Bitcoin Rally Shift: Retail Investors Take Charge

Bitcoin Rally Shift: Retail Investors Take Charge

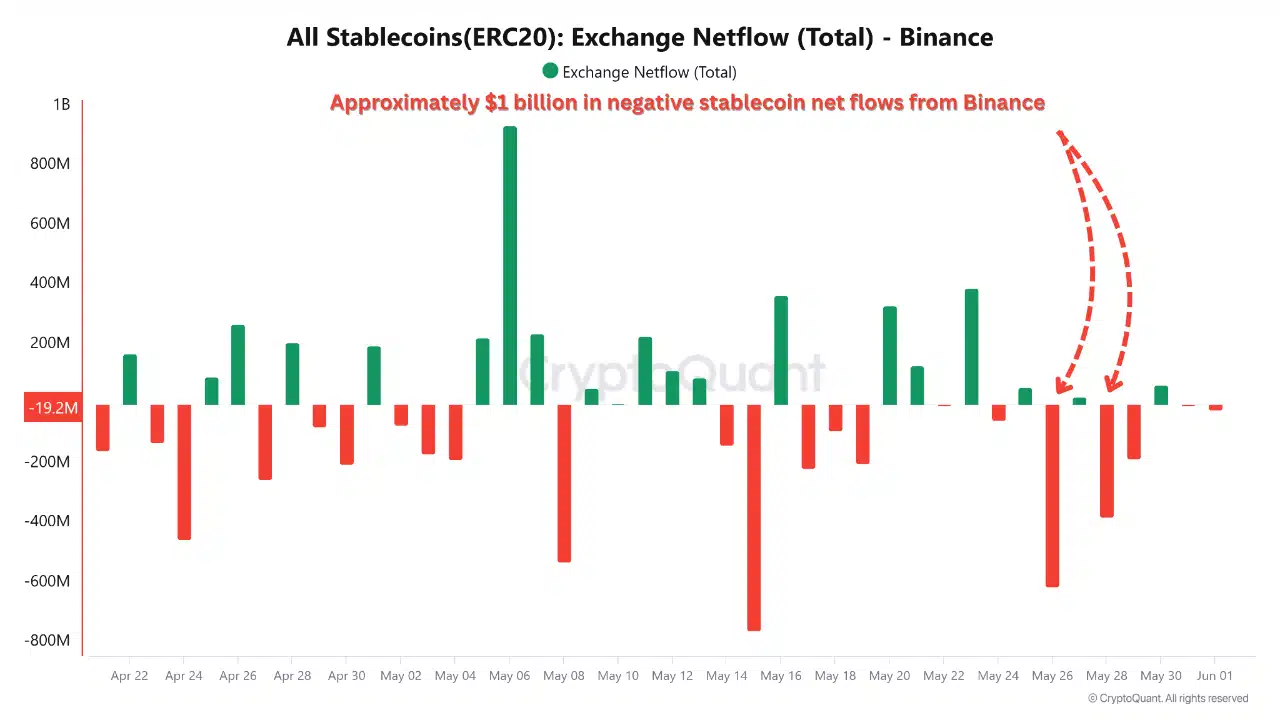

A significant shift is underway in the Bitcoin market. While Bitcoin recently neared record highs, over $1 billion in stablecoins exited Binance, indicating that long-term holders are reducing their exposure and de-risking. Simultaneously, smaller retail investors are aggressively entering the market, potentially sustaining the recent rally.

Waning Liquidity or Strategic Rotation?

Binance's net stablecoin outflows exceeding $1 billion in May represent a substantial liquidity shift. This drawdown often signals caution among large players. While Bitcoin surpassed $110K, the capital base fueling this rally might be shrinking. This could precede a cooling-off period or represent a moment of profit rotation by larger investors.

