Bitcoin Short-Term Holders in Trouble

Bitcoin Short-Term Holders Face Losses After Price Dip

Bitcoin (BTC) briefly dipped below the $100,000 mark during Monday's trading, impacting short-term holders (STHs). While the price has since recovered to $102,691 (at press time), on-chain data shows STHs are selling at a loss.

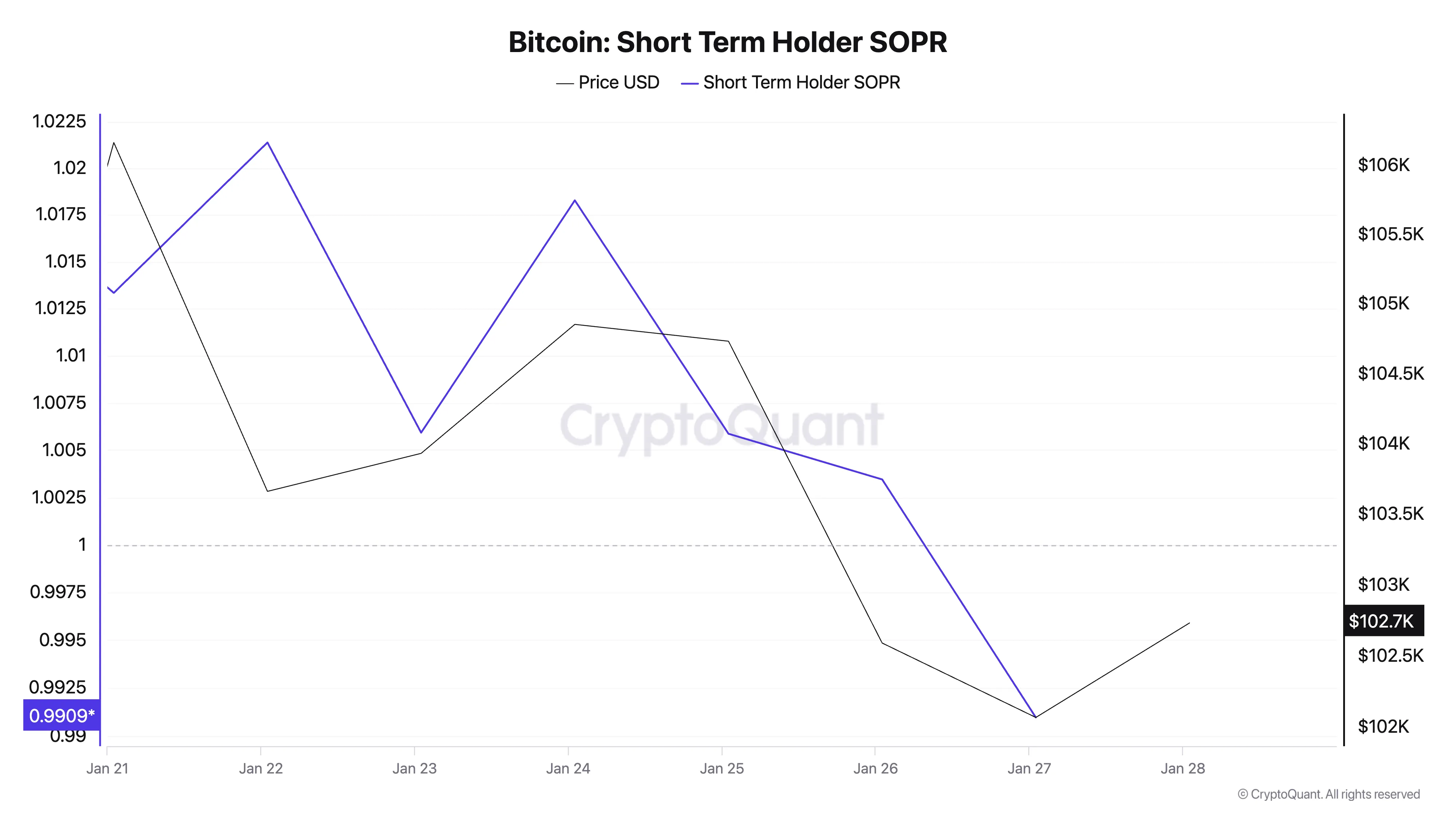

Analyzing the Spent Output Profit Ratio (SOPR)

