Bitcoin Surges Past $110K: ETF Inflows Soar

Bitcoin Price Soars Above $110,000

Bitcoin (BTC) reached a new all-time high, exceeding $110,000, driven by significant investor confidence and substantial inflows into Bitcoin spot exchange-traded funds (ETFs).

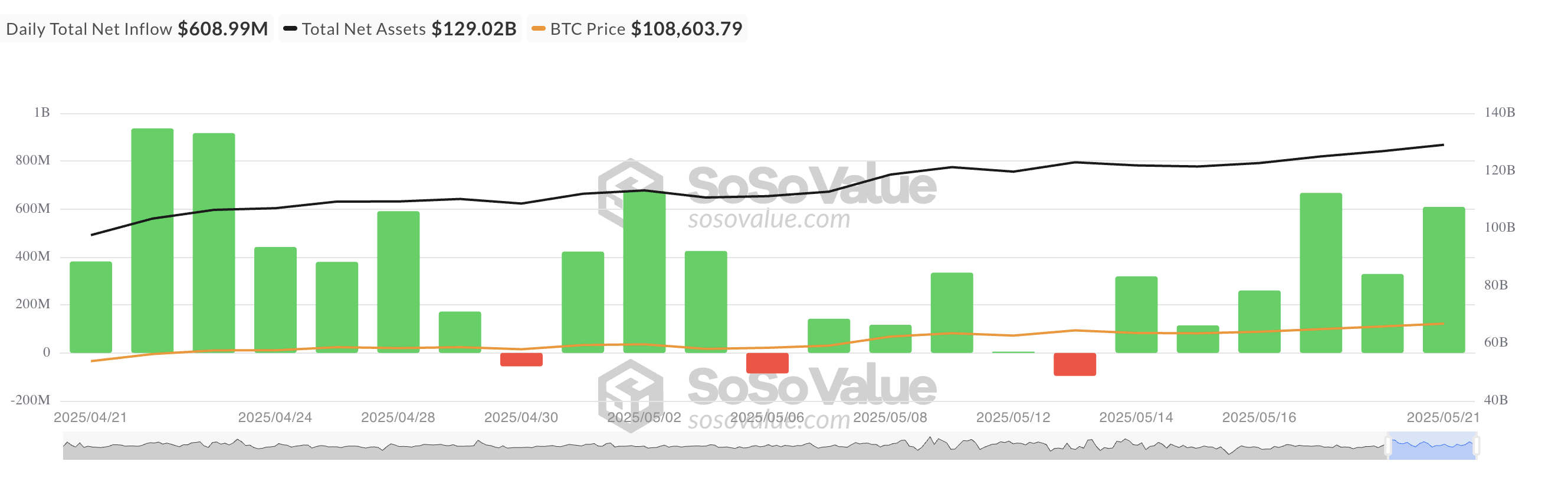

Record ETF Inflows Fuel Bitcoin's Rise

Wednesday witnessed a remarkable $608.99 million in net inflows into BTC spot ETFs, marking the sixth consecutive day of positive flows. This surge represents an 85% increase compared to Tuesday's inflows. The total net asset value of all BTC spot ETFs now stands at $129.02 billion, according to SosoValue. BlackRock's IBIT ETF led the way with $530.63 million in daily inflows, bringing its total to $46.68 billion. Fidelity's FBTC ETF followed with $23.53 million, accumulating $11.83 billion in total net inflows.

