Cardano's Dip: A Bullish Signal?

Cardano (ADA) Price Action Sparks Optimism

Cardano (ADA) experienced a recent price correction, dropping 9% in the last 24 hours and struggling to maintain the $1 support level. Despite this decline, trading below $0.80, several key indicators suggest a potential bullish recovery is underway.

Shifting Trader Sentiment

A key factor contributing to the bullish sentiment is Cardano's funding rate. After spending nearly a week in negative territory (indicating short-seller dominance), it's nearing positive territory. This shift implies a surge in long positions, signifying growing trader confidence in a price rebound.

The recent price drop to $0.80 may have presented a buying opportunity for many traders, leading to the influx of long contracts. This, coupled with other positive metrics, fuels expectations of an imminent uptrend.

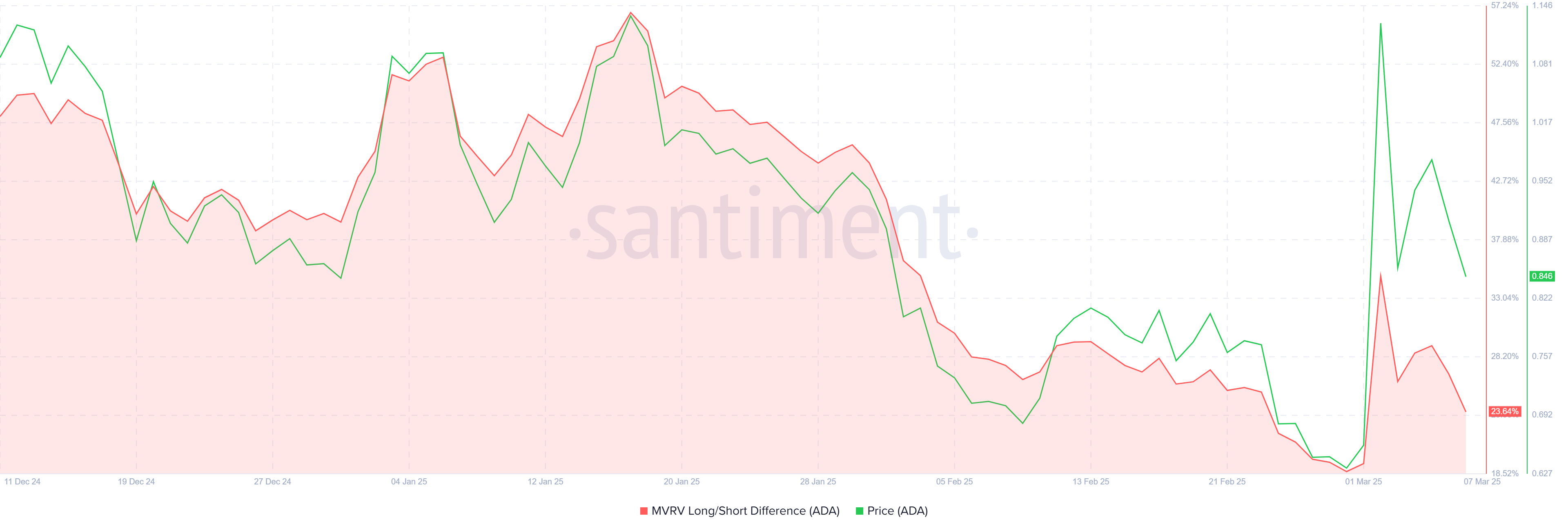

Market Value to Realized Value (MVRV) Analysis

Further supporting the bullish outlook is the positive Market Value to Realized Value (MVRV) Long/Short Difference, currently at 23%. This indicates that long-term holders (LTHs) are profitable, a sign of market stability.

The profitability of LTHs is crucial. These investors are less likely to sell, reducing downward pressure on ADA's price and bolstering overall market health.

ADA Price Outlook: Potential and Risks

While a recovery seems plausible, risks remain. ADA's recent 16.8% drop in 48 hours highlights the volatility. While support has held above $0.77, a break below this level could lead to further declines towards $0.70.

Should the funding rate turn positive and broader market conditions remain favorable, ADA could regain $0.85 as support, potentially retesting $0.99 and establishing $1.00 as a new support level.

Disclaimer: This analysis is for informational purposes only and not financial advice. Market conditions are volatile. Conduct thorough research and consult a professional before making investment decisions.