Bitcoin Hits $116K as Powell Signals Possible Rate Cuts

Crypto Market Reacts to Fed's Potential Policy Shift

Bitcoin experienced a notable surge, climbing above $116,000 on Friday. This rally, along with gains in Ether and XRP, followed remarks by Federal Reserve Chair Jerome Powell that hinted at possible future interest rate cuts.

Powell's Cautious Optimism

Speaking at the Fed’s Jackson Hole event, Powell acknowledged that inflation remains "somewhat elevated" but has significantly eased from its post-pandemic peaks. He emphasized the Fed's delicate balancing act between inflation and employment, stating that the current policy rate is nearing neutral and the labor market is stable, thus allowing for a more cautious approach.

Powell stated that the Fed's decisions would be data-driven. "Monetary policy is not on a preset course. FOMC members will make these decisions based solely on their assessment of the data and its implications for the economic outlook and the balance of risks," he said.

Market's Bullish Response

Powell’s comments were interpreted by investors as more dovish than anticipated, triggering a positive response in both crypto and stock markets.

- Bitcoin, after dipping below $112,000, rebounded to reach $116,000.

- Ethereum saw a 7% increase, reaching $4,600.

- XRP, Solana, and Chainlink each gained over 6%.

- Dogecoin and Cardano both rose by approximately 8%.

The total crypto market capitalization surpassed $4 trillion, marking a 2% increase in a single day.

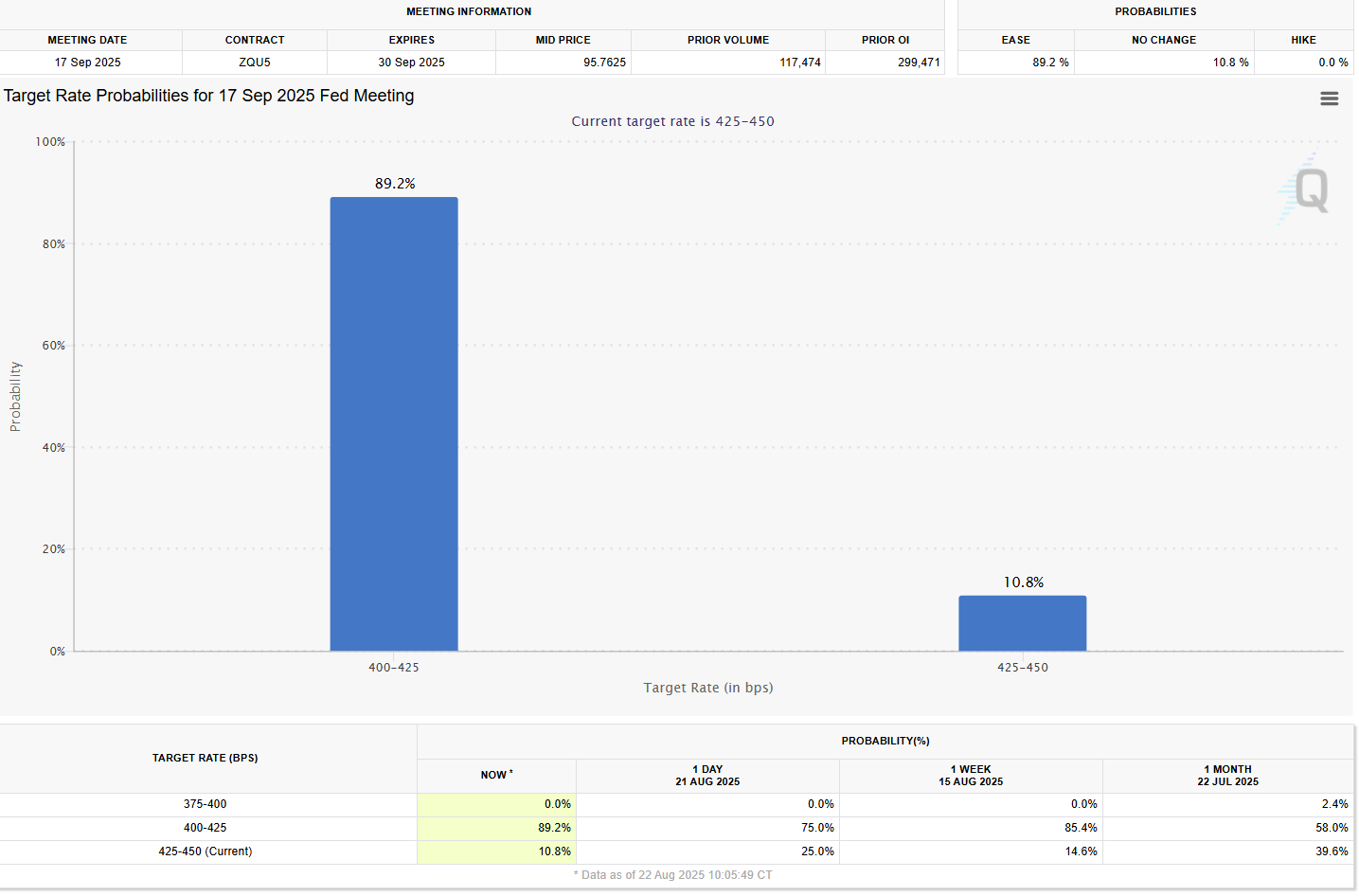

Rate Cut Expectations Soar

Following Powell's remarks, traders are now heavily favoring a quarter-point rate cut by the Fed in September. The odds of this occurring have risen to nearly 90%, up from 75% in the previous session, according to the FedWatch Tool data.