Bitcoin Price Dips Below $90,000: Bearish Signals Emerge

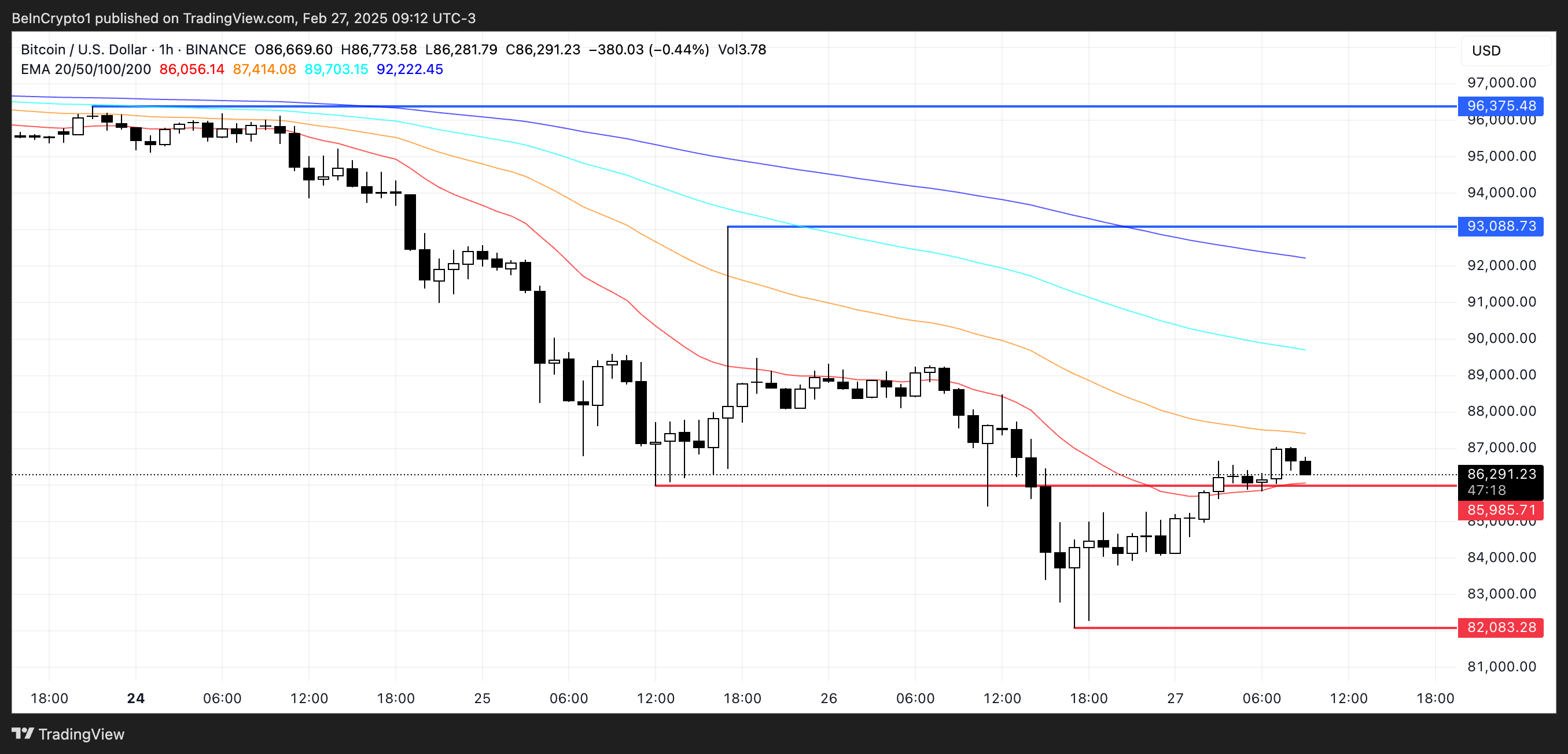

Bitcoin (BTC) experienced a significant price drop this past week, falling below $90,000 for the first time since November 2024. This represents an 11% decline over seven days, with BTC currently trading near the critical support level of $85,985.

Technical Indicators Signal Bearish Trend

Technical indicators paint a predominantly bearish picture. The Ichimoku Cloud shows a widening red cloud above the current price, suggesting increasing bearish momentum. While some short-term EMA lines are trending upward, hinting at potential recovery, the overall sentiment remains bearish.