Source: CryptoQuant

Long-Term Holders Reduce Exposure

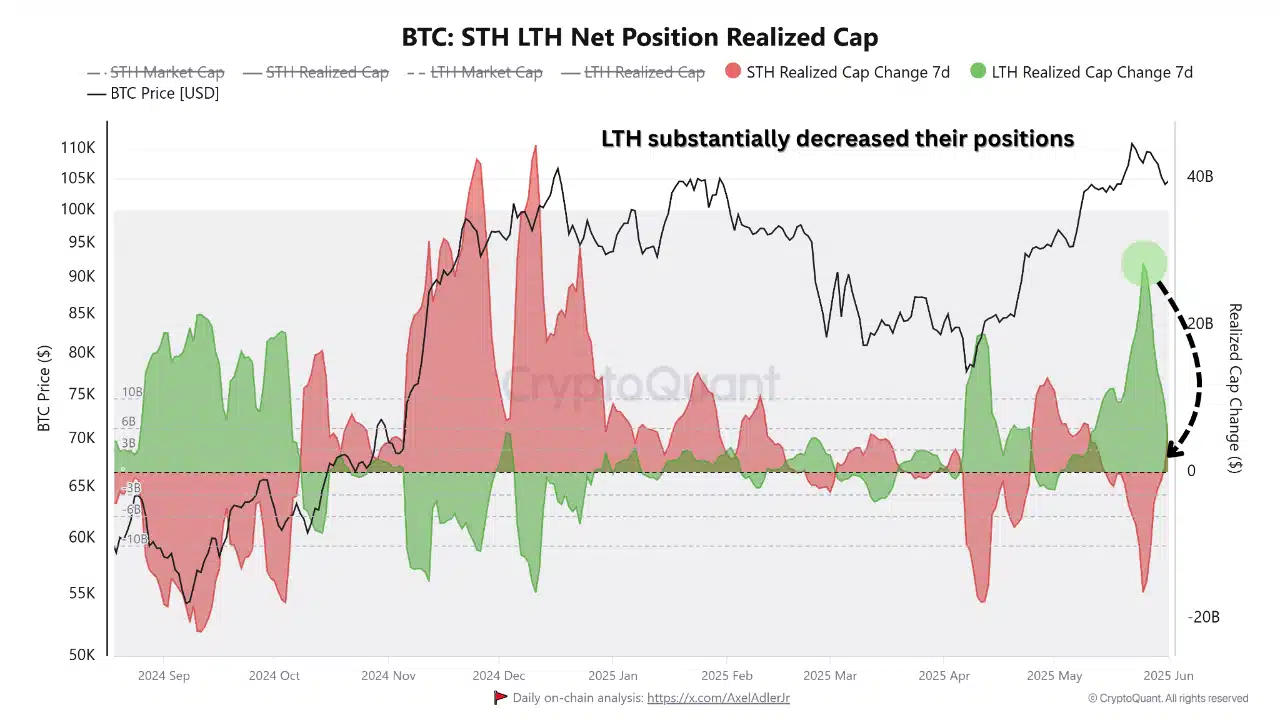

Bitcoin's long-term holders (LTHs) have significantly reduced their net realized cap, from $28 billion to $2 billion. This collapse of the green accumulation wave, now replaced by a flat line, often precedes distribution phases. This significant de-risking by experienced investors suggests potential caution.

Source: CryptoQuant

Retail Investors Drive the Rally

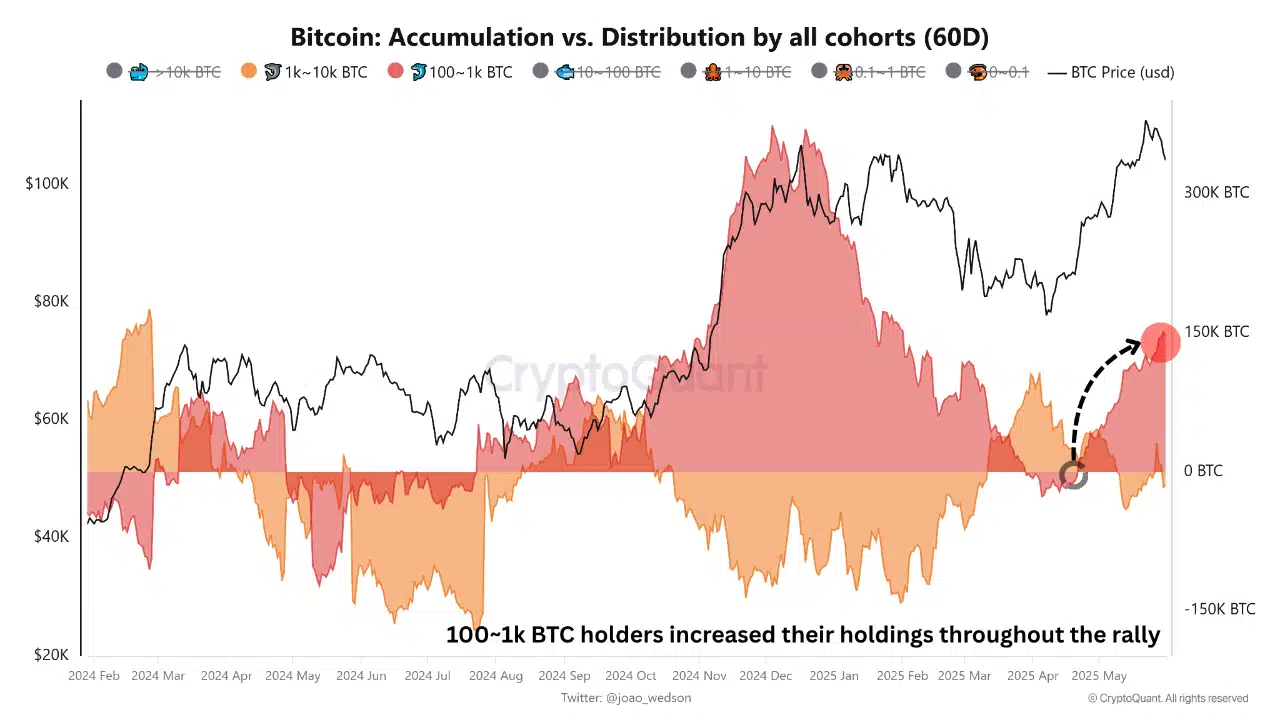

As Bitcoin climbed from $81K to $110K, wallets holding 1,000-10,000 BTC exhibited systematic distribution, indicative of profit-taking. Conversely, wallets holding 100-1,000 BTC became net accumulators, bolstering the rally. This data points to a clear shift: institutional-sized holders are selling, while smaller, retail-driven wallets are buying.

Source: CryptoQuant

This retail-led rally raises questions about its sustainability given the decreased institutional support. The market's vulnerability to sharp reversals increases if macroeconomic factors or regulatory changes emerge.

Is this a Transition or Turning Point?

The recent market activity suggests a potential transition or turning point. While the shift to a retail-driven market might signal broader adoption, it also introduces new risks. The balance of power has undoubtedly changed, and the market's future trajectory remains uncertain.

Codeum, a blockchain security and development platform, provides comprehensive services including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Learn more at [Codeum's Website].