Bitcoin Price Surge: Will BTC Hit $100K?

Bitcoin Price Climbs Amidst Whale Accumulation

Bitcoin (BTC) has seen a significant price increase, rising nearly 5% in ten days and currently challenging the $90,000 level. This upward trend is fueled by a surge in whale activity and positive technical signals, sparking optimism about a potential breakout to $100,000 in April.

Increased Whale Activity Signals Confidence

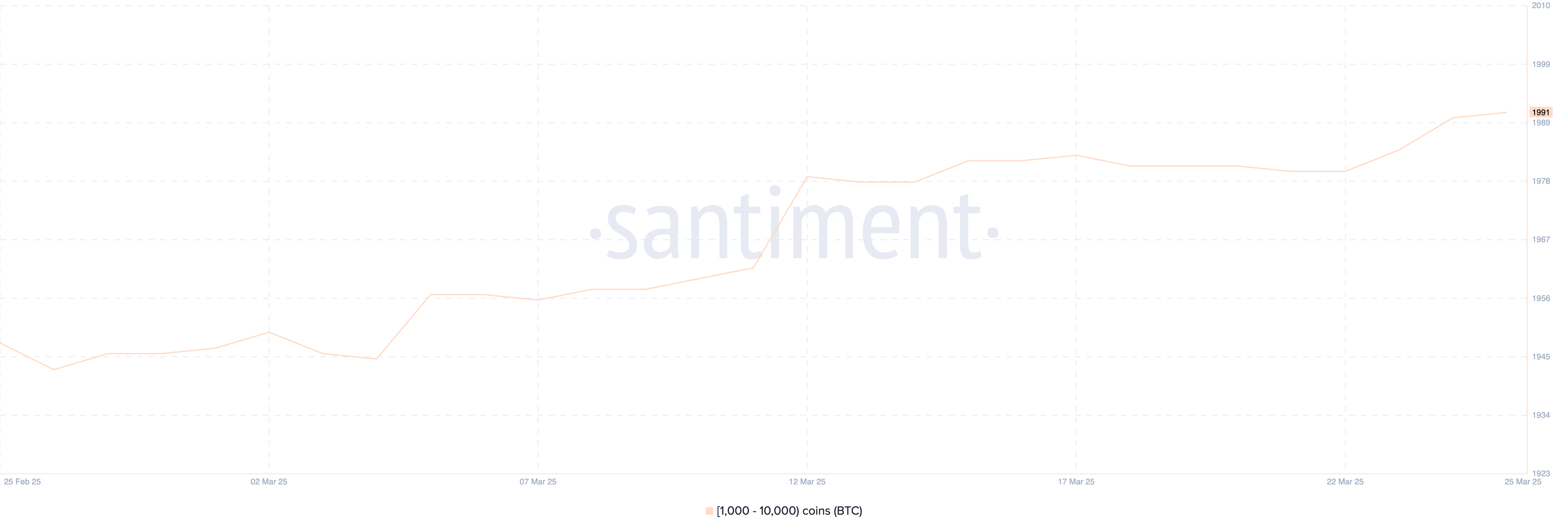

The number of Bitcoin whales (wallets holding 1,000-10,000 BTC) reached its highest level since December 15th, increasing from 1,980 on March 22nd to 1,991 on March 25th. This accumulation by large holders, often seen as "smart money," suggests renewed confidence in the market.

While the growth rate has slowed recently, this multi-month high in whale count indicates underlying market strength and potential institutional investment ahead of a possible bullish move.

