Bitcoin Price Dip: NVT Golden Cross Signals Caution

Bitcoin (BTC) experienced a 6.54% drop in the past 24 hours, following a broader cryptocurrency market downturn fueled by escalating trade tensions. The price briefly touched a 2025 low of $91,000.

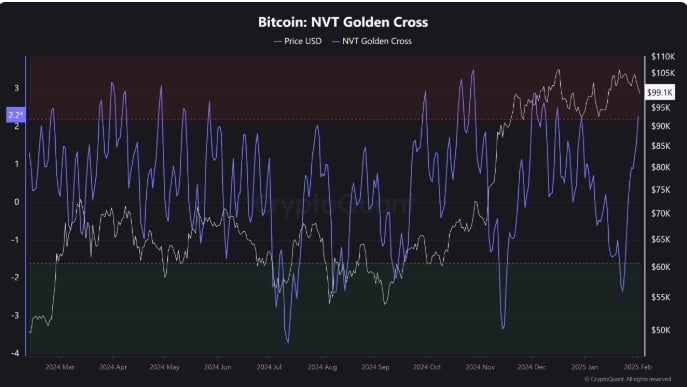

Bitcoin's NVT Golden Cross Reaches Critical Level

Data from CryptoQuant shows Bitcoin's NVT Golden Cross reaching a value of 2, a critical level indicating potential market overheating and increased bearish pressure. This suggests bears are gaining momentum, potentially leading to sustained downward pressure. This aligns with the bearish sentiment observed among some American investors.

Source: CryptoQuant

Contrasting Indicators: A Mixed Outlook

While the NVT Golden Cross signals concern, other indicators offer a more nuanced perspective. Regions outside the U.S. display continued optimism.