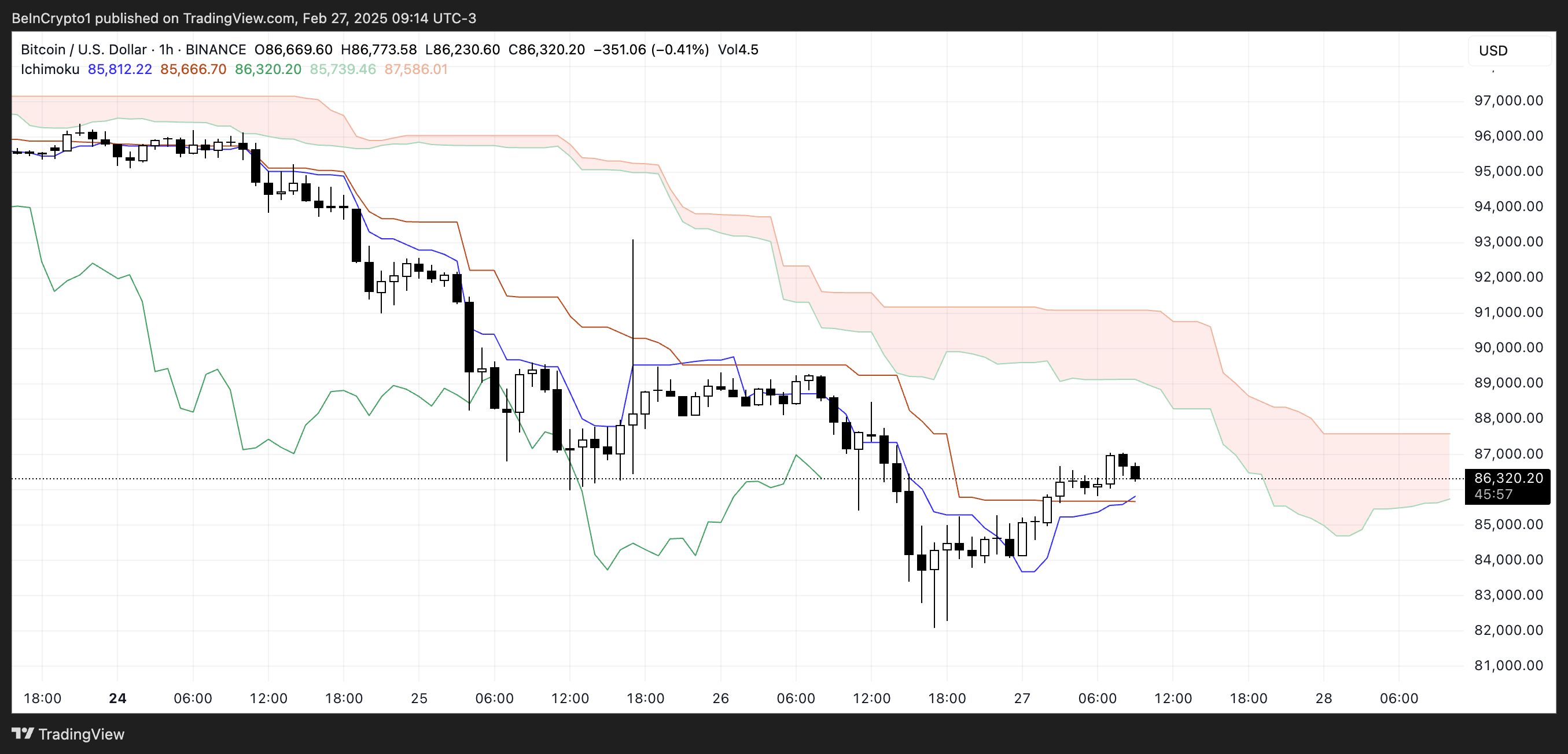

Ichimoku Cloud Analysis

The Bitcoin Ichimoku Cloud displays a clear bearish setup. The red cloud (Kumo) acts as resistance, and the Leading Span A (green line) sits below the Leading Span B (red line). The price is trading below both the Tenkan-sen (conversion line) and the Kijun-sen (baseline), further reinforcing the downward pressure. Although the Tenkan-sen is flattening, indicating a potential pause, it remains below the Kijun-sen, maintaining the bearish bias. The Chikou Span (lagging line) is below both the price and the cloud, supporting the continuation of the bearish trend. A sustained break above the cloud resistance and a Tenkan-sen crossover above the Kijun-sen would be needed to reverse this trend.