Source: SosoValue

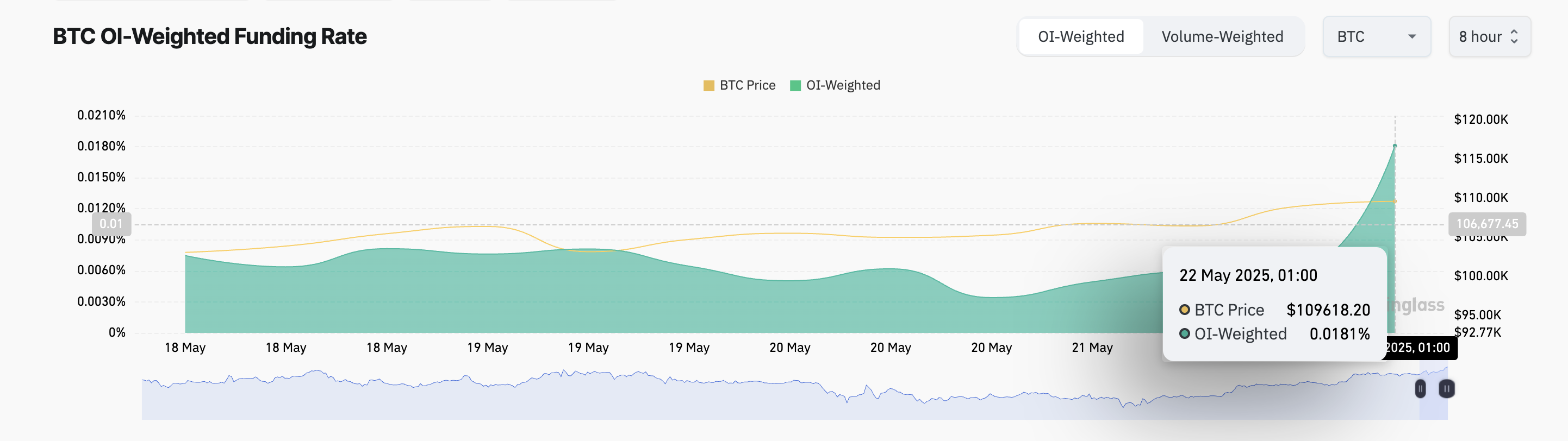

Market Sentiment: Cautious Optimism

While BTC briefly touched $111,880, a slight pullback to around $111,618 at the time of writing suggests a period of consolidation. However, technical indicators still point to bullish pressure. The derivatives market reflects this, with Coinglass data showing BTC's funding rate at 0.018%, its highest single-day value since February 22. A high funding rate indicates a significant number of traders holding long positions, suggesting strong bullish sentiment.

Source: Coinglass

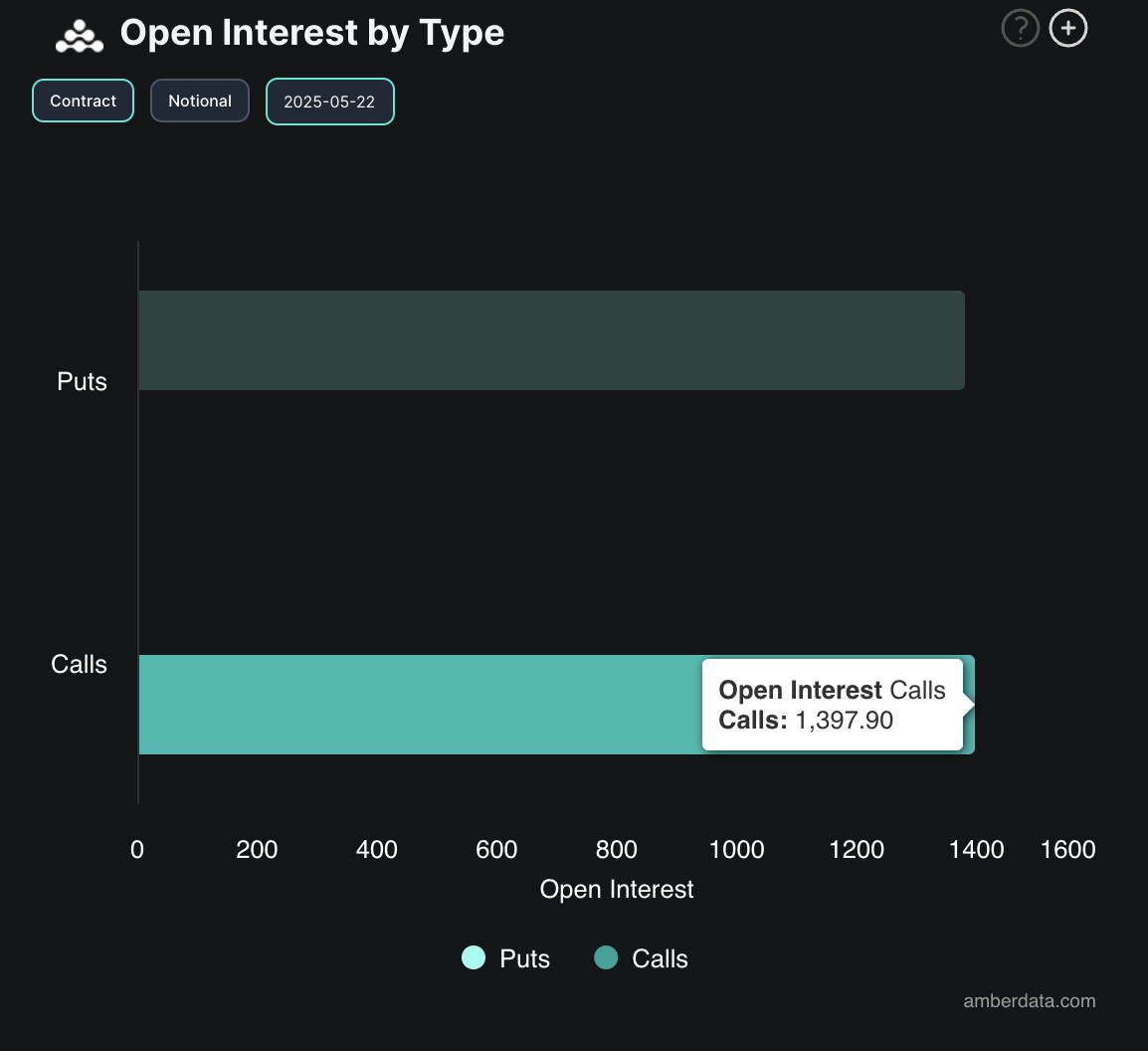

Despite the bullish momentum, options market data from Deribit reveals a balanced sentiment, with almost equal demand for calls (betting on price increases) and puts (betting on price decreases). This suggests cautious optimism, as traders await confirmation of whether the price will sustain its position above $110,000.

Source: Deribit

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Market conditions are volatile. Conduct your own research before making any investment decisions.

Codeum Note: Codeum provides comprehensive blockchain security solutions, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us to secure your blockchain project.