CEX Traffic Plunges: Coinbase & Binance Hit Hard

Crypto Exchange Traffic Takes a Dive

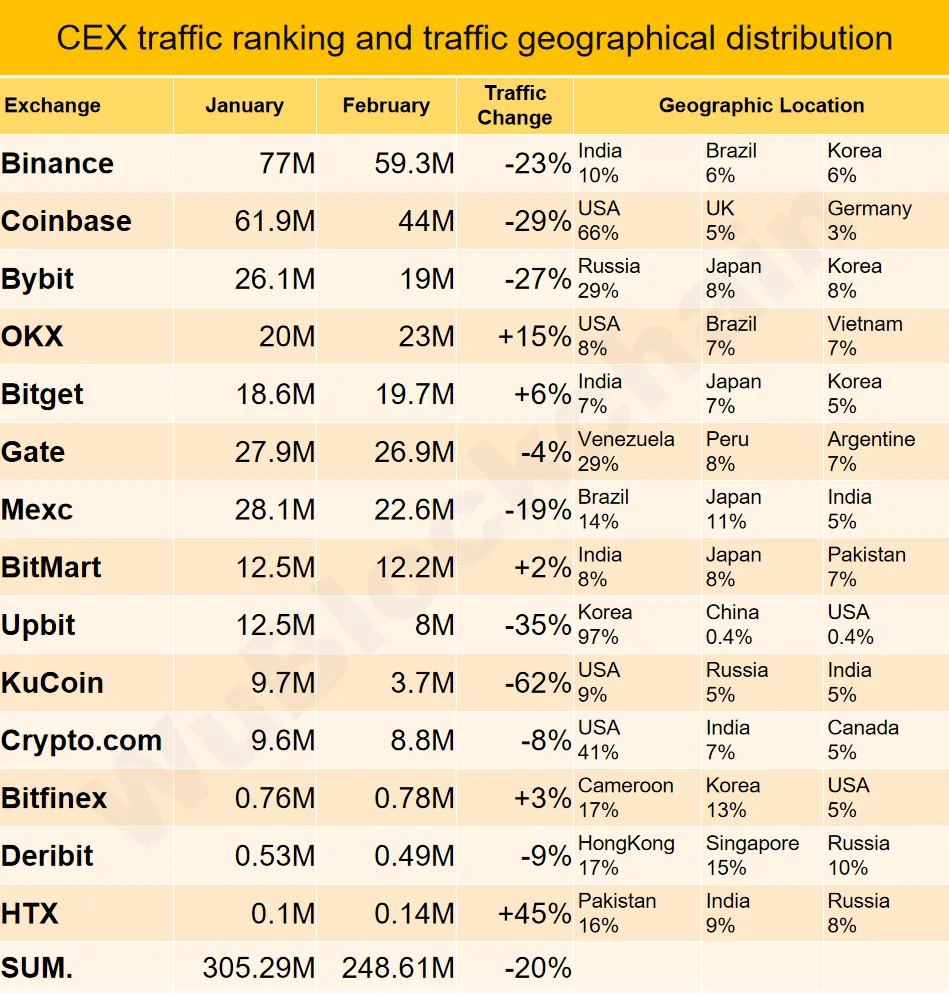

New data reveals a significant decline in traffic across centralized exchanges (CEXs) in February, with industry leaders Coinbase and Binance particularly affected. The report indicates that both exchanges experienced nearly a 30% drop in traffic, accompanied by a decrease in spot and derivatives trading volumes. This downturn reflects growing apprehension among retail investors.

Binance and Coinbase Lag Behind Competitors

While both Coinbase and Binance saw some positive developments during February, their performance significantly lagged behind other CEXs. Overall CEX traffic fell approximately 20%, making the losses at Binance and Coinbase particularly noteworthy. Even though spot trading volume slightly outperformed the average for both, the considerable user traffic decline raises concerns.

The situation is especially puzzling considering the positive news surrounding both companies. Coinbase benefited from the SEC dropping a major lawsuit, and Binance launched a community vote to list Pi Network, resulting in a policy shift. Despite these developments, both exchanges saw a decline in user engagement.

CEX User Traffic in February 2025. Source: Wu Blockchain

In contrast, some CEXs saw growth. OKX experienced a 15% increase, and Bitget saw a 6% rise. This divergence suggests a potential shift in investor preference.

Weak Investor Sentiment and Market Fear

The overall decline in CEX traffic and trading volume points towards a bearish market sentiment, particularly among retail investors. Throughout March, weak investor sentiment persisted, with US investors leading the sell-off. This market fear might be the underlying factor impacting even successful exchanges like Coinbase and Binance. While positive news events had little impact on reversing the trend, the market’s overall negative outlook remains a dominant factor.

Binance Trading Volume Over the Past Two Weeks. Source: CoinGecko

Codeum, a leading blockchain security and development platform, offers comprehensive services to navigate the complexities of the crypto market. Our services include smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us to learn how we can help your project thrive in this evolving landscape.

Disclaimer: This article provides information for educational purposes only. It is not financial advice. Always conduct thorough research and consult with a financial professional before making any investment decisions.