Bitcoin Price Dip Below $100K: Market Analysis

Bitcoin experienced significant price fluctuations in the past 24 hours, briefly exceeding $100,000 before a retracement. This volatility reflects ongoing market uncertainty, with traders reacting to short-term price swings. However, signs of long-term stability are emerging, driven by established investors holding their Bitcoin.

Bitcoin's Unconventional Trajectory

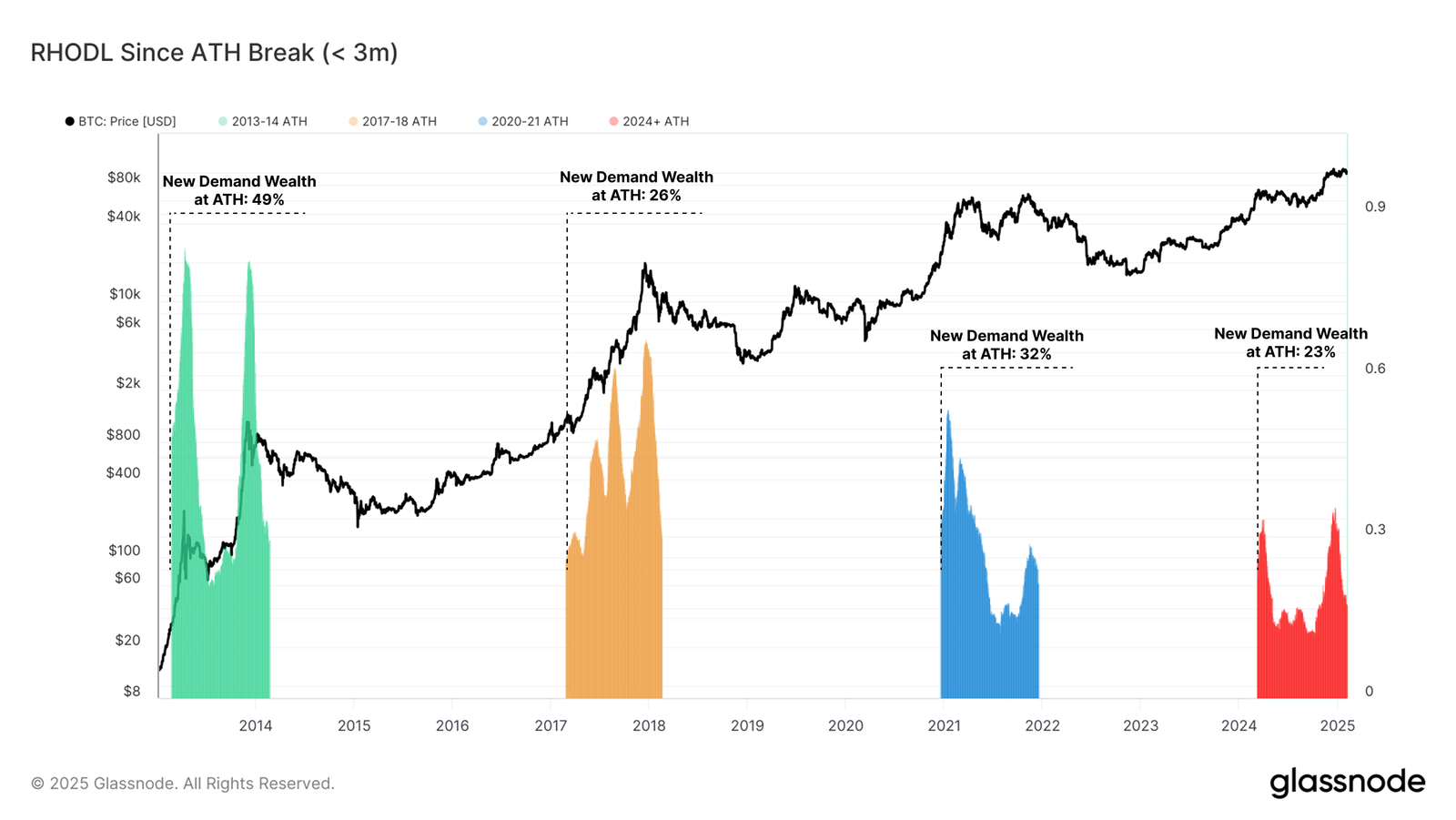

The RHODL (Realized HODL) ratio since Bitcoin's recent all-time high (ATH) is 23%. While new demand remains substantial, the wealth held in coins older than three months is lower than in previous cycles. This indicates that new demand arrives in bursts rather than a sustained pattern.

Unlike past cycles concluding a year after the first ATH break, the current cycle shows an atypical trajectory. Bitcoin reached a new ATH in March 2024, but demand hasn't matched past rallies. This raises questions about the cycle's future.

Three-month rolling realized volatility remains below 50% this cycle, contrasting with past bull runs exceeding 80-100%. This reduced volatility suggests a more structured Bitcoin price action, with mature investors fostering a more stable market.

The 2023-2025 cycle exhibits a stair-stepping pattern: price rallies followed by consolidation. Unlike previous cycles' extreme swings, Bitcoin's current path shows gradual increases, supporting a more controlled bull market and mitigating crash risks.

Bitcoin Price Prediction: Crucial Support Levels

While Bitcoin's long-term outlook remains uncertain due to short-term volatility, the immediate forecast suggests vulnerability to correction. Bitcoin trades near key support levels; further declines could lead to a deeper retracement.

Losing the $95,869 support could trigger a drop toward $93,625. While holders have avoided significant profit-taking, further losses might initiate selling pressure, extending the correction.

Conversely, a bounce off $95,869 could help Bitcoin reclaim $100,000. Breaking this psychological barrier would invalidate the bearish outlook, potentially initiating a new uptrend.

Disclaimer: This analysis is for informational purposes only and shouldn't be considered financial advice. Market conditions are volatile. Conduct thorough research and consult a professional before making financial decisions. Codeum offers smart contract audits and other blockchain security services to help mitigate risk in the crypto market.