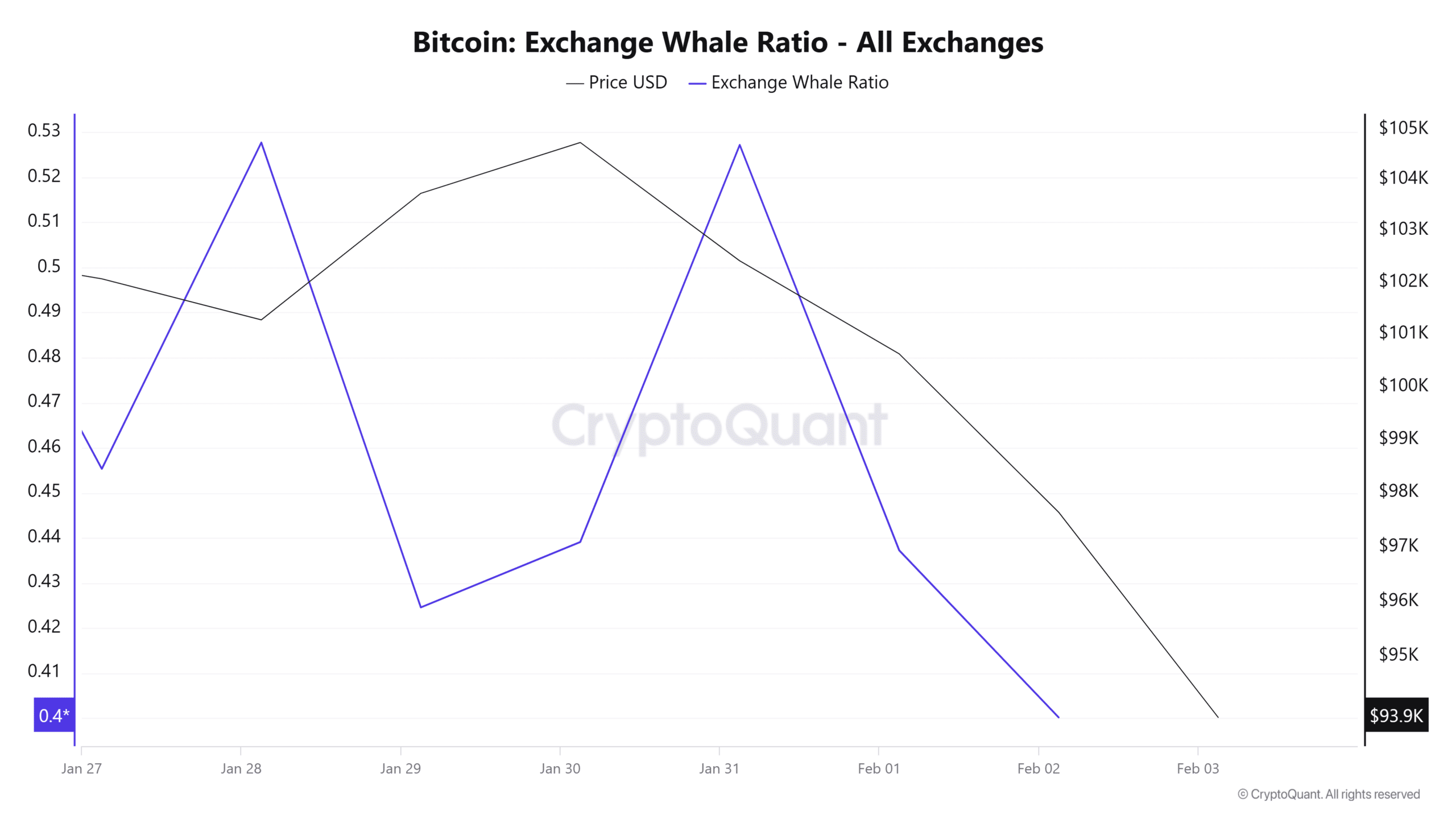

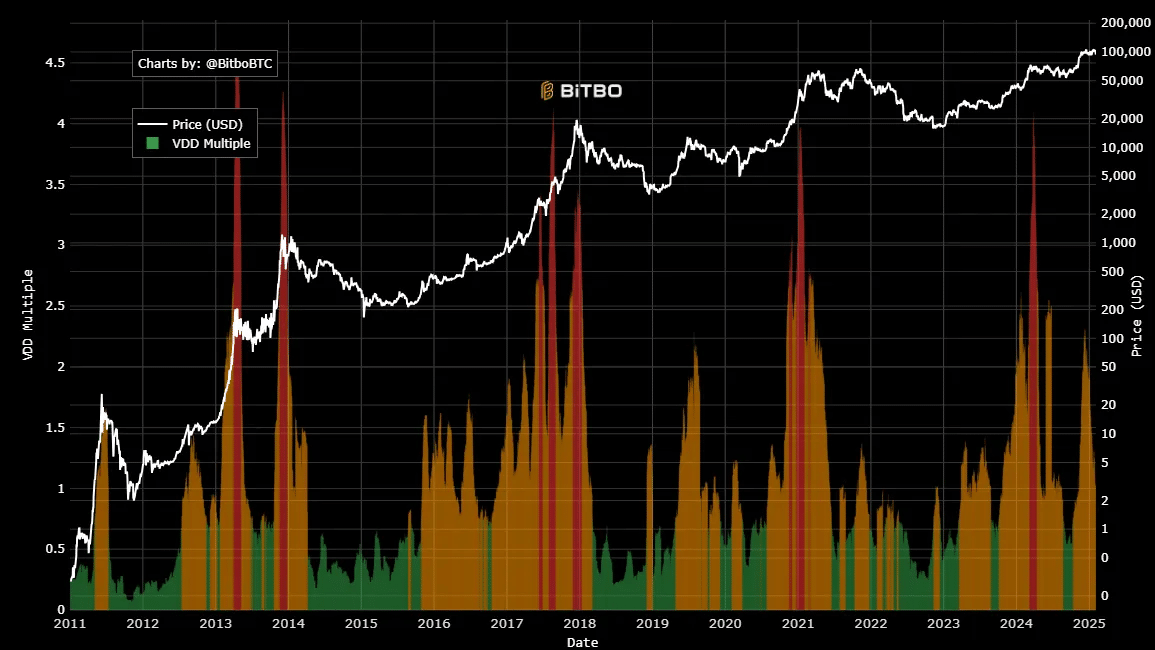

Whale Activity and Long-Term Holder Sentiment

The Exchange Whale Ratio has dropped to a 10-day low, indicating that large Bitcoin holders are not actively selling. This suggests confidence in a potential price rebound. Furthermore, the VDD Multiple remains above 1 (at 1.05), implying long-term holders aren't panic-selling and the market has underlying stability.

Source: CryptoQuant

Source: Bitbo

Short-Term Correction or Sustained Downturn?

The current price decline appears to be driven primarily by short-term holders, with long-term holders and whales exhibiting bullish behavior. This suggests a potential short-term correction rather than a sustained bearish trend. A recovery could see BTC reclaim $96,370 and target $98,000. However, further correction could lead to a dip to $92,103.

Codeum Note: For robust blockchain security and development, consider Codeum's services including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies.

This analysis provides insights but doesn't constitute financial advice. Always conduct your own thorough research.