Bitcoin Whale Activity & Market Outlook

Bitcoin (BTC) has traded below $88,000 since March 7th, struggling to gain momentum amidst fluctuating market sentiment. Technical indicators, including the Ichimoku Cloud and EMAs, currently suggest a bearish trend, although a reversal isn't impossible.

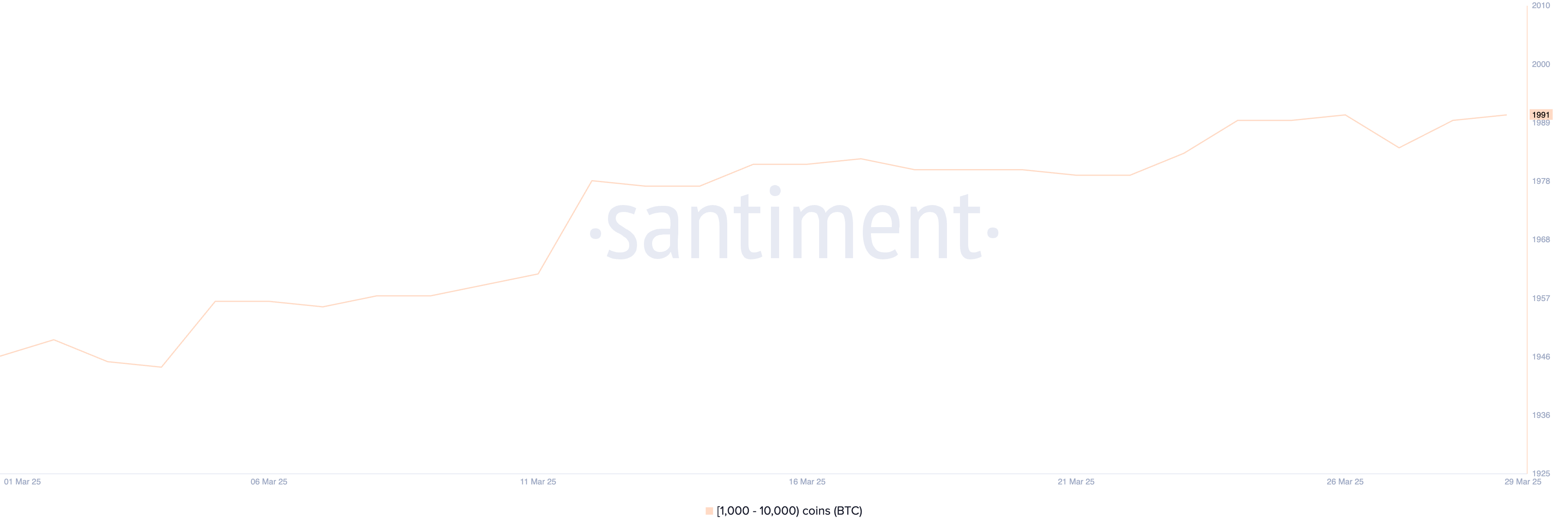

Bitcoin Whale Accumulation Reaches 3-Month High

The number of Bitcoin whales (wallets holding at least 1,000 BTC) has increased significantly. On March 22nd, there were 1,980 such addresses; this has risen to 1,991. While seemingly small, this 11-address increase represents substantial large-scale accumulation—the highest level in over three months.

Tracking whale activity is crucial, as these large holders significantly influence price movements. Increased whale addresses often indicate rising confidence among institutional investors and high-net-worth individuals. This accumulation suggests reduced selling pressure and potentially bullish sentiment.

