CRV Soars After Trump's DeFi Bill

Curve DAO (CRV) experienced a significant price increase following the signing of a new bill into law by President Trump. The legislation protects Decentralized Finance (DeFi) assets, shielding them from overly burdensome IRS regulations. This event has sparked considerable interest and speculation regarding the future price trajectory of CRV.

Trump's DeFi Bill and its Impact on CRV

On April 10th, President Trump signed the first-ever crypto bill into law, specifically safeguarding the DeFi ecosystem. This action effectively prevents the implementation of the proposed IRS Digital Assets Sale and Exchanges Rule (also known as the DeFi Broker Rule), which would have imposed stringent reporting requirements on both custodial and non-custodial DeFi services. Representative Mike Carey highlighted the bill's importance, stating that the DeFi Broker Rule "needlessly hindered American innovation, infringed on the privacy of everyday Americans, and was set to overwhelm the IRS."

The positive market reaction to this news is evident in the performance of various DeFi tokens, with CRV leading the charge. A 19% surge in CRV's price within 24 hours and 48% monthly gains demonstrate strong investor confidence.

Market Analysis: CRV Accumulation and Price Projections

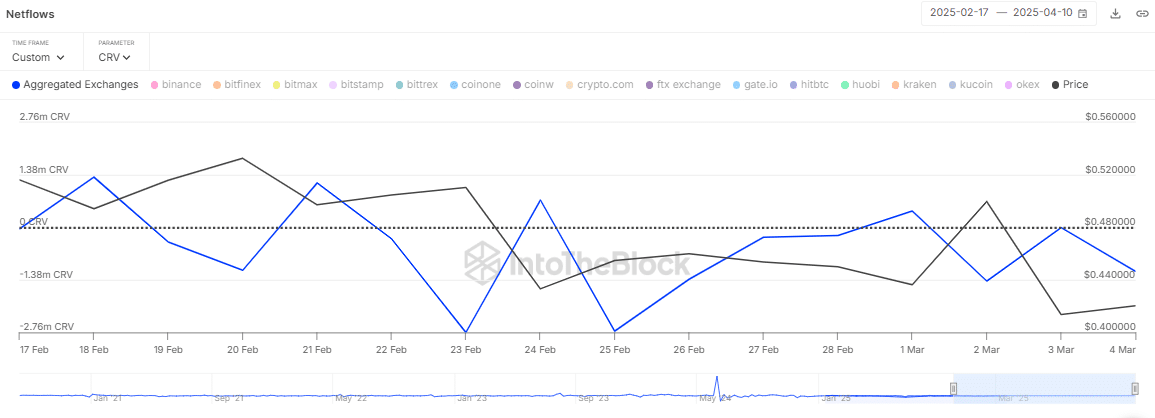

Following the news, spot market traders accumulated 1.15 million CRV (approximately $667,000), suggesting long-term investment strategies. This influx of CRV into private wallets signals bullish sentiment.