Technical Indicators Point to Bullish Momentum

Ichimoku Cloud Analysis

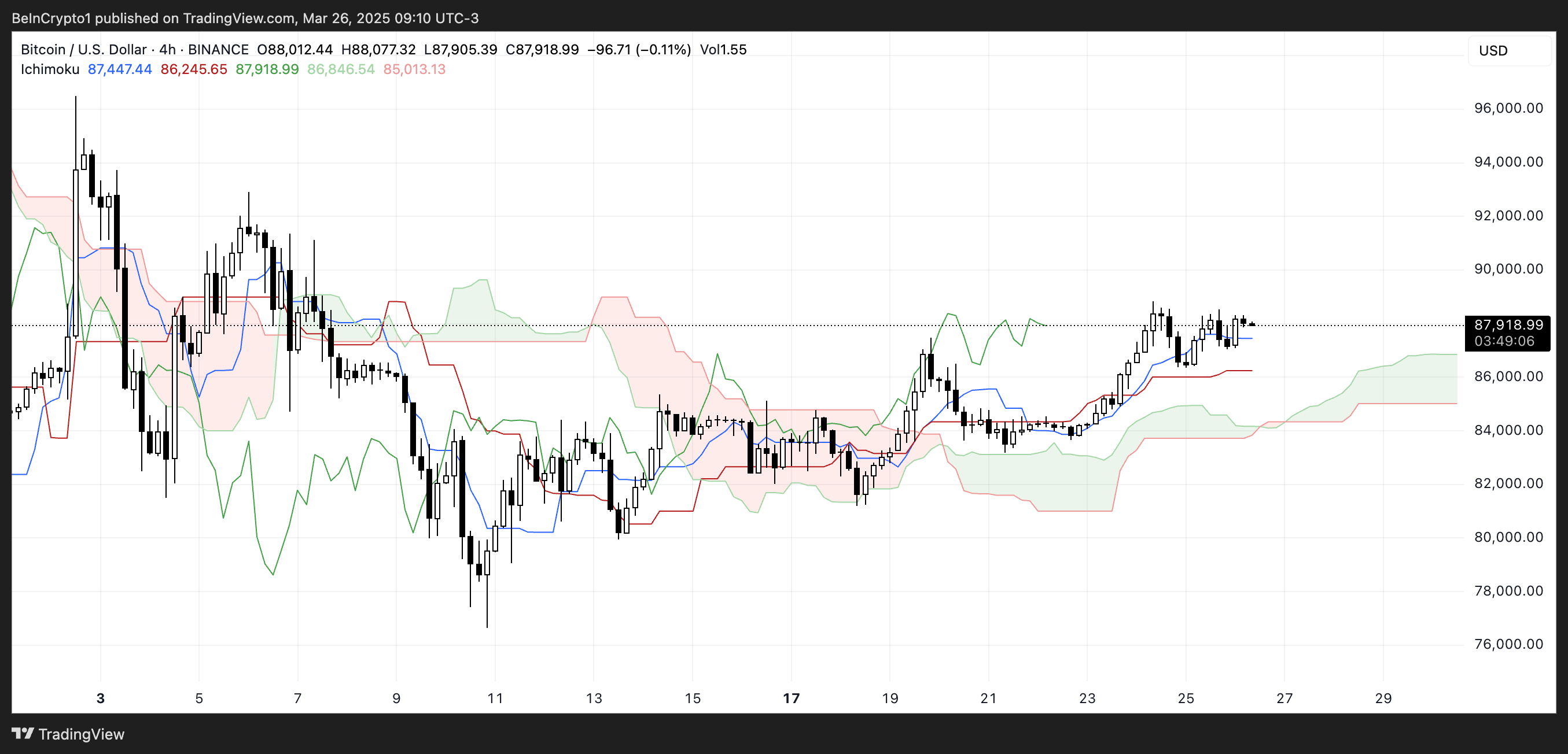

Bitcoin's Ichimoku Cloud shows a bullish structure. The price is above the cloud, which is itself turning green and rising. The Tenkan-sen (blue) is above the Kijun-sen (red), indicating short-term bullish momentum, although a slight flattening suggests potential consolidation.

The wide, upward-sloping future cloud (Kumo) signals strong support and increasing trend strength. The Chikou Span (lagging line) is well above past price action, further bolstering bullish sentiment.

EMA Analysis and Potential Golden Cross

Bitcoin's EMA lines are aligning for a potential golden cross, which historically signals a new bullish phase. A successful break above the $88,807 resistance could trigger a move towards $92,928, potentially reaching $100,000 with continued momentum. However, failure to break this resistance could lead to a pullback to $84,736 or lower.

Will Bitcoin Reach $100,000 in April?

The confluence of increased whale accumulation and positive technical indicators paints a bullish picture for Bitcoin. While a move to $100,000 in April is possible, it's crucial to remember that the cryptocurrency market is highly volatile. A failure to break key resistance levels could lead to a price correction. Thorough research and caution are advised.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Market conditions are subject to change. Conduct your own research before making any investment decisions.