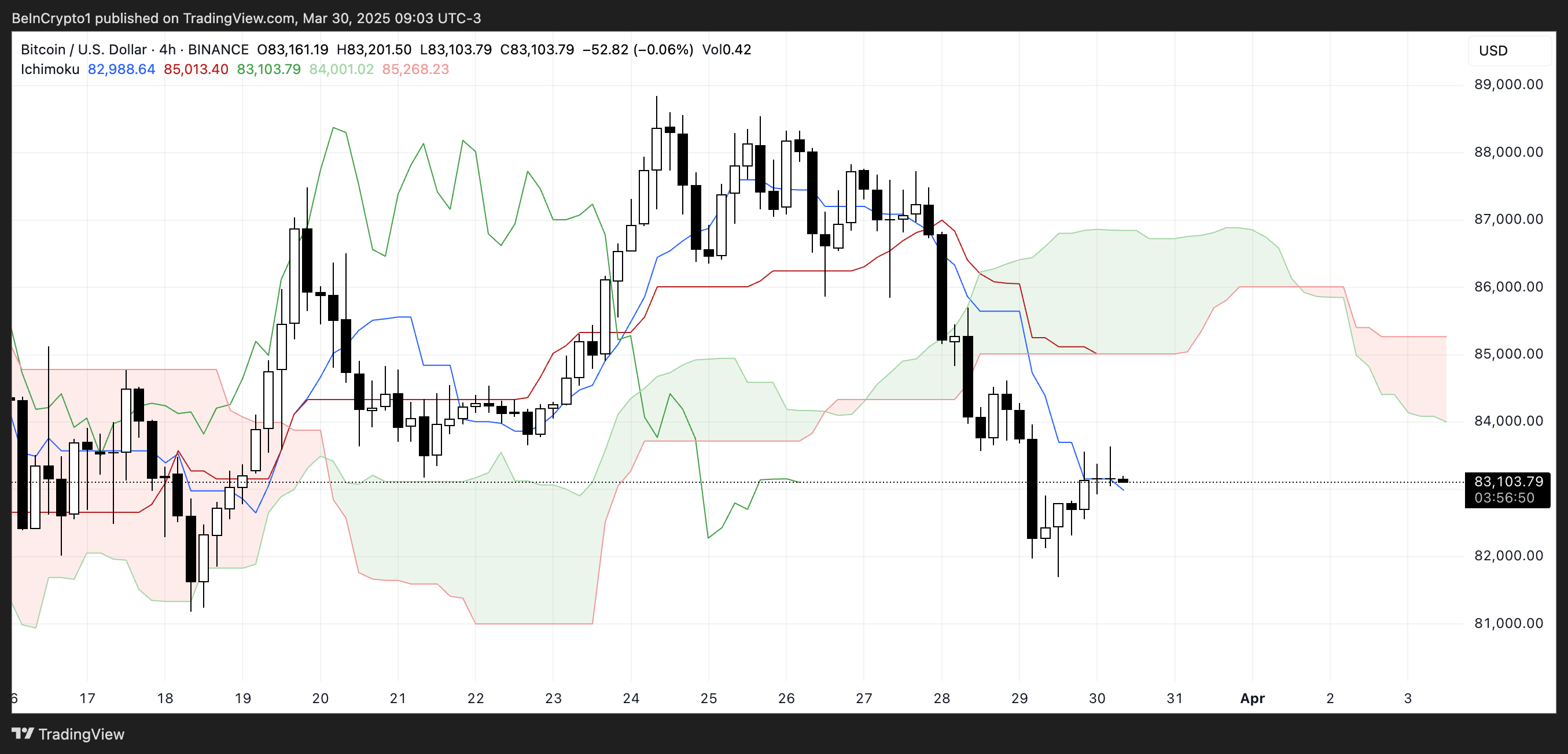

Ichimoku Cloud Hints at Bearish Trend

Bitcoin's Ichimoku Cloud chart shows price consolidation below the Kijun-sen (red line) following a sharp downward movement. The Tenkan-sen (blue line) remains below the Kijun-sen, suggesting short-term bearish momentum. The Lagging Span (green line) trails below both price and the cloud, reinforcing a bearish outlook.

The Kumo (cloud) projects downward, with Senkou Span A (green) below Senkou Span B (red), indicating resistance overhead. However, the cloud's thin structure suggests potential vulnerability; a strong buyer influx could trigger a reversal.

Currently, the Ichimoku indicators lean towards caution, with the prevailing trend remaining bearish.

