Bitcoin Scarcity: Implications for Price

Bitcoin's Increasing Scarcity: A Path Beyond $100K?

Bitcoin's inherent scarcity, capped at 21 million coins, is a key differentiator from fiat currencies. Unlike inflationary government-issued money, Bitcoin's fixed supply makes it increasingly valuable over time. This scarcity, further amplified by halving events, is a significant factor influencing price.

Understanding Bitcoin Halvings

Bitcoin's halving mechanism reduces the reward miners receive for processing transactions approximately every four years. This halving cuts the rate of new Bitcoin entering circulation in half. Glassnode data shows that 900,000 blocks have been mined since Bitcoin's inception. With each halving, the issuance rate slows considerably.

- Before the last halving: Miners received 6.25 BTC per block, adding roughly 900 BTC daily to the circulating supply.

- After the last halving: The reward dropped to 3.125 BTC per block, reducing the daily addition to approximately 450 BTC.

This decrease in supply has already been associated with a 47% surge in BTC's price since the most recent halving.

Source: Glassnode

The Looming Supply Squeeze

The next Bitcoin halving, anticipated around block height 1,050,000 in 2028, will further reduce the block reward to 1.5625 BTC. This translates to a mere 225 BTC entering circulation daily—a significant decrease.

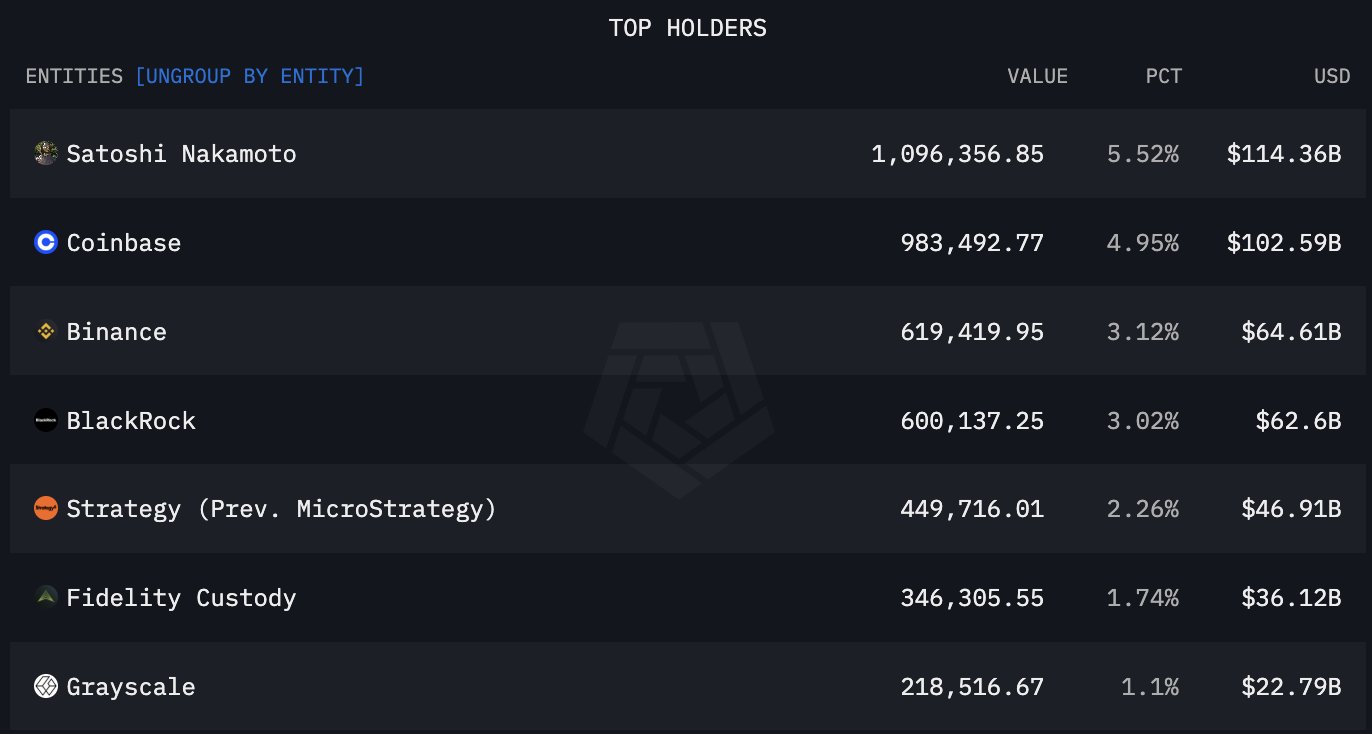

With only approximately 1.7 million Bitcoin left to mine, the upcoming halving will intensify the scarcity. This dwindling supply, combined with growing demand, could significantly impact the price. The fact that the top 8 holders control approximately 4.51 million BTC (21% of the total supply) further contributes to this market pressure.

Source: X

Future Price Projections

While precise price predictions are speculative, a surge in Bitcoin's market capitalization to $3 trillion or $5 trillion could easily drive the price of a single Bitcoin to $143,000, $238,000, or even higher. The inherent scarcity combined with increased demand creates a bullish outlook.

Codeum: Your Partner in Blockchain Security

At Codeum, we understand the complexities of the blockchain industry. We offer comprehensive services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Let us help you navigate the challenges and opportunities of this rapidly evolving landscape.