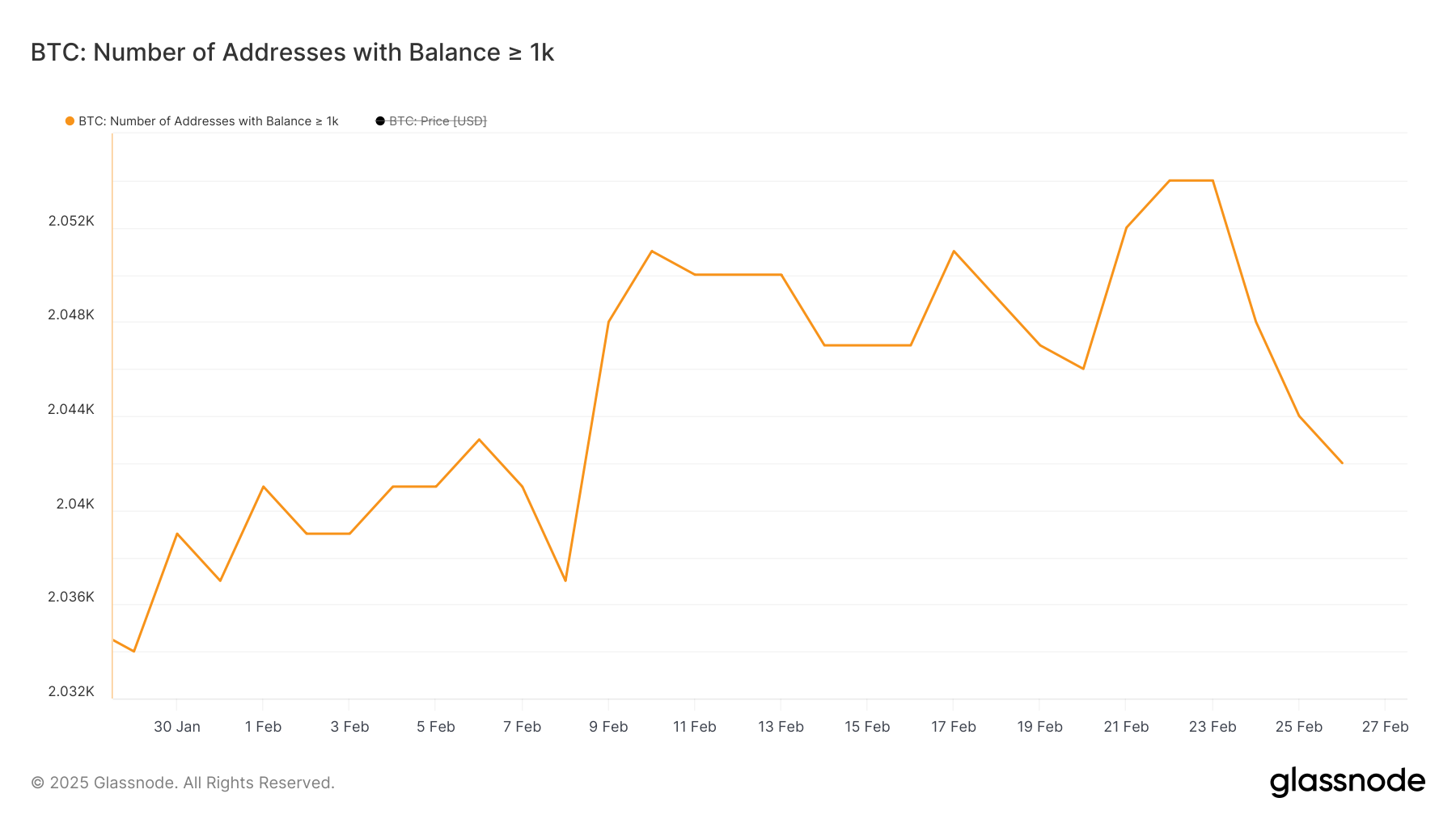

Whale Activity Decreases

The number of Bitcoin whales (addresses holding at least 1,000 BTC) peaked at 2,054 on February 22 but has since declined to 2,042. While this decrease could signal short-term selling pressure as whales take profits or redistribute holdings for security, the overall whale count remains historically high, indicating sustained institutional interest in Bitcoin as a long-term store of value.

Tracy Jin, COO of MEXC, commented, "The long-term trend remains positive due to institutional demand and infrastructure development. However, the short-term outlook is pressured by liquidation of excess leverage and decreased risk appetite. This correction is ultimately beneficial for BTC's long-term health."

Bitcoin's Future: Recovery Above $90,000?

Bitcoin faces significant resistance at $85,985. A break below this level could lead to a further decline towards $82,000. Despite the bearish EMA configuration, with short-term indicators below long-term counterparts, short-term EMAs trending upwards suggest a potential near-future trend reversal. A recovery above $96,000-$100,000 would signal market readiness for renewed growth.

Maria Carola, CEO of StealthEx, stated, "Bitcoin's long-term trajectory remains strong. Institutional investment and infrastructure development strengthen its position. Short-term, recovery above $96,000-$100,000 is needed for new growth; otherwise, a deeper correction may occur."

Codeum Note: At Codeum, we provide comprehensive blockchain security solutions, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultations, and partnerships with launchpads and crypto agencies. Contact us to secure your blockchain project.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Market conditions are subject to change.