Bitcoin's Wall Street Embrace: A Risk Asset?

Bitcoin's Wall Street Embrace: A Risk Asset?

The narrative surrounding Bitcoin has shifted. Once viewed as an anti-establishment, censorship-resistant asset, it's now deeply intertwined with Wall Street's fortunes. This integration, while initially seen as a positive sign of mainstream adoption, has introduced new complexities.

The Changing Landscape

In its early years, Bitcoin's price remained largely unaffected by traditional market fluctuations. However, that independence is eroding. Recent data reveals a strong correlation between Bitcoin's price and the performance of the S&P 500, indicating it's increasingly behaving like a traditional risk asset.

This correlation is evident even during periods of significant market volatility. For example, the 2013 Cyprus banking crisis saw a dramatic Bitcoin price surge as investors sought refuge from the traditional financial system. However, this trend suggests a different reality: when Wall Street experiences volatility, Bitcoin follows suit.

The 'Digital Gold' Debate

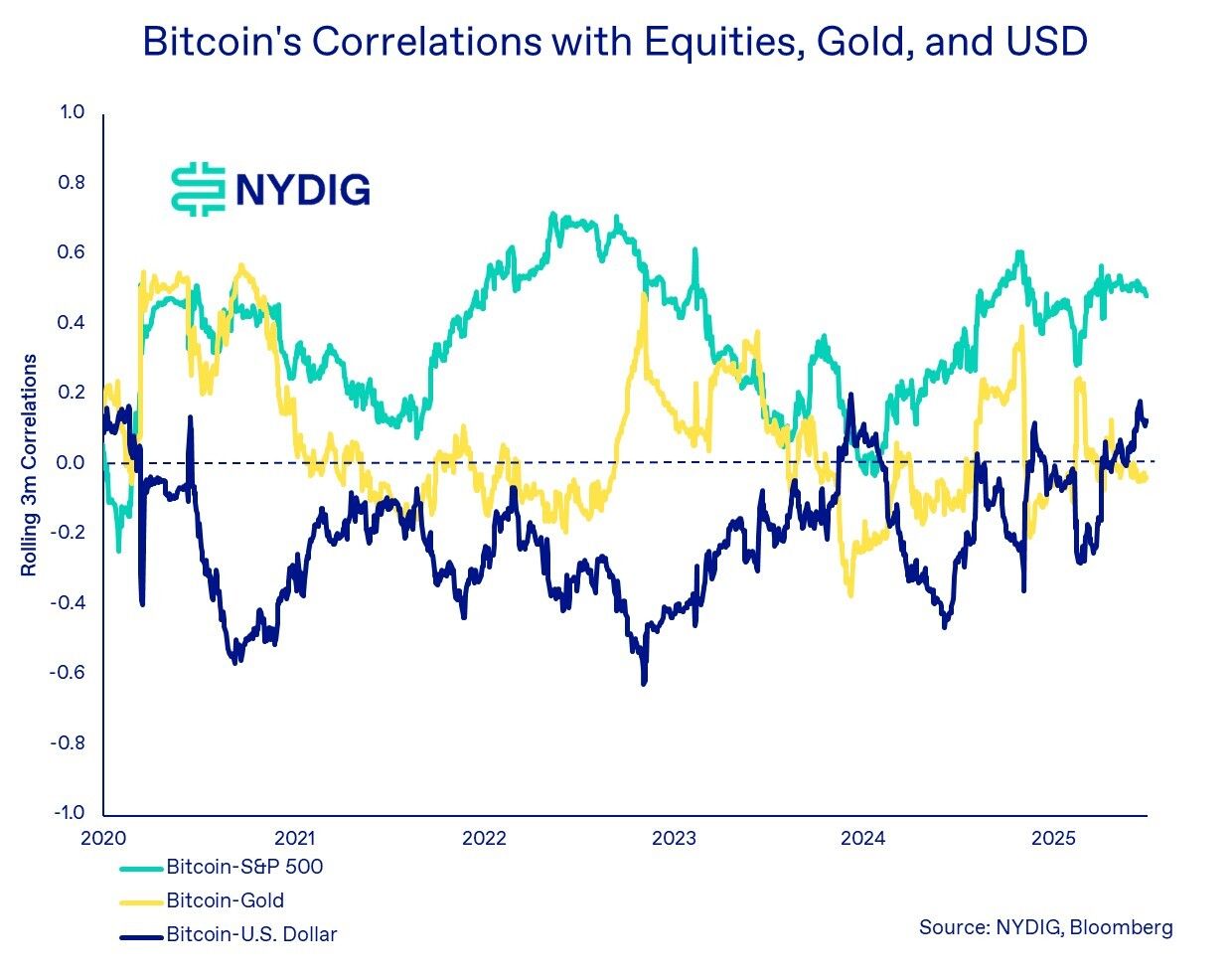

The 'digital gold' comparison, which positions Bitcoin as a safe haven asset, is also being challenged. Recent research from NYDIG indicates a near-zero correlation between Bitcoin's price and both physical gold and the US dollar. This challenges the argument that Bitcoin serves as a hedge against macroeconomic uncertainty.

Understanding the Correlation

The growing correlation between Bitcoin and traditional markets stems from several factors. Macroeconomic trends, geopolitical events, and central bank policy decisions significantly influence investor sentiment, affecting both equities and cryptocurrencies. The NYDIG report highlights a correlation coefficient of 0.48 between Bitcoin and US equities, indicating a strong relationship.

The Future of Bitcoin

While the short-to-medium-term outlook suggests continued correlation with traditional markets, Bitcoin's core characteristics—limited supply, borderless access, and decentralized nature—remain unchanged. Long-term holders and maximalists maintain faith in Bitcoin's underlying value proposition. However, investors need to adapt their strategies to this new reality, recognizing Bitcoin's increased sensitivity to broader market dynamics.

Codeum helps navigate this evolving landscape by offering a range of blockchain security services, including smart contract audits, KYC verification, and custom smart contract and DApp development. Our expertise in tokenomics and security consultation assists projects in mitigating risks and building secure, robust applications. We partner with launchpads and crypto agencies, fostering a secure ecosystem for blockchain innovation.