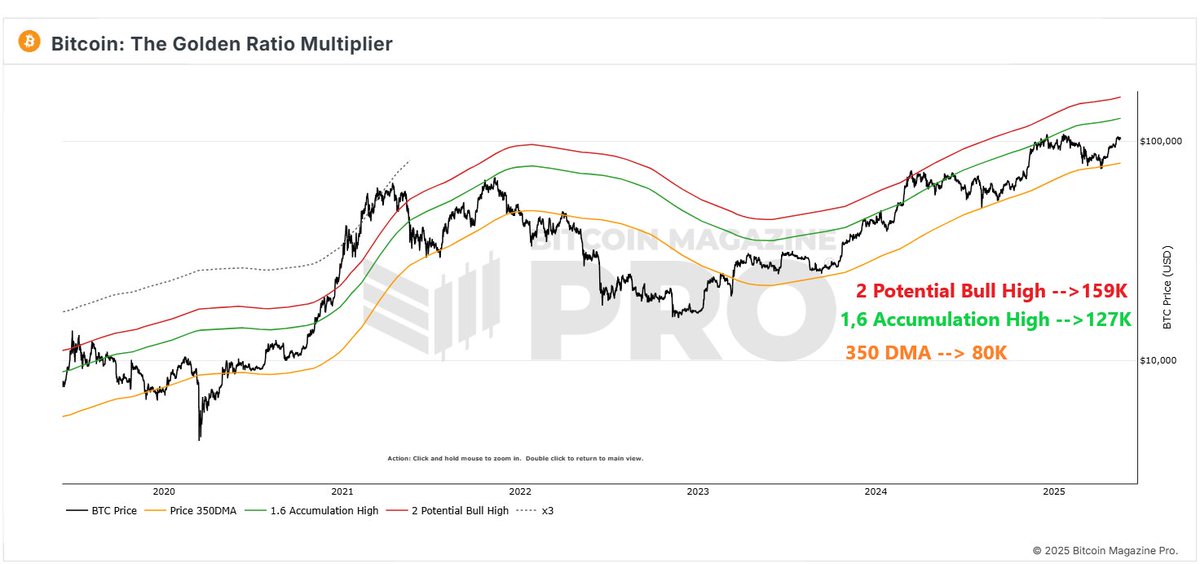

Bitcoin Price Prediction: $159,000?

Bitcoin's Q1 2025 Slowdown and Q2 Surge

Bitcoin's price growth faltered in the first quarter of 2025 amidst US macroeconomic uncertainty. However, a significant market rebound is underway, with Bitcoin's price increasing by over 25% this quarter, outperforming many large-cap assets. This positive trend suggests further potential upside.

Key Price Levels to Watch in Q2 2025

On-chain analyst Burak Kesmeci highlighted three crucial Bitcoin price levels using the Golden Multiplier Ratio, a technical indicator based on Fibonacci multipliers applied to the 350-day moving average (350DMA).

- $127,000: This resistance level aligns with the 1.6x multiplier of the 350DMA, historically representing a mid-cycle top in previous bull runs.

- $159,000: This level corresponds to the 2x multiplier of the 350DMA and has historically marked cycle tops. Reaching this target requires a successful break above $127,000.

- $80,000: This acts as a crucial support level, coinciding with the 350DMA. A breach below this level could negate the current bullish outlook.

Source: @burak_kesmeci on X

Kesmeci emphasizes that these levels are subject to change based on Bitcoin's price movement. The Golden Multiplier Ratio relies on moving averages, which are dynamic.

Current Bitcoin Price

At the time of writing, Bitcoin is trading around $103,275 with minimal price change in the last 24 hours.

Source: BTCUSDT chart on TradingView

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk.

Codeum: Your Partner in Blockchain Security

Navigating the complexities of the crypto market requires a robust understanding of blockchain security. Codeum provides comprehensive services to ensure the safety and integrity of your blockchain projects, including:

- Smart contract audits

- KYC verification

- Custom smart contract and DApp development

- Tokenomics and security consultation

- Partnerships with launchpads and crypto agencies