Chainlink (LINK) Backed by Revenue Reserve

Chainlink Establishes LINK Reserve Backed by Revenue

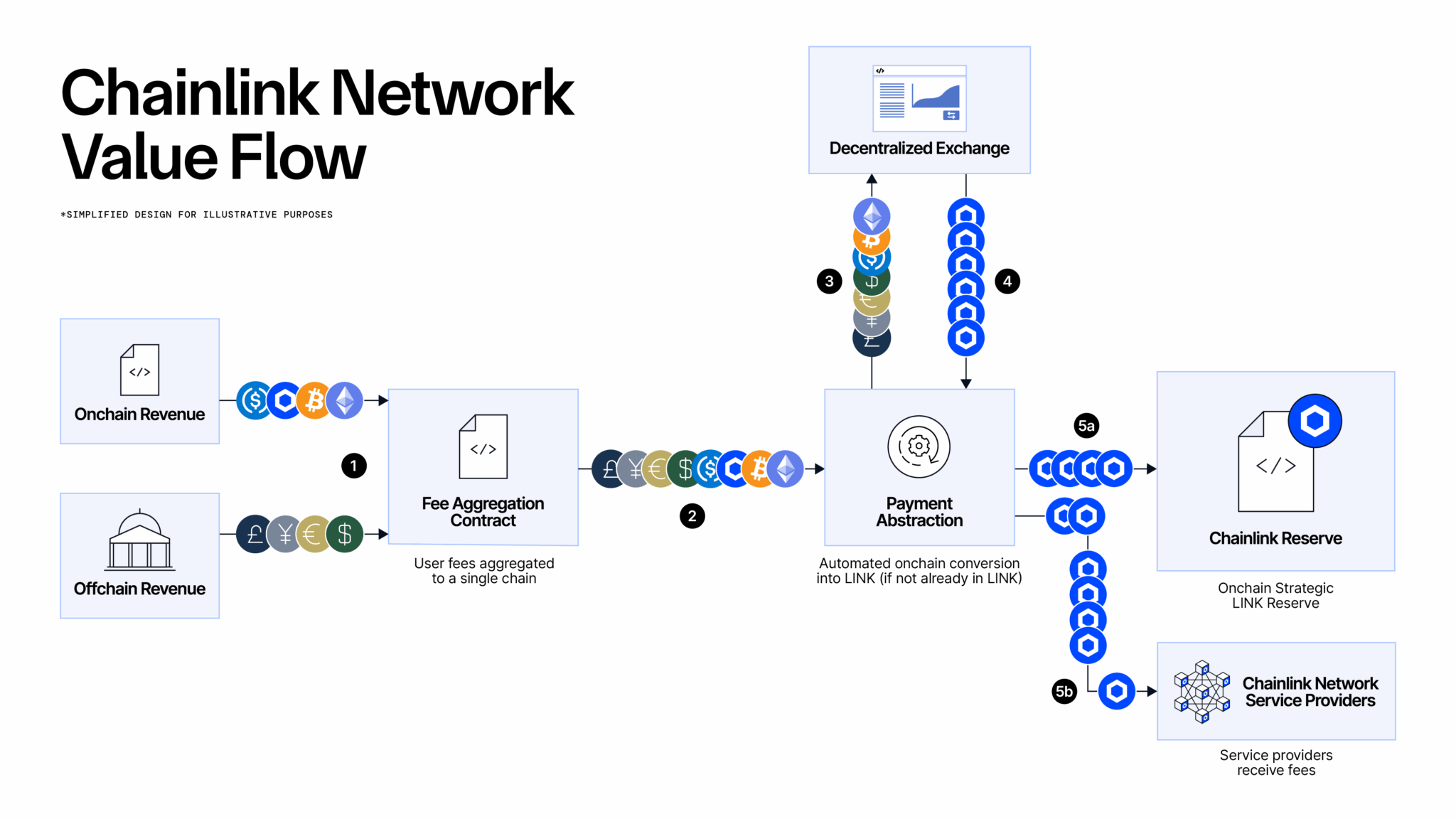

Chainlink is launching an on-chain reserve system called Chainlink Reserve, designed to accumulate LINK tokens from revenue generated by both off-chain and on-chain operations. The initiative was announced on Thursday, marking a significant step in Chainlink's economic sustainability.

Off-chain revenue comes from enterprises accessing Chainlink’s infrastructure, while on-chain fees originate from protocols across DeFi and Web3. Securing over $80 billion in value through more than 2,000 price feeds, Chainlink is a major oracle provider supporting applications across 60+ blockchains.

Payment Abstraction

The new reserve builds upon Chainlink’s Payment Abstraction infrastructure. This system allows users to pay for Chainlink services via their preferred payment methods, which are then automatically converted to LINK using Chainlink services and decentralized exchanges. For projects seeking reliable oracle services and secure on-chain operations, platforms like Codeum provide resources for smart contract development and security audits to ensure seamless integration.

Strategic Implications

“The launch of the Chainlink Reserve marks a pivotal evolution, establishing a strategic LINK reserve funded using off-chain revenue, as well as from on-chain service usage,” said Chainlink co-founder Sergey Nazarov. “Demand for the Chainlink standard has already created hundreds of millions of dollars in revenue, substantially from large enterprises.”

Chainlink reports that the reserve has already accumulated over $1 million worth of LINK tokens during its initial phase. No withdrawals are expected for several years, allowing the reserve to grow as more revenue is converted into LINK.

This effort aims to make Chainlink’s economic model more sustainable. In addition to user fee revenue, the platform has introduced architectural upgrades, such as the Chainlink Runtime Environment (CRE), to reduce operational costs. Furthermore, the reserve smart contract includes a timelock for transparency and security during any future withdrawals.

Chainlink's Reach

Chainlink’s network supports major financial institutions and protocols, including Swift, Euroclear, Mastercard, Fidelity International, UBS, ANZ, Aave, GMX, and Lido, facilitating transactions across decentralized finance, banking, and tokenized real-world assets.