Bitcoin Trading Slowdown: Price Shift Ahead?

Bitcoin Trading Activity Slows: Is a Price Shift Imminent?

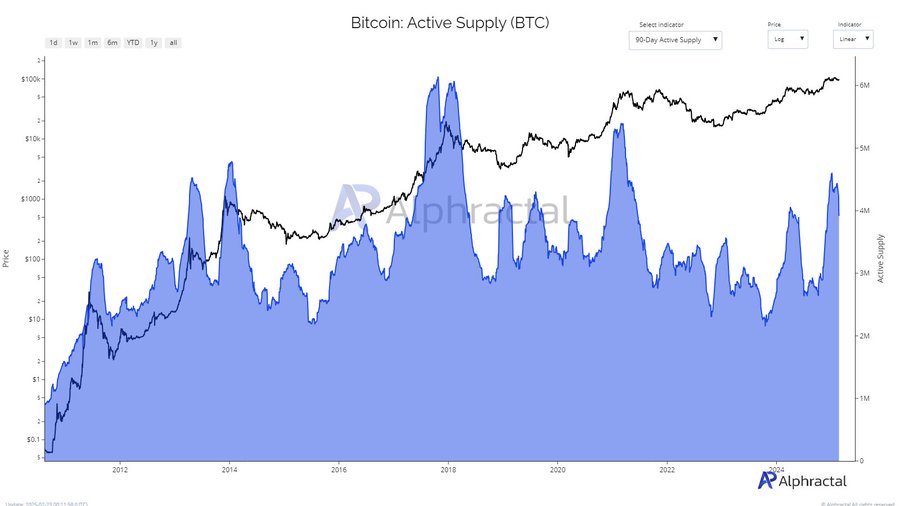

Recent weeks have witnessed a notable decline in Bitcoin's (BTC) 90-day active supply, prompting questions about market demand and investor sentiment. This crucial metric, tracking Bitcoin moved at least once in 90 days, reflects both new market interest and overall trader mood.

Active Supply, Market Demand, and Sentiment

A high active supply usually indicates increased market participation and rising demand from short-term traders. Conversely, a drop suggests reduced interest, as long-term holders tend to hold during quieter periods. Historically, significant active supply shifts have correlated with price fluctuations.

Factors Behind the Shift

The recent decrease in Bitcoin's 90-day active supply points to less short-term trading, indicating reduced interest from new participants. Several factors might contribute to this:

- Increased market volatility due to policy uncertainties and inflation concerns.

- More cautious trading behavior among investors.

- A more favorable regulatory environment encouraging long-term holding.

- A "wait-and-see" approach by institutional investors.

If this trend persists, Bitcoin's price could consolidate sideways or dip slightly.

Historical Trends and Patterns

Historically, Bitcoin's active supply rises during bull market peaks and contracts during early rallies or post-halving consolidation periods. Charts show active supply spikes during major price surges (2013, 2017, 2021), followed by declines during corrections. The current downturn mirrors pre-breakout trends, suggesting potential consolidation before another upward move.

Source: Alphractal

Impact on BTC's Price?

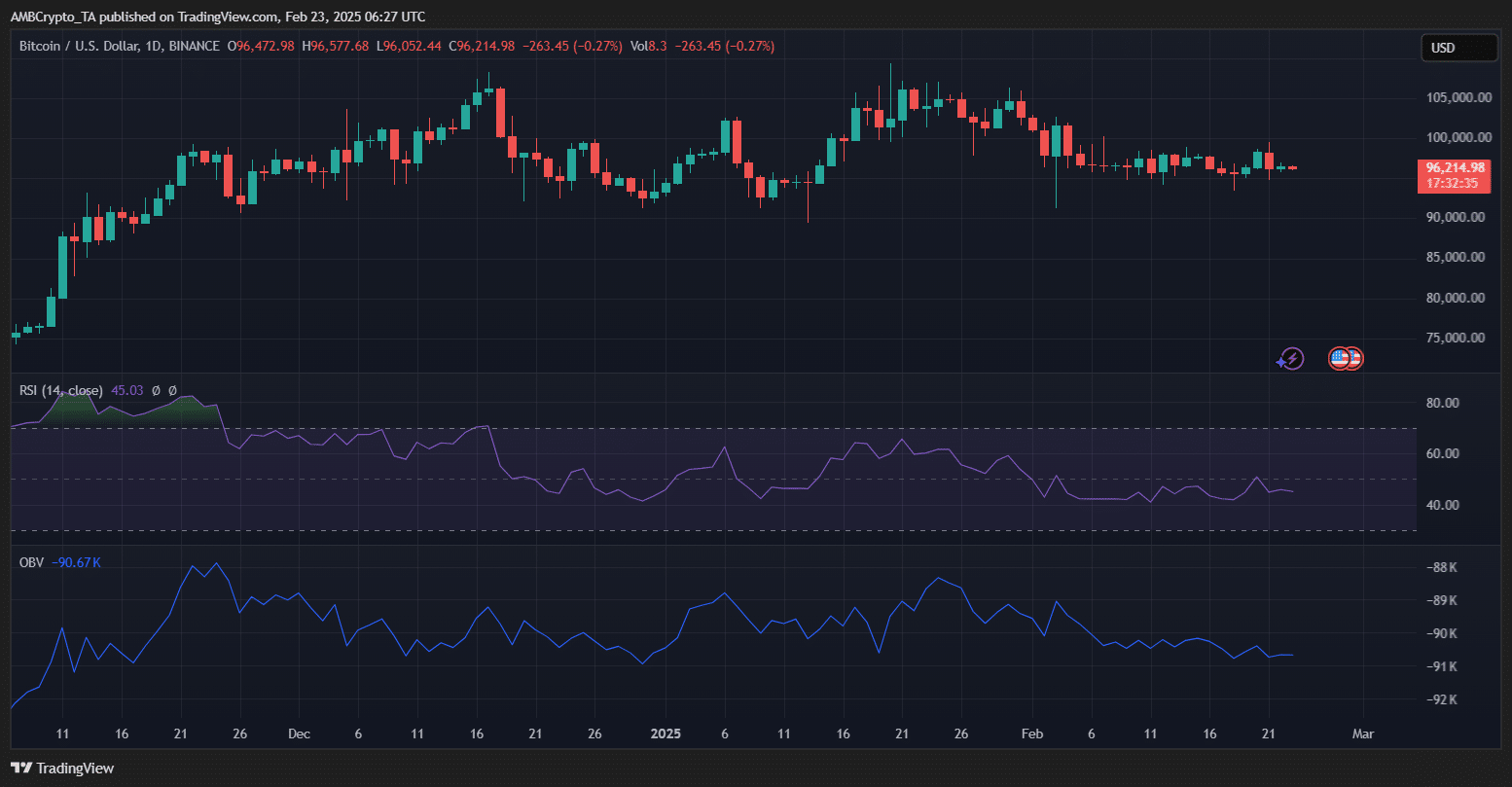

At press time, Bitcoin traded at $96,214, down 0.27% in 24 hours. The RSI at 45.03 suggests neutral territory (neither oversold nor overbought). The OBV's downward trend indicates weakening buying pressure, aligning with the decreased active supply.

Source: TradingView

BTC has consolidated below $100,000. Diminished short-term trading suggests investor caution. A pullback towards $90,000 is possible if momentum isn't regained. However, increased demand could push BTC towards $100,000 resistance.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk.

Codeum offers comprehensive blockchain security services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us to secure your blockchain project.