Bitcoin's Reduced Volatility: A Sign of Maturity?

Bitcoin Price Volatility: A Significant Shift

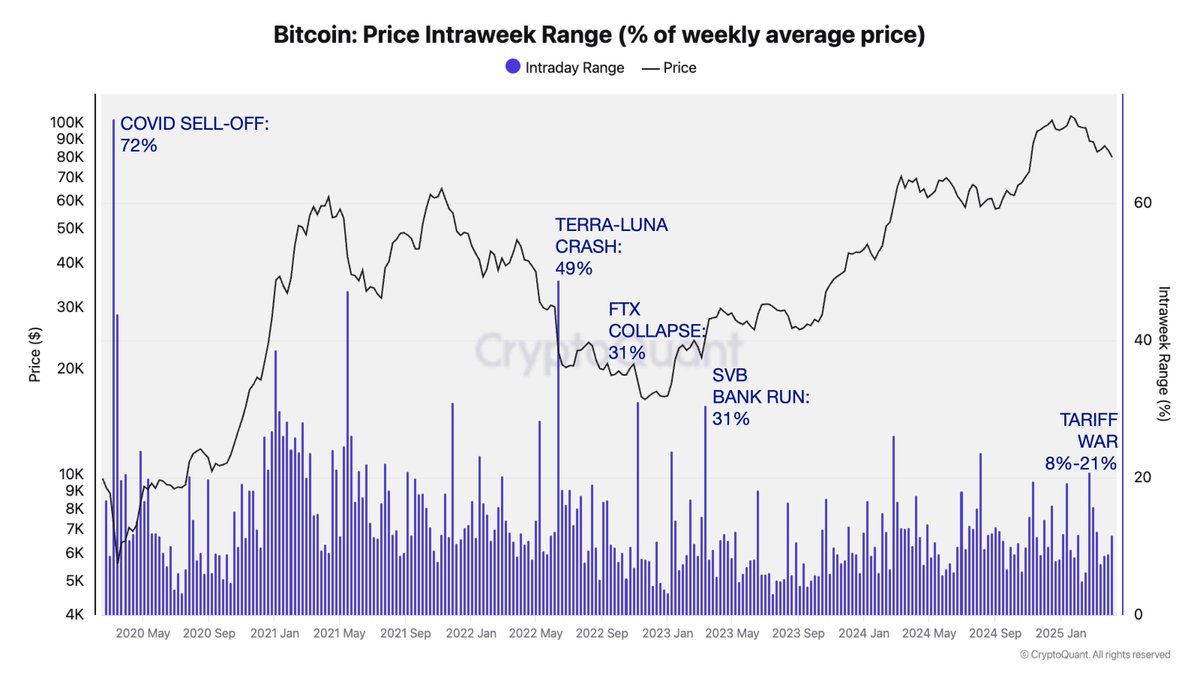

Recent weeks have seen the cryptocurrency market grapple with uncertainty due to fluctuating global macroeconomic conditions. Bitcoin's price swung wildly between $74,000 and $83,000 in just a few days, initially dropping after President Trump's trade tariff announcements, then recovering after a pause in tariffs (excluding China).

Is Bitcoin Becoming a More Mature Asset?

While Bitcoin's price remains reactive to global trade news, on-chain analytics suggest a significant shift. CryptoQuant's head of research, Julio Moreno, highlighted that current volatility is notably lower than during past events like the COVID-19 crash, Terra-Luna collapse, FTX downfall, and the SVB bank run. He used the Price Intraweek Range metric, which measures the percentage change in Bitcoin's average weekly price.

Key Volatility Data Points:

- COVID-19 (April 2020): 72% Intraweek Range

- Terra Luna Collapse (May 2022): 49% Intraweek Range

- FTX Collapse (Late 2022) & SVB Bank Run (Early 2023): 31% Intraweek Range

- Current (Amid Trade Tensions): 8% - 21% Intraweek Range

Source: @jjcmoreno on X

This reduced volatility suggests increased maturity, improved market structure, and deeper liquidity in the Bitcoin market. The growing number of long-term holders and increasing corporate adoption are likely contributing factors. Institutional investors are increasingly viewing Bitcoin as a hedge against macroeconomic uncertainty rather than a high-risk asset.

Bitcoin Price Update

At the time of writing, BTC is trading around $83,700, a 5% increase in the last 24 hours.

Source: BTCUSDT chart on TradingView

Need robust security for your blockchain projects? Codeum offers a range of services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us today to learn more.