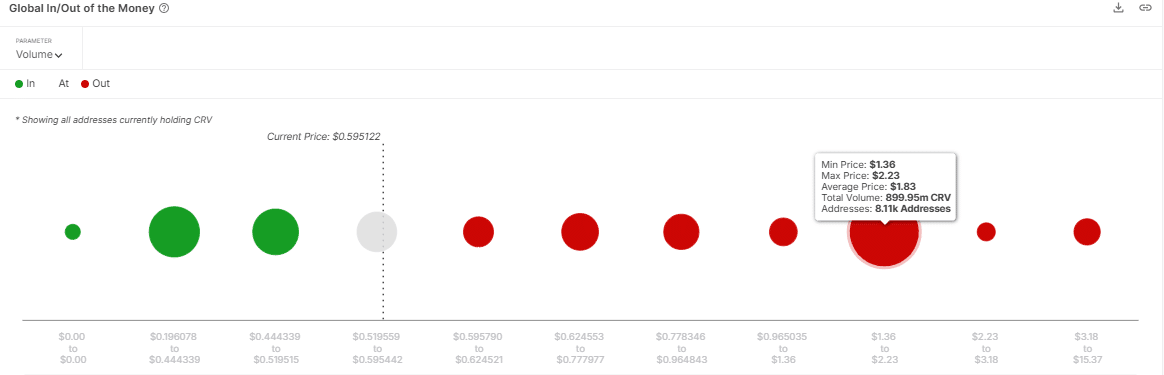

Analysis of the In/Out of the Money Around Price (IOMAP) indicator reveals minimal resistance until $1.83. Beyond that level, 899.95 million CRV sell orders could potentially cap further upward movement. However, sustained buying pressure could propel CRV towards this resistance zone.

Source: IntoTheBlock

Source: IntoTheBlock

Potential Dip Before Further Rise

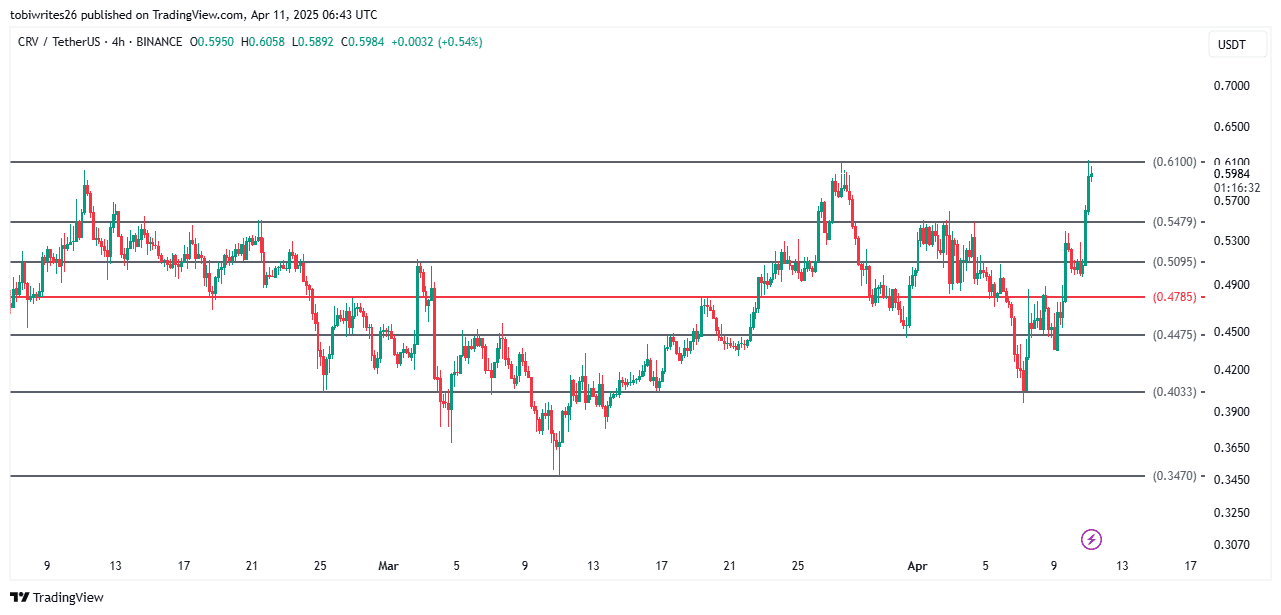

Despite the bullish outlook, a price correction is possible before a sustained rally. Currently, CRV is facing resistance near $0.61, a level that previously triggered price declines. However, potential support levels at $0.549, $0.509, and $0.478 could mitigate any significant drop. This expected minor dip shouldn't overshadow the overall bullish sentiment.

Source: TradingView

While some selling pressure is evident in the derivatives market, indicated by a negative OI-weighted funding rate, the overall picture points to a positive outlook for CRV in the near term. Strong accumulation and limited immediate resistance suggest further upside potential.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. The cryptocurrency market is inherently volatile.

Codeum provides expert services in blockchain security and development, including smart contract audits, KYC verification, custom smart contract development, tokenomics consulting, and partnerships with launchpads and crypto agencies. Contact us to learn more.