Bybit Hack: $1.4B ETH Theft Impacts Crypto Markets

Bybit Hack: $1.4 Billion in ETH Stolen

The recent Bybit hack resulted in the theft of approximately $1.4 billion worth of Ethereum (ETH), sending shockwaves through the crypto market. A breakdown of the stolen funds reveals:

- 77% traceable: Offers hope for recovery.

- 20% untraceable: Poses a significant challenge for authorities.

- 3% frozen: A small victory in the ongoing investigation.

The hackers employed sophisticated techniques, rapidly converting 417,348 ETH into Bitcoin (BTC) across 6,954 wallets, averaging 1.71 BTC per wallet. This large-scale conversion is a key factor impacting market volatility.

Market Volatility and Liquidity

This massive influx of BTC from the converted ETH is likely to significantly impact Bitcoin's market liquidity. The increased supply on exchanges could lead to price fluctuations and heightened volatility in the coming days. The distribution across numerous wallets complicates tracking and recovery efforts.

Uncertainty and Speculation

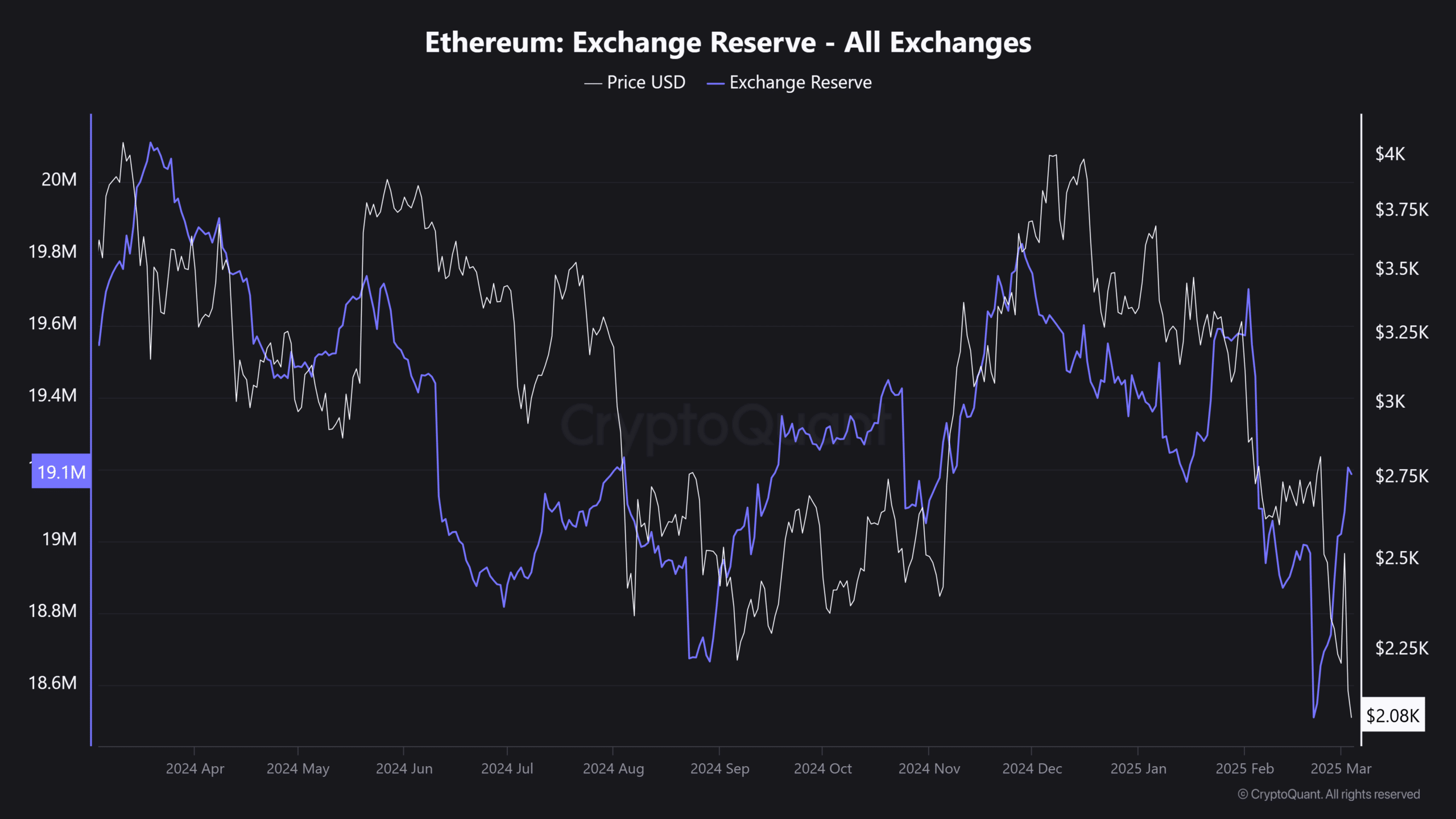

Adding to market uncertainty is the ongoing speculation surrounding the lack of confirmation of Trump's alleged pro-ETH/BTC stance. This has fueled concerns about potential market manipulation and investor doubts. The recent rise in ETH reserves, after hitting a yearly low, further exacerbates the situation.

Navigating the Volatility

The crypto market is currently navigating a complex and volatile landscape. Traders and investors need to proceed with caution, as unexpected price swings are highly likely. Robust risk management strategies are crucial during this period of uncertainty.

Codeum provides comprehensive blockchain security solutions, including smart contract audits, KYC verification, and custom smart contract and DApp development. We partner with launchpads and crypto agencies to ensure the security and integrity of blockchain projects. Contact us to learn how we can help mitigate risks and secure your blockchain investments.

Source: CryptoQuant