CryptoQuant data reveals a declining Spent Output Profit Ratio (SOPR) for BTC STHs over the past week. As the price fell below $100,000, the SOPR dropped below 1, currently sitting at 0.99. A SOPR below 1 indicates STHs (holding BTC for 3-6 months) are selling at a loss. A SOPR above 1 signifies they are selling at a profit.

This suggests that many investors who bought BTC within the last six months are currently experiencing losses.

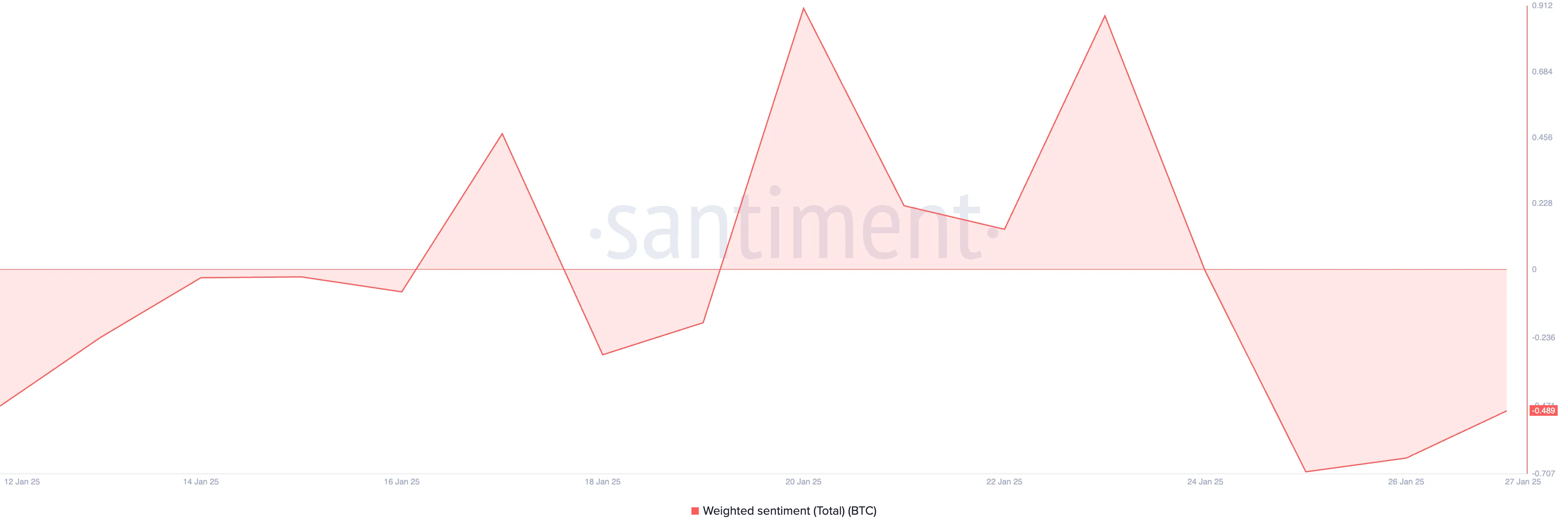

Negative Sentiment Weighs on Bitcoin

Despite the price rebound, negative sentiment persists. Santiment data shows a weighted sentiment of -0.48, a bearish indicator reflecting investor skepticism and reduced trading activity.

BTC Price Prediction: A Fork in the Road?

The price of Bitcoin could fall below $100,000 to around $99,378 if this negative sentiment deepens. Conversely, a sustained uptrend and improved market sentiment could push BTC towards reclaiming its all-time high of $109,356.

Disclaimer: This analysis is for informational purposes only and should not be considered financial or investment advice. Market conditions change rapidly. Conduct thorough research and consult a professional before making any investment decisions.