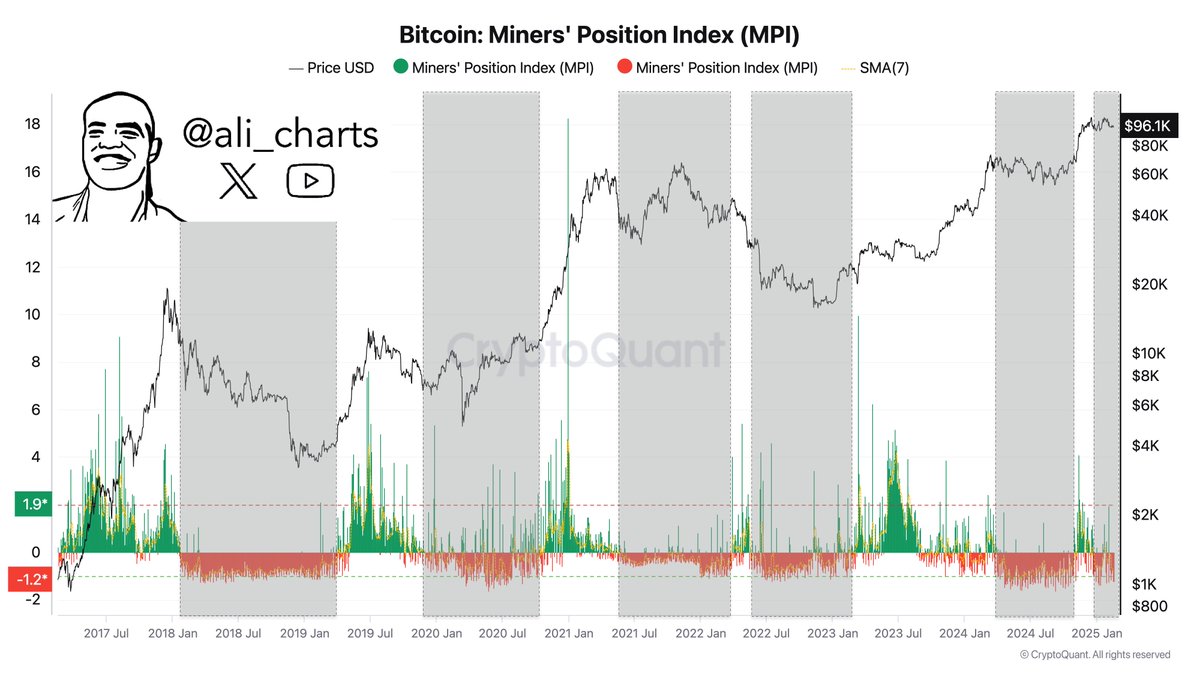

Decreased Bitcoin Mining Activity

Analyst Ali Martinez also highlighted the correlation between prolonged price corrections and declines in Bitcoin mining activity. This suggests a potential for further price adjustments.

Solana's Bearish Sentiment

The Solana ecosystem experienced a heightened bearish sentiment, partly due to the LIBRA rug pull. This contributed to the overall market downturn.

Disclaimer: This analysis reflects current market conditions and expert opinions. Conduct thorough research before making any investment decisions. Codeum is not responsible for personal financial losses.

Codeum: For secure and reliable blockchain development, consider Codeum's services: smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies.