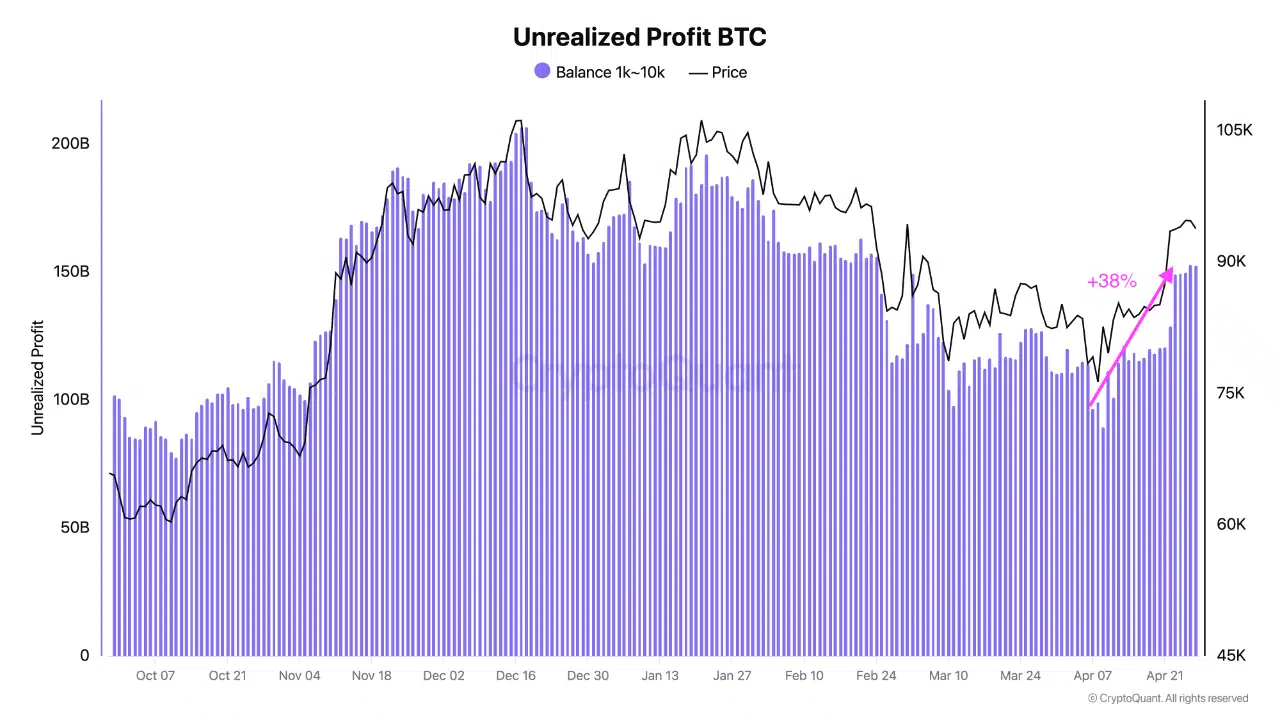

Bitcoin Whale Alert: $150B in Profits, Market Impact?

Bitcoin Whale Alert: Potential Sell-off Looms

Bitcoin whales are currently sitting on a substantial $150 billion in unrealized profits—their largest holdings since February. This significant accumulation raises concerns about potential market volatility. Data from CryptoQuant reveals a 38% increase in unrealized gains during April alone.

The rising number of whale wallets further fuels speculation about strategic positioning as Bitcoin approaches key resistance levels. This concentration of power in the hands of a few players could lead to significant price fluctuations.

Understanding the Risks

- Massive Unrealized Gains: The current $150 billion in unrealized profits represents a considerable potential source of sell pressure.

- Increased Whale Wallet Count: A growing number of whale wallets suggests coordinated activity and potential for market manipulation.

- Historical Precedent: Past instances of high unrealized gains among whales have often preceded market corrections.

Historically, when unrealized profits near the $200 billion mark, whales tend to start selling, cooling down the market. While Bitcoin's price has recently surged above $90,000, the question remains whether these massive profits will remain unrealized or translate into significant sell pressure.

Codeum: Securing the Future of Blockchain

Navigating the complexities of the crypto market requires robust security measures. Codeum offers comprehensive blockchain security solutions, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us to learn how we can help secure your blockchain project.

Source: CryptoQuant