Bitcoin's 8% Surge: Bullish or Bear Trap?

Bitcoin Price Rebounds, but Volatility Remains

Bitcoin (BTC) experienced an 8% surge in the last 24 hours, reaching $93,202, recovering from last month's losses. While attempting to establish $93,625 as support, this rally has reignited bullish sentiment. However, caution is warranted. Market trends and trader sentiment remain at odds, heightening volatility risks.

Sentiment-Driven Trading: A Risky Strategy

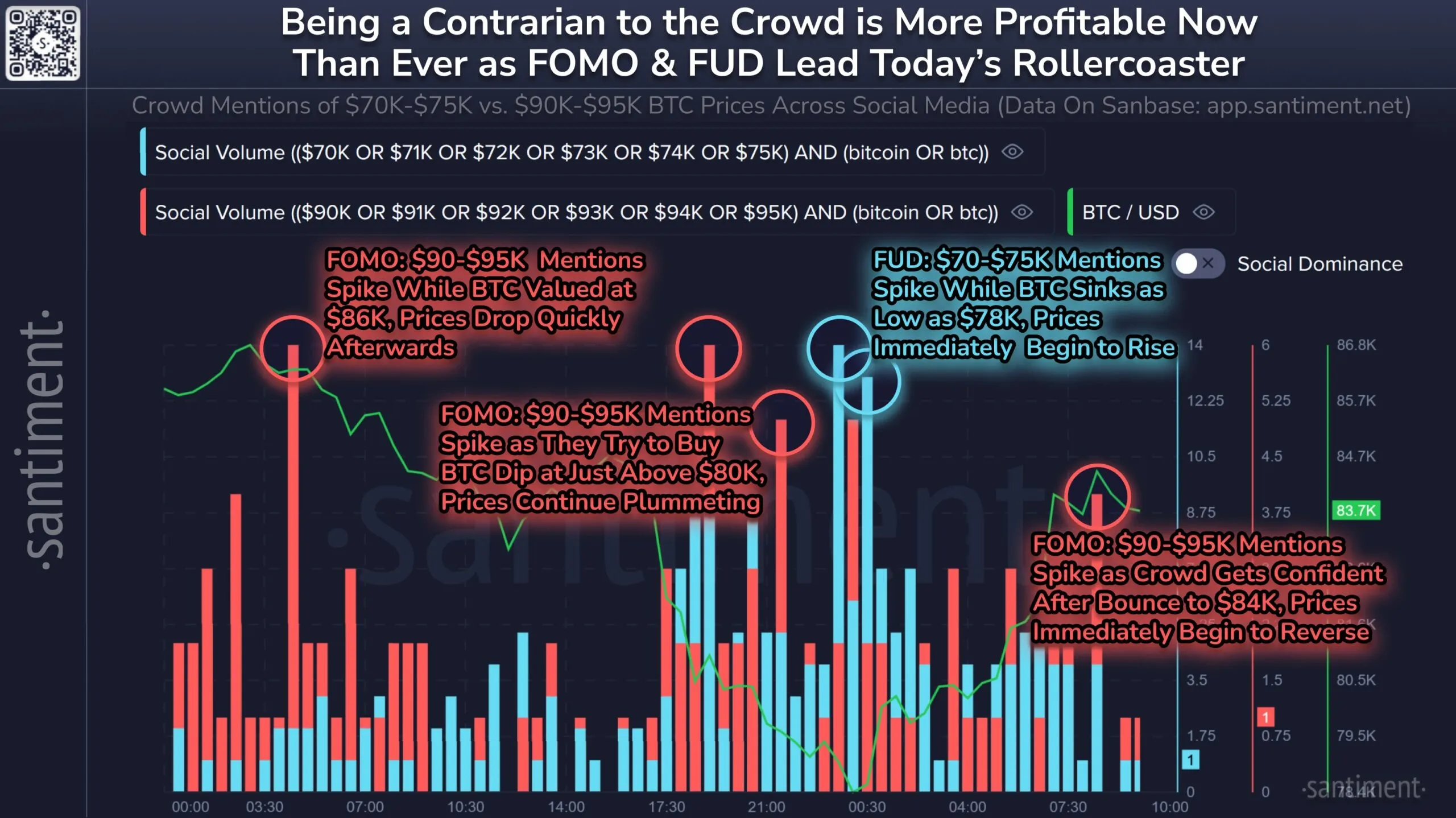

Data from Santiment reveals a concerning pattern: traders frequently misinterpret Bitcoin's price movements. Anticipated rallies often lead to declines, and predicted drops are frequently followed by unexpected price increases. This unpredictability underscores the risks of sentiment-driven trading.

As Bitcoin aims for $100,000, investors should prioritize volatility monitoring. Contrarian strategies – acting against the prevailing sentiment – may prove more effective in this uncertain market. Codeum offers expert guidance on navigating this volatility through our tokenomics and security consulting services.

Bitcoin Dominance and Historical Fractals

Bitcoin's dominance currently stands at 60.74%, forming a pattern reminiscent of 2020-2021. This period saw sharp price increases followed by significant declines. While Bitcoin has demonstrated price recovery during periods of declining dominance, the sustainability of such moves is dependent on broader market conditions. As dominance decreases, altcoins often gain traction, but Bitcoin historically benefits in the long term. This current market structure suggests a transition phase with potential for further BTC upside.

Crucial Support Levels for Bitcoin

Bitcoin's recent rise needs to solidify support levels to sustain the uptrend. Holding above $93,625 could propel the price towards $97,696. Successfully flipping the 50-day EMA to support is critical, erasing February's losses and establishing a stronger base for continued growth. Failure to maintain above $95,761 might invalidate bullish momentum, potentially causing a drop towards $92,005.

Codeum Note: For secure smart contract development and thorough audits to mitigate risks within this volatile market, consider partnering with Codeum. We provide smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consulting, and partnerships with launchpads and crypto agencies.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Market conditions change rapidly. Conduct thorough research and consult a professional before making any investment decisions.