Bitcoin Price Holds Steady at $105,000 Despite Low Whale Activity

Bitcoin (BTC) experienced a 3% price increase in the last 24 hours, holding steady around $105,000. This relatively muted rally follows significant developments: the SEC's revocation of SAB 121, enabling banks to custody crypto, and the Trump administration's executive order establishing a Digital Asset Stockpile.

Market Indicators: A Mixed Bag

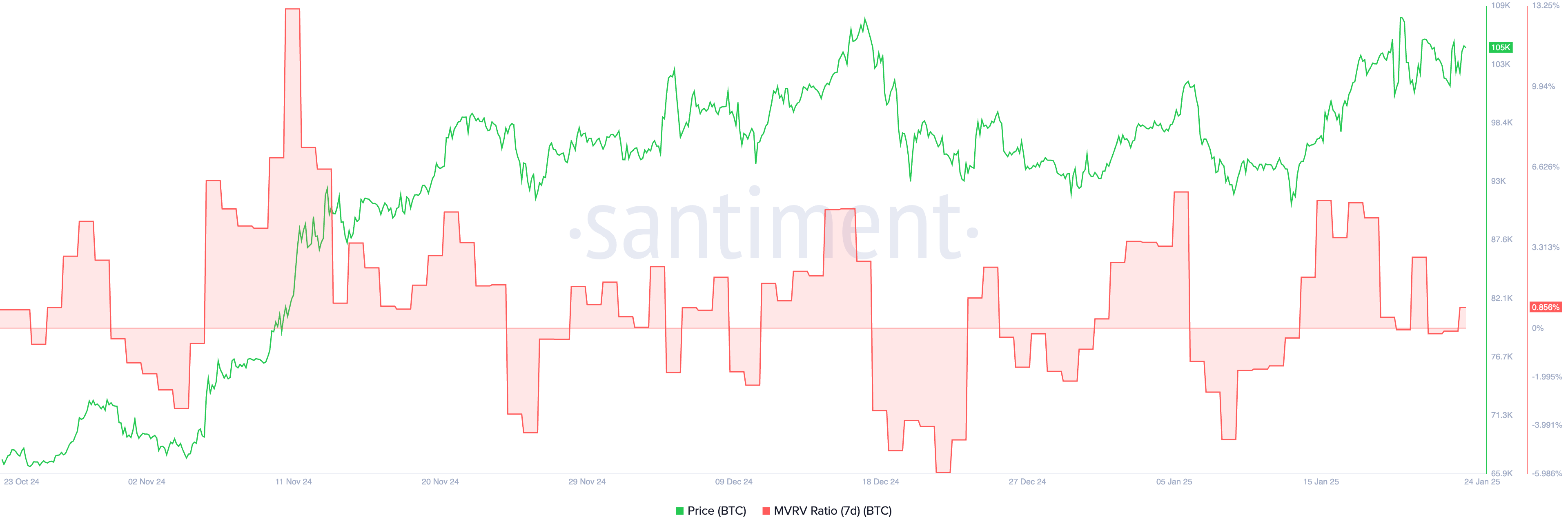

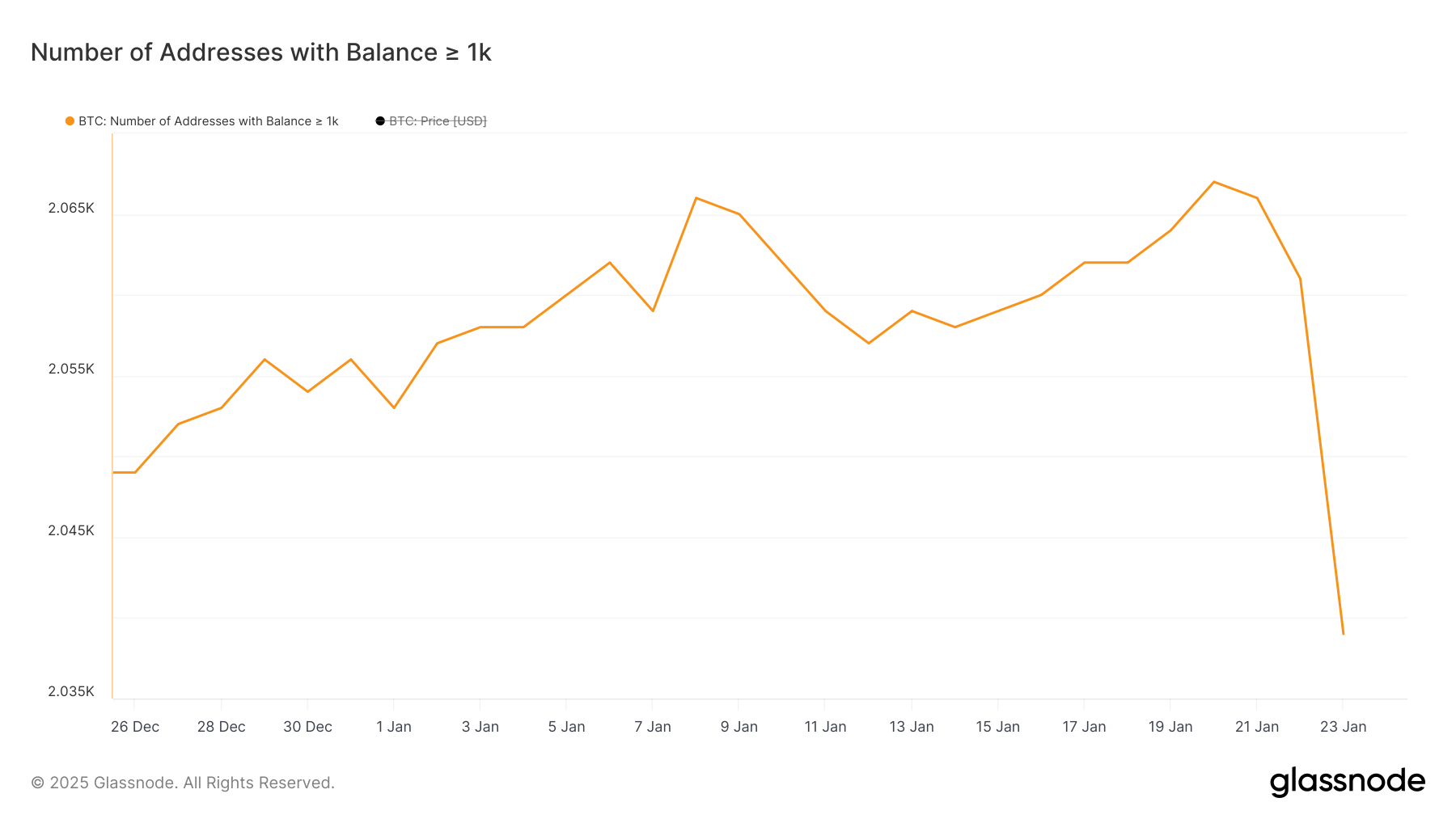

The 7-day Market Value to Realized Value (MVRV) Ratio currently sits at 0.85%, suggesting potential for short-term growth. Historically, this ratio reaches 5-6% before price corrections. However, the current low value indicates that the market isn't overextended. Meanwhile, whale activity (wallets holding 1,000+ BTC) has fallen to its lowest point in a year, signaling potential caution among large holders. This decline could reflect a wait-and-see approach regarding upcoming executive orders or a shift in investment strategies after BTC's stabilization above $100,000.

MVRV Ratio: Room for Growth?

A positive MVRV ratio generally indicates that recent Bitcoin buyers are, on average, profitable. The current positive value suggests improving short-term market sentiment. However, historical data suggests a likely price correction once the ratio reaches higher levels.

Source: Santiment

Decreased Whale Activity: A Cautious Market?