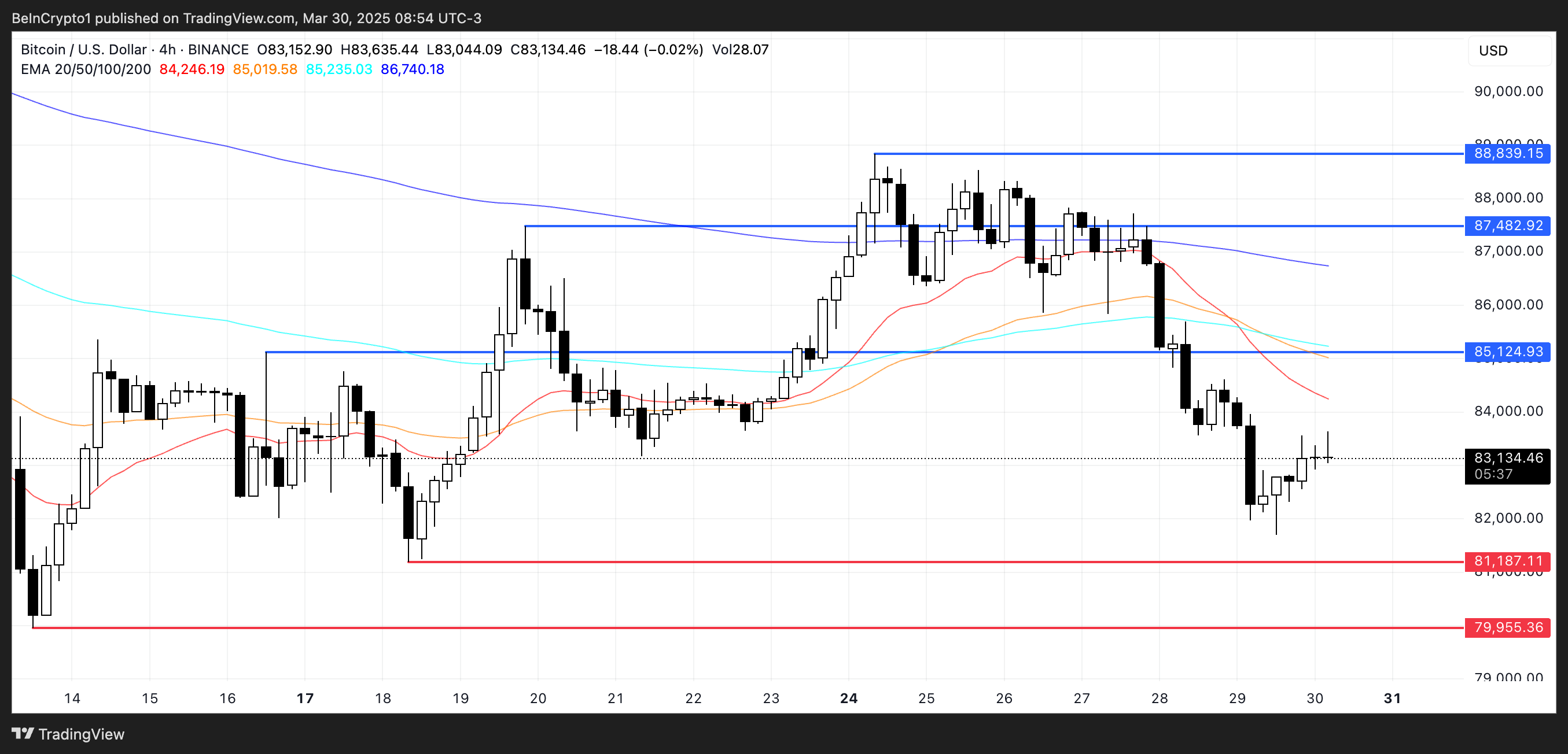

Bitcoin Price: Potential for $88,000?

Bitcoin's EMA lines point to a downtrend, with short-term averages below longer-term ones. However, if buyers regain control, Bitcoin's price may challenge resistance levels near $85,124. Breaking this could open paths to $87,482 and potentially $88,839, assuming sustained bullish momentum.

Conversely, failure to build upward momentum would strengthen the bearish structure, potentially leading to revisits of support around $81,187, and potentially lower to $79,955.

Codeum Note: At Codeum, we provide comprehensive blockchain security and development services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us to ensure your projects are secure and compliant.

Disclaimer: This analysis is for informational purposes only and shouldn't be considered financial advice. Market conditions change rapidly. Conduct your own research and consult a professional before making any financial decisions.