The number of Bitcoin whales has dropped significantly, reaching its lowest level since January 30, 2024. This reduction in activity, while potentially driven by anticipation of upcoming regulatory announcements or profit-taking, is a key indicator to watch. Large holder behavior can significantly influence market trends.

Source: Glassnode

Lucas Outumuro, Head of Research at IntoTheBlock, notes: "The amount of Bitcoin held by long-term holders has decreased by 1.5 million BTC (approximately $150 billion) in the last year. Their selling accelerated since Trump’s election in November, with 500,000 BTC (around $50 billion) leaving long-term holder addresses since then. This trend resembles a pattern from previous bull cycles...">

BTC Price Outlook: Consolidation or Breakout?

Bitcoin's Exponential Moving Average (EMA) lines currently display a bullish signal, yet their lack of substantial upward momentum suggests a potential period of consolidation.

Source: TradingView

Outumuro adds: "There is a combination of institutions and short-term speculators driving the demand-side..."

Further details on the Digital Asset Stockpile could trigger a price surge, potentially pushing BTC above $110,000. Conversely, a bearish reversal could lead to support testing around $99,486, with a possible drop to $95,800 if that level breaks.

Codeum Note: Codeum provides comprehensive blockchain security services, including smart contract audits, KYC verification, and custom smart contract & DApp development. We help build secure and reliable blockchain solutions. Contact us today!

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Market conditions are volatile. Conduct thorough research and consult a professional before making financial decisions.